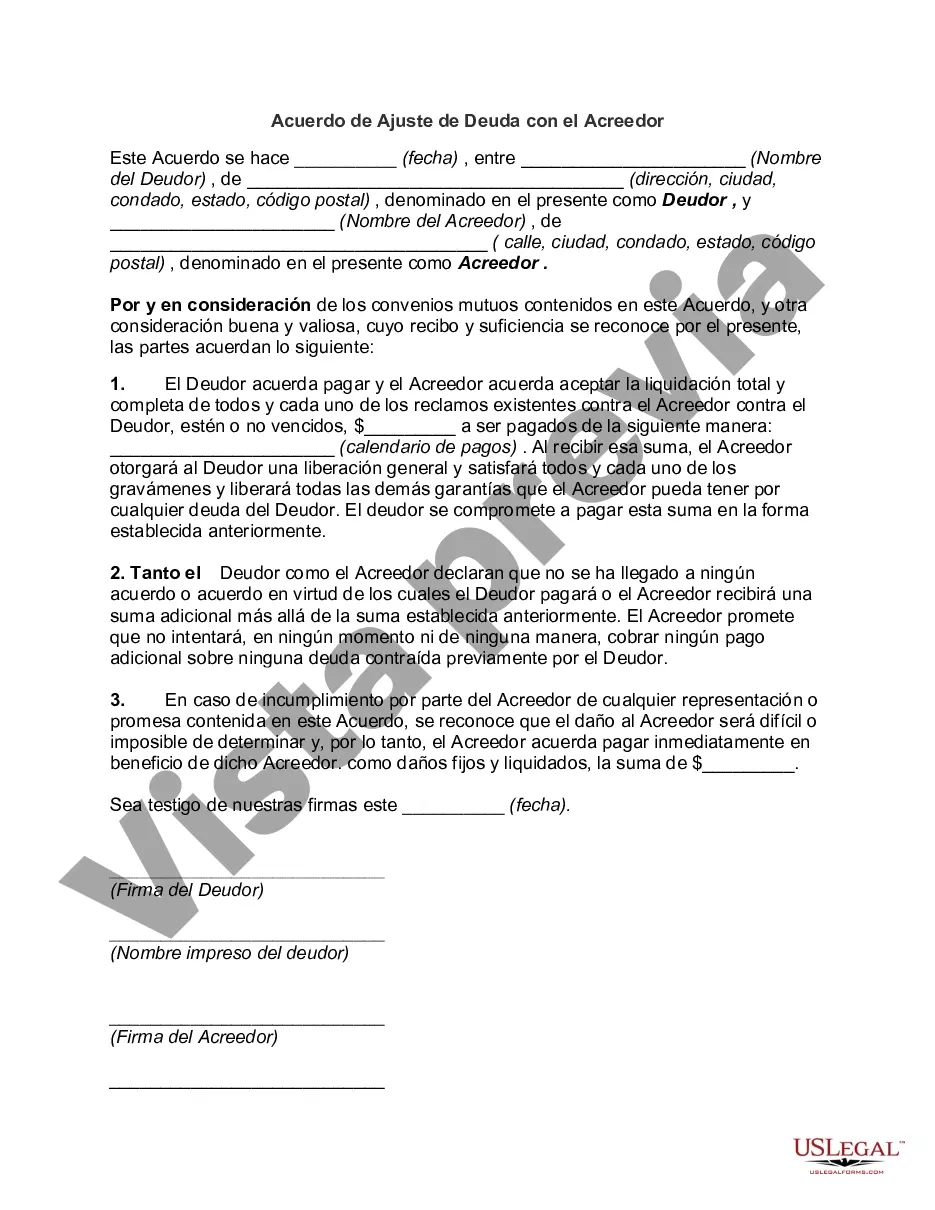

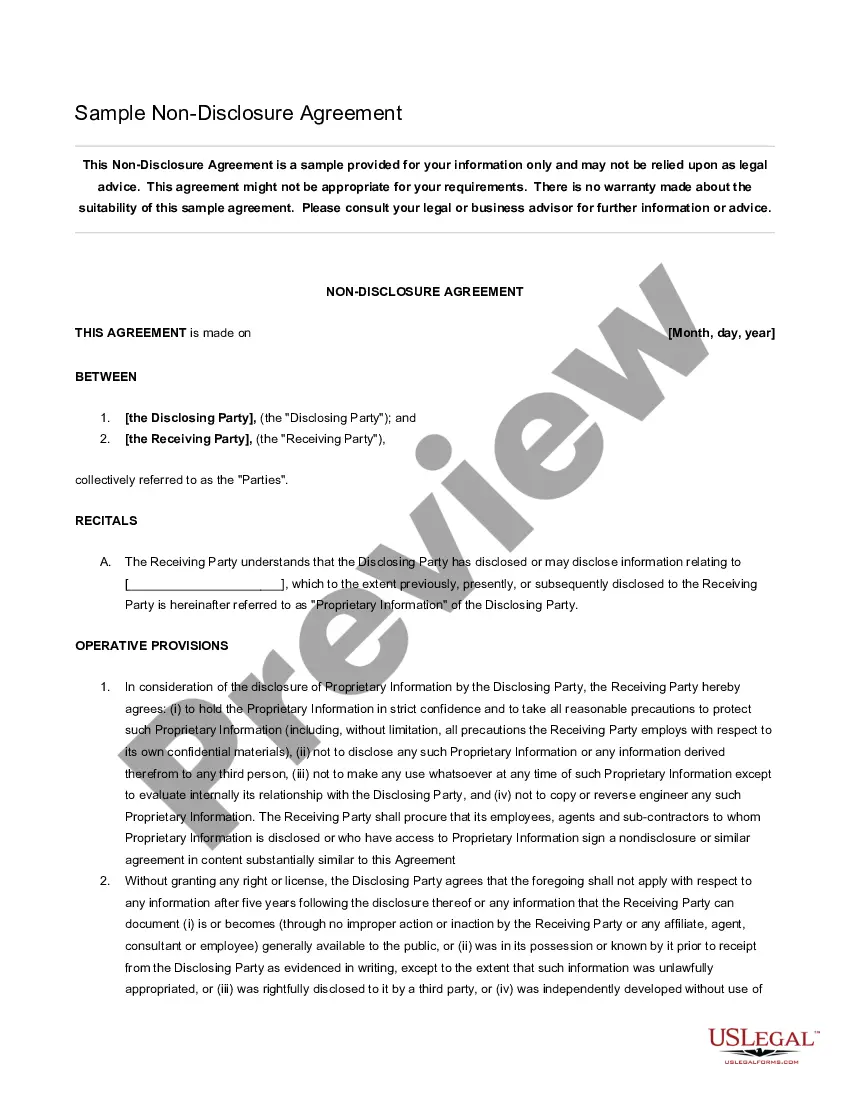

Oakland, Michigan Debt Adjustment Agreement with Creditor In Oakland, Michigan, a Debt Adjustment Agreement with a Creditor is a legal contract that allows individuals or businesses to negotiate and establish a structured plan to repay their outstanding debts. This agreement provides debtors with an opportunity to regain control over their financial situation by working directly with their creditors to develop an affordable repayment plan. A Debt Adjustment Agreement is a voluntary arrangement that creditors may consider as an alternative to legal actions such as foreclosure, repossession, or bankruptcy. By entering into this agreement, debtors can avoid the severe consequences of these actions while making efforts to repay their debts over time. Keywords: Oakland, Michigan, Debt Adjustment Agreement, Creditor, structured plan, outstanding debts, financial situation, voluntary arrangement, repayment plan, foreclosure, repossession, bankruptcy. Types of Oakland, Michigan Debt Adjustment Agreement with Creditor: 1. Individual Debt Adjustment Agreement: This type of agreement is designed for individuals who are overwhelmed by their personal debts, such as credit card debts, medical bills, or personal loans. It allows debtors to negotiate with their individual creditors to create a repayment plan that fits their specific financial circumstances. 2. Business Debt Adjustment Agreement: This type of agreement is catered to businesses facing financial difficulties due to accumulated debts. Businesses can work closely with their creditors to develop a repayment plan that aligns with their cash flow and operational capabilities. 3. Mortgage Debt Adjustment Agreement: This specific agreement focuses on individuals or businesses struggling with mortgage payments. It involves negotiations between the debtor and mortgage lender to establish a revised repayment plan, potentially reducing monthly mortgage payments or extending the loan term. 4. Vehicle Debt Adjustment Agreement: This type of agreement is relevant for individuals or businesses facing delinquencies or repossession threats on their vehicle loans. It enables debtors to negotiate with their vehicle lender to modify the repayment terms, potentially reducing monthly payments, adjusting interest rates, or extending the loan duration. 5. Tax Debt Adjustment Agreement: This agreement addresses outstanding tax debts owed to local, state, or federal tax authorities. Debtors can work with tax agencies to establish a payment plan, potentially reducing penalties and interest charges while ensuring gradual and manageable repayment. Keywords: Oakland, Michigan, Debt Adjustment Agreement, Creditor, individual, business, mortgage, vehicle, tax, negotiations, repayment plan, cash flow, operational capabilities, delinquencies, repossession, tax debts, penalties, interest charges. In conclusion, an Oakland, Michigan Debt Adjustment Agreement with a Creditor provides individuals and businesses with an opportunity to negotiate manageable repayment plans to resolve outstanding debts. Different types of agreements are tailored to suit various debt scenarios, including personal debts, business debts, mortgage debts, vehicle loans, and tax debts. By entering into these agreements, debtors can work towards regaining financial stability and avoiding more severe consequences such as foreclosure or bankruptcy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Oakland Michigan Acuerdo De Ajuste De Deuda Con El Acreedor?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Oakland Debt Adjustment Agreement with Creditor meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Oakland Debt Adjustment Agreement with Creditor, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Oakland Debt Adjustment Agreement with Creditor:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Oakland Debt Adjustment Agreement with Creditor.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!