Phoenix Arizona Debt Adjustment Agreement with Creditor: A Comprehensive Guide Introduction: In Phoenix, Arizona, a Debt Adjustment Agreement with a Creditor is a legally binding contract between a debtor and a creditor that outlines the terms and conditions for resolving outstanding debts. This agreement aims to provide debtors with a structured and manageable repayment plan while offering creditors assurances regarding debt recovery. Tailored to address the unique financial situations of individuals and businesses, various types of Debt Adjustment Agreements are available in Phoenix, Arizona. Types of Phoenix Arizona Debt Adjustment Agreements with Creditor: 1. Individual Debt Adjustment Agreement: This type of agreement is designed for individuals burdened by personal debts, such as credit card bills, medical expenses, or personal loans. Individuals work with a debt adjustment agency or directly negotiate with their creditors to create a repayment plan that suits their financial capability. 2. Business Debt Adjustment Agreement: Specifically formulated for businesses facing financial difficulties, this agreement allows businesses in Phoenix, Arizona, to address their outstanding debts and regain financial stability. By working with creditors and a debt adjustment agency, businesses can modify repayment terms, reduce interest rates, or negotiate partial debt settlements. Key Elements of a Phoenix Arizona Debt Adjustment Agreement with Creditor: 1. Debt Identification and Verification: The agreement should clearly identify the debts, including the amounts owed, the respective creditors, and account numbers. Verification of the debt is crucial to ensure accuracy and prevent disputes. 2. Negotiated Repayment Terms: Both parties must establish repayment terms that are feasible for the debtor and acceptable to the creditor. This may involve extending the repayment period, lowering interest rates, or seeking reduced settlements for the debt. 3. Monthly Payment Schedule: A detailed monthly payment schedule is essential to monitor progress and ensure adherence to the agreement. The agreement should specify the amount that the debtor will pay each month and the duration of the repayment plan. 4. Interest Rates and Fees: If any changes are made to the original interest rates or fees, they must be clearly outlined in the agreement. This can include reducing the interest rate, waiving late payment fees, or stopping additional interest accrual. 5. Legal Implications: The Debt Adjustment Agreement should address the legal consequences of non-compliance by both parties. This includes stipulations regarding breach of agreement, default, and potential legal actions. 6. Confidentiality: To protect the privacy of the debtor, the agreement should include a confidentiality clause ensuring that all personal and financial information remains secure and is only shared with authorized parties. Conclusion: A Phoenix Arizona Debt Adjustment Agreement with a Creditor offers individuals and businesses a structured path towards debt resolution and financial recovery. By working closely with creditors and debt adjustment agencies, debtors can negotiate favorable repayment terms, while creditors can receive assurance of debt recovery. Whether it is an individual or business debt adjustment agreement, these legal agreements provide a promising solution to alleviate the burden of outstanding debts and pave the way for a brighter financial future.

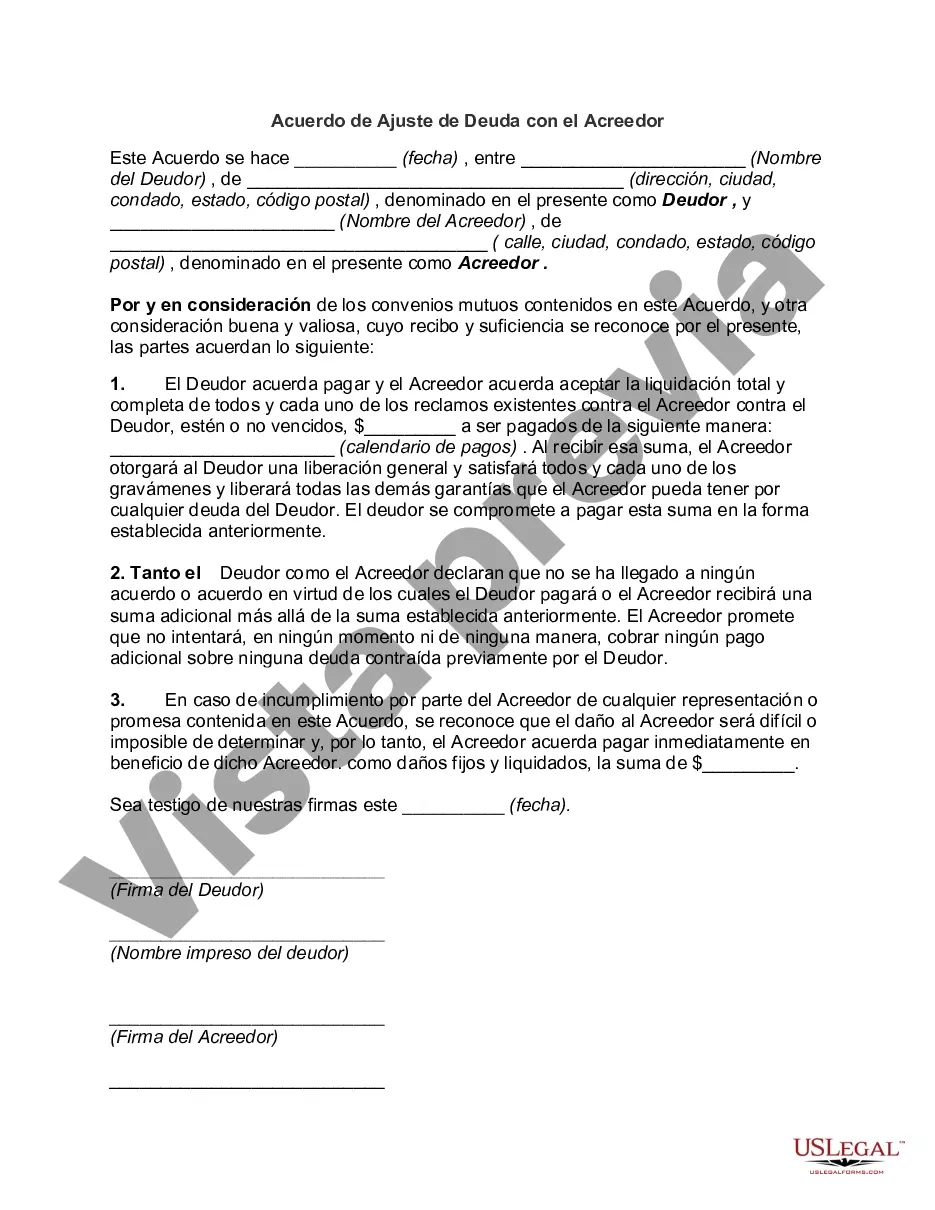

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Phoenix Arizona Acuerdo De Ajuste De Deuda Con El Acreedor?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Phoenix Debt Adjustment Agreement with Creditor, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how to locate and download Phoenix Debt Adjustment Agreement with Creditor.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Examine the related document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and purchase Phoenix Debt Adjustment Agreement with Creditor.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Phoenix Debt Adjustment Agreement with Creditor, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you have to cope with an extremely challenging case, we recommend using the services of an attorney to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant documents with ease!