Palm Beach, Florida is known for its beautiful beaches, luxurious lifestyle, and exclusive neighborhoods. However, residents sometimes find themselves facing financial difficulties, resulting in a need for debt adjustment agreements with creditors. These agreements allow individuals to negotiate a settlement or repayment plan with their creditors in order to resolve outstanding debts. One type of Palm Beach, Florida debt adjustment agreement with a creditor is a debt settlement agreement. In this arrangement, the debtor and creditor agree to settle the debt for a reduced amount, typically paying a lump sum or structured payments. This can be beneficial for individuals who are unable to pay the full amount owed but wish to resolve their debt and avoid potential legal actions. Another type of debt adjustment agreement is a debt management plan. This involves working with a credit counseling agency that negotiates with creditors on behalf of the debtor. The agency consolidates the debtor's debts into one monthly payment and negotiates reduced interest rates or waived fees. Debt management plans can provide individuals with a structured and manageable repayment plan, making it easier for them to become debt-free. When entering into a Palm Beach, Florida debt adjustment agreement with a creditor, it is important to understand the terms and conditions outlined in the agreement. The agreement should clearly state the total debt amount, the repayment terms, interest rates (if applicable), and any additional fees involved. It is crucial for individuals to carefully review and comprehend all aspects of the agreement before signing. In order to ensure a successful debt adjustment agreement, individuals should consider seeking the assistance of a professional debt relief service or a qualified attorney who specializes in debt negotiation. These professionals can provide guidance, advice, and representation throughout the negotiation process. Overall, Palm Beach, Florida debt adjustment agreements with creditors provide an opportunity for individuals to regain control over their financial situation. Whether through debt settlement agreements or debt management plans, these agreements offer individuals a chance to alleviate their debts and work towards financial stability. It is important to thoroughly research and consider all options before entering into any debt adjustment agreement to ensure the best possible outcome.

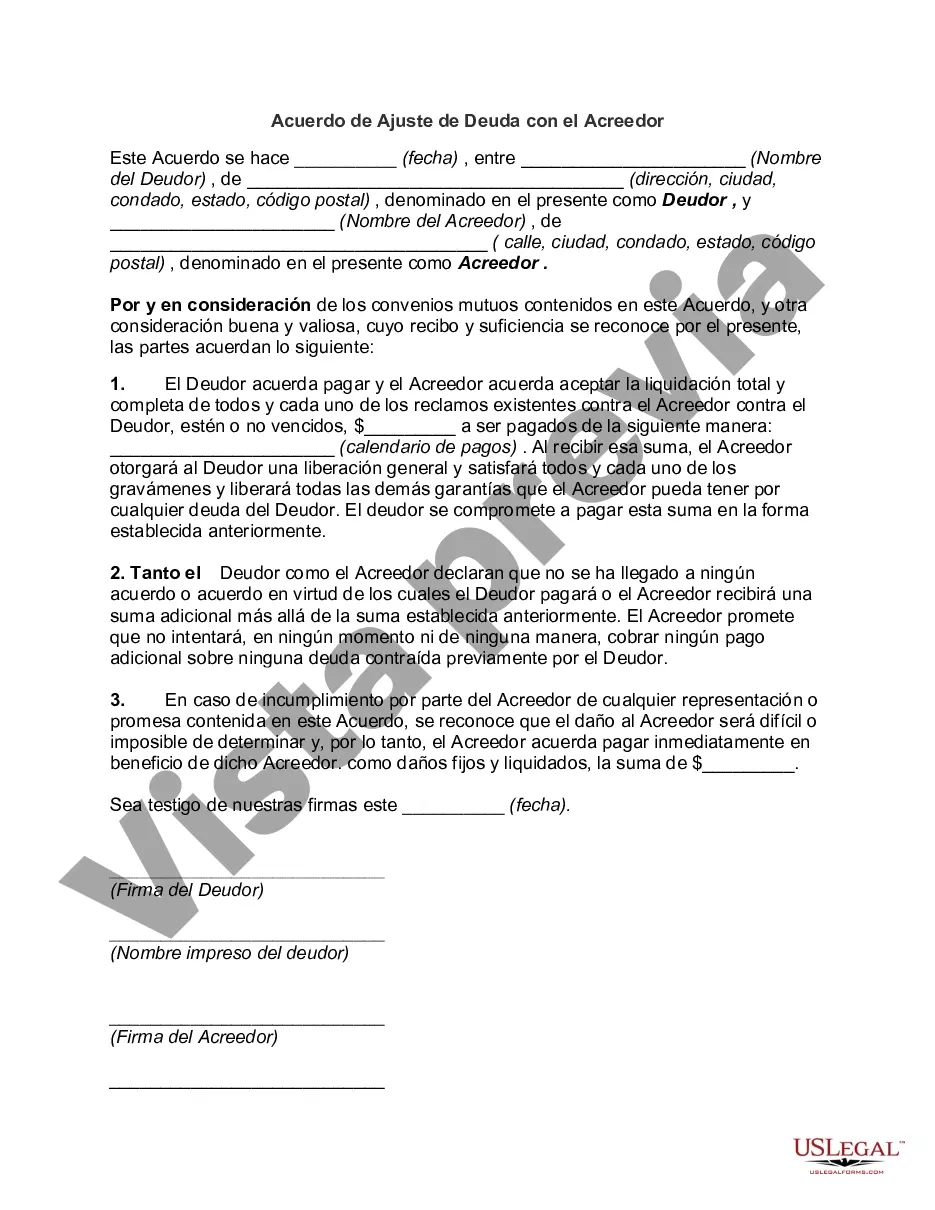

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Palm Beach Florida Acuerdo De Ajuste De Deuda Con El Acreedor?

If you need to get a trustworthy legal form provider to get the Palm Beach Debt Adjustment Agreement with Creditor, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support make it simple to find and execute different papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Palm Beach Debt Adjustment Agreement with Creditor, either by a keyword or by the state/county the document is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Palm Beach Debt Adjustment Agreement with Creditor template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less pricey and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or complete the Palm Beach Debt Adjustment Agreement with Creditor - all from the comfort of your sofa.

Join US Legal Forms now!