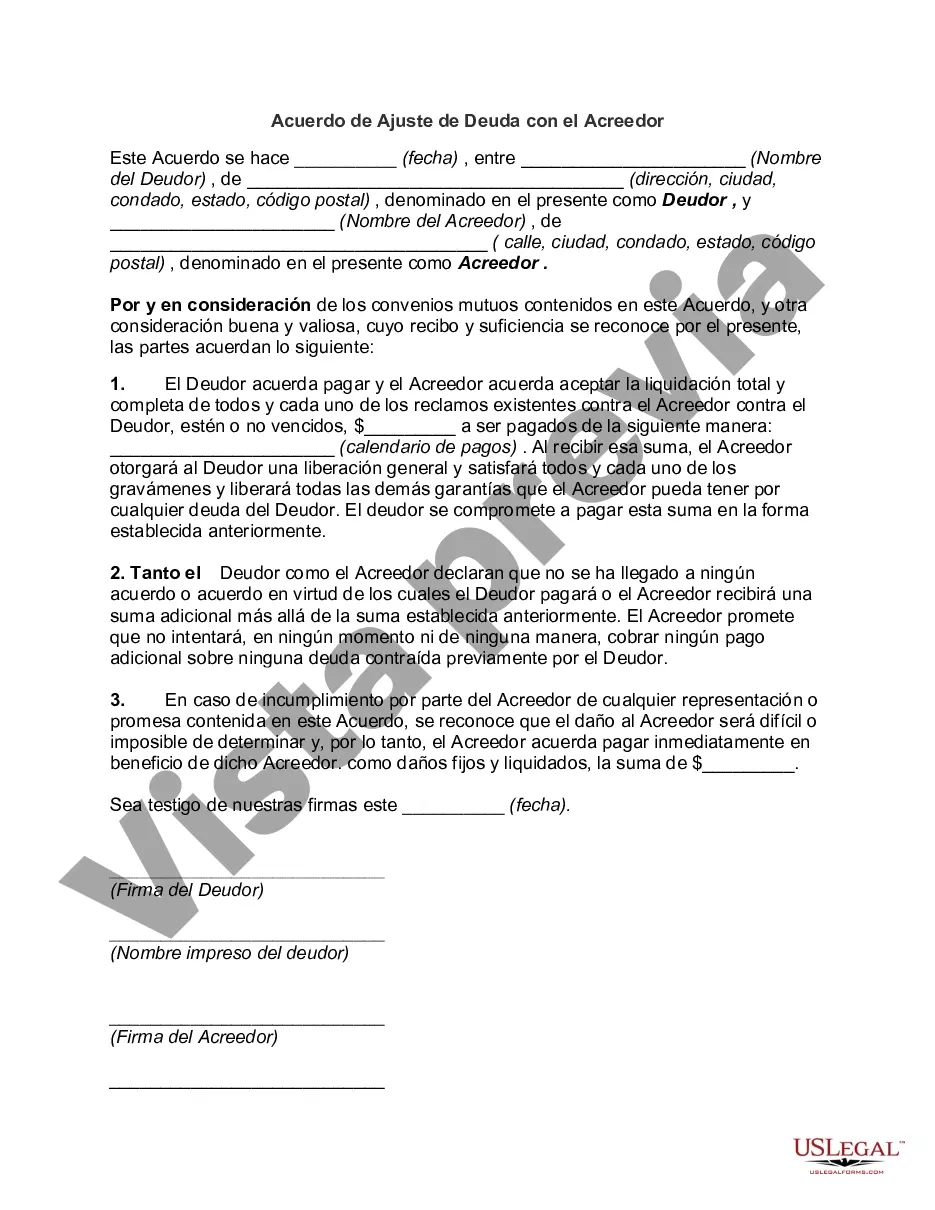

San Antonio, Texas Debt Adjustment Agreement with Creditor: A San Antonio Debt Adjustment Agreement with a Creditor is a legal contract entered into between an individual or business residing in San Antonio, Texas, and one of their creditors. This agreement aims to establish a settlement plan to repay a debt owed to the creditor while taking into consideration the unique financial circumstances of the debtor. These debt adjustment agreements are designed to provide individuals or businesses that are struggling with overwhelming debt a structured and manageable plan to repay their creditors. By negotiating with the creditor, debtors can potentially reduce the total amount owed, lower interest rates, or establish affordable repayment terms. The terms of the agreement typically vary based on the specific circumstances of the debtor and the creditor's willingness to cooperate. In some cases, a San Antonio Debt Adjustment Agreement may involve negotiating a lump-sum payment to settle the debt in full. Alternatively, it can facilitate a revised payment plan where the debtor agrees to make regular installments over an extended period. It's important to note that there can be different types of Debt Adjustment Agreements based on the specific circumstances of the debtor and the creditor's preferences. These variations include: 1. Lump-Sum Settlement Agreement: This type of agreement involves a one-time payment settlement. Debtors negotiate with the creditor to pay a significantly reduced amount, often less than the initially owed debt, to fully settle the debt. 2. Revised Payment Plan Agreement: In this agreement, debtors work with creditors to establish an affordable repayment plan based on their financial situation. The creditor may agree to reduce interest rates, waive fees, or extend the repayment period to facilitate manageable monthly payments. 3. Debt Consolidation Agreement: If a debtor has multiple creditors, they may opt for a debt consolidation agreement. This involves combining all outstanding debts into a single loan or credit facility, often with reduced interest rates. The debtor then makes a single monthly payment to the consolidation lender, who distributes it among the various creditors. San Antonio Texas Debt Adjustment Agreements with Creditors provide a structured and legal framework for debtors to alleviate their financial burdens while establishing a cooperative relationship with the creditor. By successfully navigating these agreements, individuals and businesses can regain control of their finances and work towards a debt-free future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out San Antonio Texas Acuerdo De Ajuste De Deuda Con El Acreedor?

Creating documents, like San Antonio Debt Adjustment Agreement with Creditor, to take care of your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents intended for different cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the San Antonio Debt Adjustment Agreement with Creditor template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting San Antonio Debt Adjustment Agreement with Creditor:

- Ensure that your form is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the San Antonio Debt Adjustment Agreement with Creditor isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and get the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!