A Riverside California Debt Adjustment Agreement with a creditor is a legally binding contract between an individual or business in Riverside, California, and their creditor or creditors. It sets out the terms and conditions for adjusting or modifying the debt owed to the creditor in order to make it more manageable for the debtor. There are different types of Riverside California Debt Adjustment Agreements with creditors, depending on the specific circumstances and needs of the debtor. Some common types include: 1. Debt Settlement Agreement: This type of agreement allows the debtor to negotiate a reduced lump-sum payment with the creditor to settle the debt for less than the full amount owed. It typically requires the debtor to make a one-time payment, often using savings or a lump sum borrowed from another source. 2. Debt Consolidation Agreement: In this agreement, the debtor consolidates multiple debts into a single, more manageable payment plan. The debtor may work with a debt consolidation company or create their own repayment plan, which can involve lower interest rates or extended repayment terms. 3. Debt Management Agreement: This type of agreement involves working with a credit counseling agency to negotiate a new repayment plan with the creditor. The agency typically consolidates the debtor's debts, collects a monthly payment from the debtor, and distributes it to the creditors on behalf of the debtor. 4. Debt Repayment Plan: In a repayment plan agreement, the debtor and creditor agree on a revised payment schedule that allows the debtor to pay off the debt over an extended period. This can involve lower monthly payments or reduced interest rates, making it easier for the debtor to meet their financial obligations. 5. Debt Restructuring Agreement: This agreement involves restructuring the debtor's existing debt, often by lowering the interest rate, extending the repayment period, or reducing the total amount owed. It provides the debtor with a more affordable repayment plan while still ensuring the creditor receives their owed payments. When entering into a Riverside California Debt Adjustment Agreement with a creditor, it is essential for both parties to carefully review and understand the terms and conditions. Seeking legal or financial advice may also be beneficial to ensure that the agreement meets the debtor's financial needs and goals.

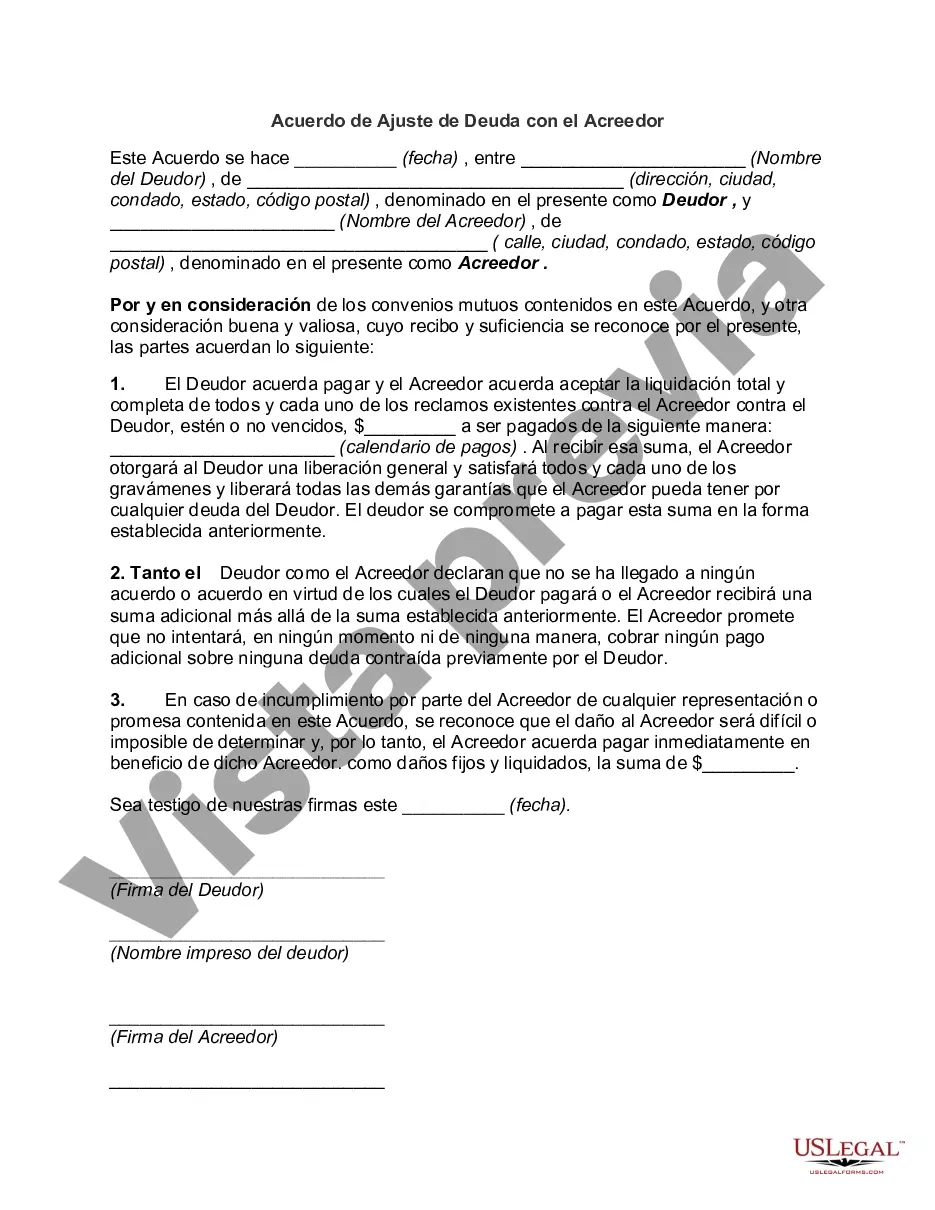

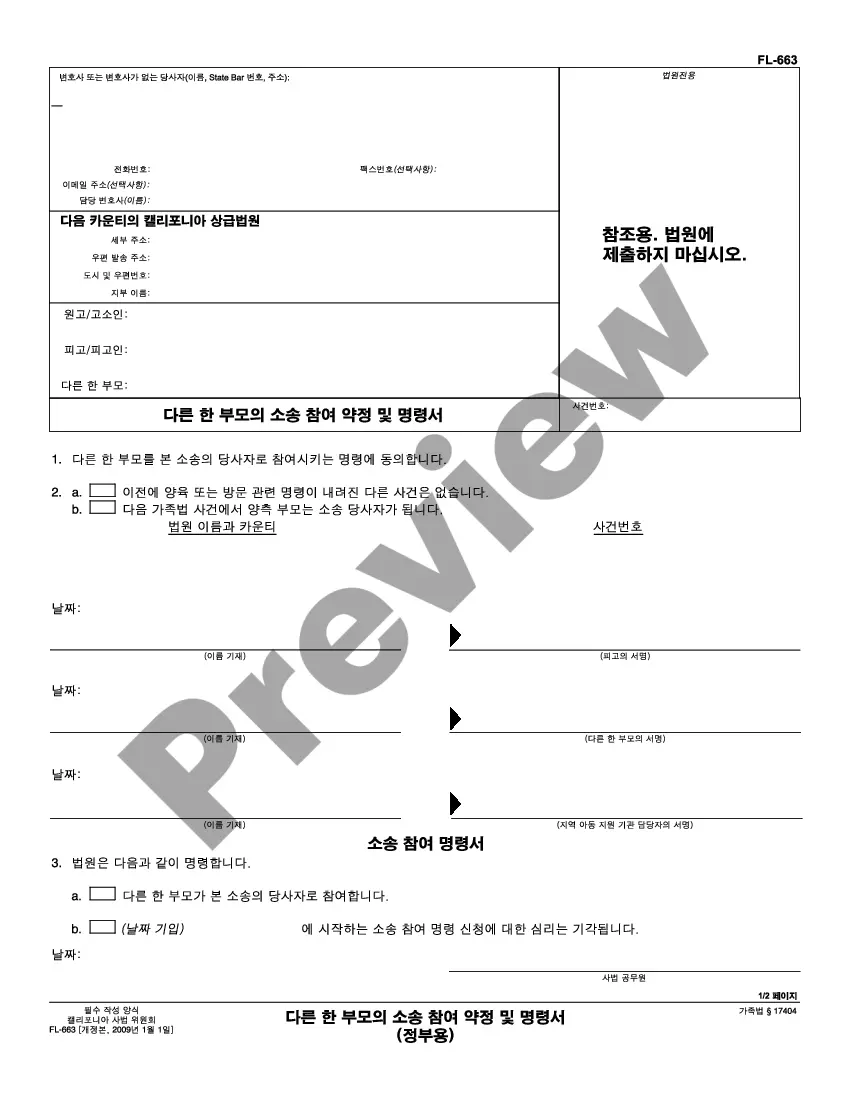

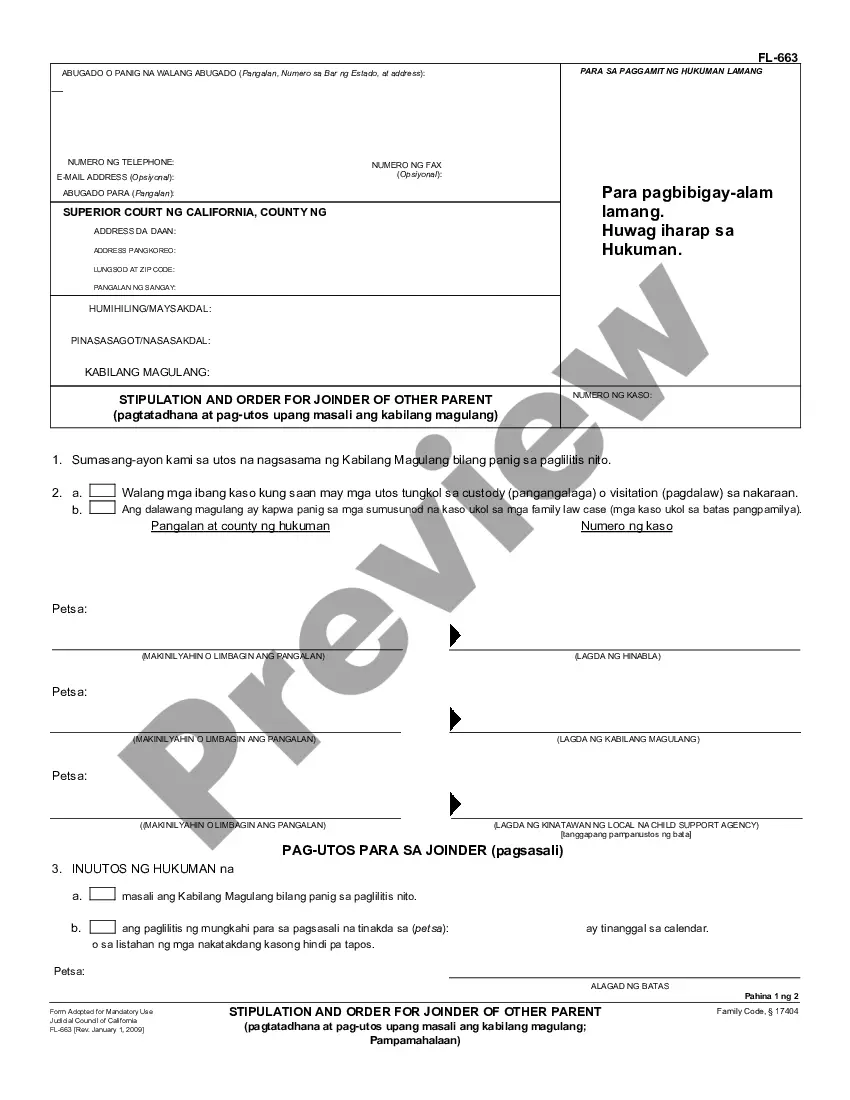

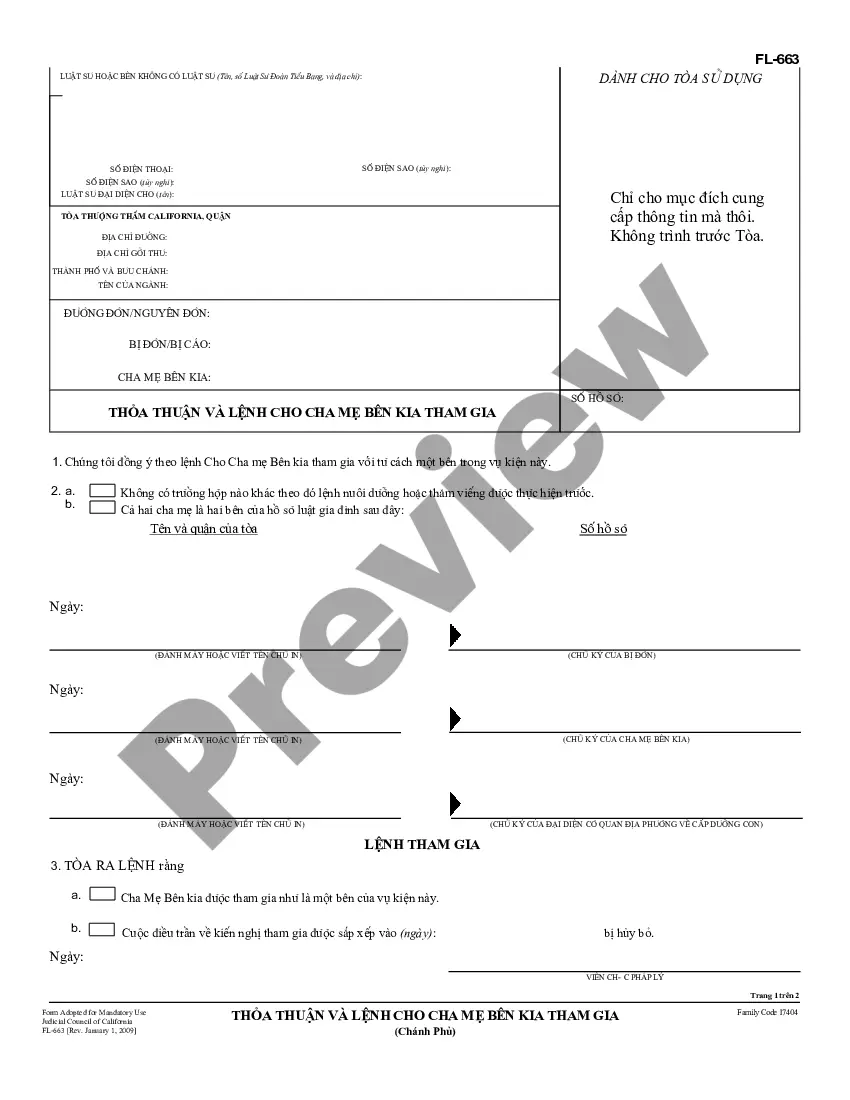

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Riverside California Acuerdo De Ajuste De Deuda Con El Acreedor?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Riverside Debt Adjustment Agreement with Creditor, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Riverside Debt Adjustment Agreement with Creditor from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Riverside Debt Adjustment Agreement with Creditor:

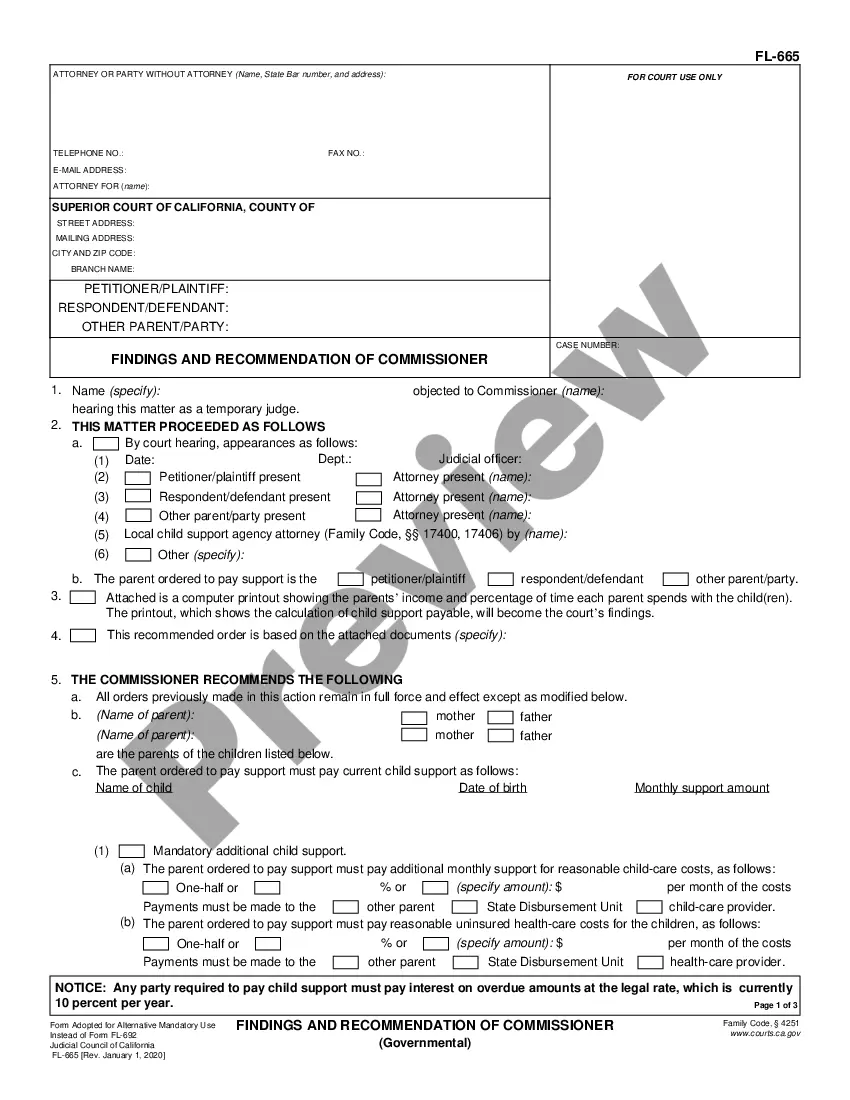

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!