A San Bernardino California Debt Adjustment Agreement with a creditor is a legally binding contract entered into by an individual or entity trying to resolve their outstanding debts with their creditors. The agreement outlines the terms and conditions under which the debtor will repay their debts, providing them with a structured plan to clear their financial obligations and potentially avoid bankruptcy. There are various types of San Bernardino California Debt Adjustment Agreements with Creditors, each tailored to suit the debtor's unique financial circumstances. Some of these agreements are: 1. Debt Settlement Agreement: This type of agreement allows the debtor to negotiate with their creditor to settle their debts for a reduced amount. The debtor typically offers a lump sum payment or agrees on a revised repayment plan to clear their balance. 2. Debt Repayment Agreement: In this agreement, the debtor and creditor establish a structured repayment plan for the outstanding debts. The debtor agrees to make regular payments over a specific period until the entire debt is paid off. 3. Debt Consolidation Agreement: This agreement combines multiple debts into a single loan, usually at a lower interest rate, to simplify repayment. The debtor makes a monthly payment to the consolidation company, who distributes the funds among the creditors until all debts are settled. 4. Debt Management Agreement: A debt management agreement involves a credit counseling agency working on behalf of the debtor to negotiate lower interest rates, waive fees, and establish a repayment plan that works within the debtor's means. 5. Debt Restructuring Agreement: This agreement allows the debtor to negotiate with their creditor to modify the terms of the original debt, such as the interest rate or repayment period, to make it more manageable for the debtor. San Bernardino California Debt Adjustment Agreements with Creditors are a crucial tool for individuals or entities struggling with overwhelming debt. These agreements provide a fair and structured approach towards addressing financial difficulties, allowing debtors to regain control of their finances and creditors to receive at least a portion of their outstanding debts. Seeking professional advice from a financial advisor or credit counseling agency is often recommended navigating the complex process of drafting and negotiating these agreements.

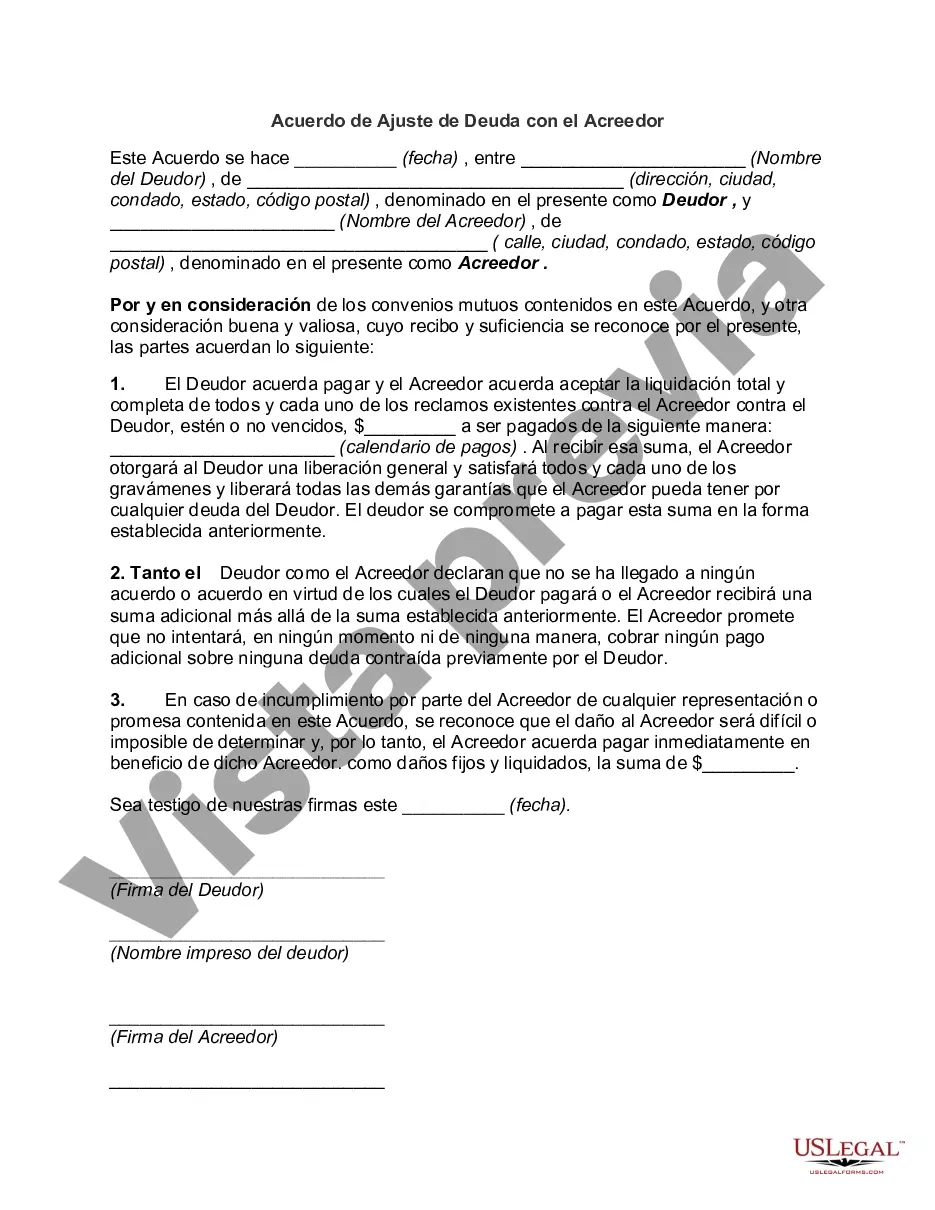

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out San Bernardino California Acuerdo De Ajuste De Deuda Con El Acreedor?

If you need to get a reliable legal paperwork provider to find the San Bernardino Debt Adjustment Agreement with Creditor, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting materials, and dedicated support make it simple to get and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to search or browse San Bernardino Debt Adjustment Agreement with Creditor, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the San Bernardino Debt Adjustment Agreement with Creditor template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate contract, or execute the San Bernardino Debt Adjustment Agreement with Creditor - all from the comfort of your home.

Sign up for US Legal Forms now!