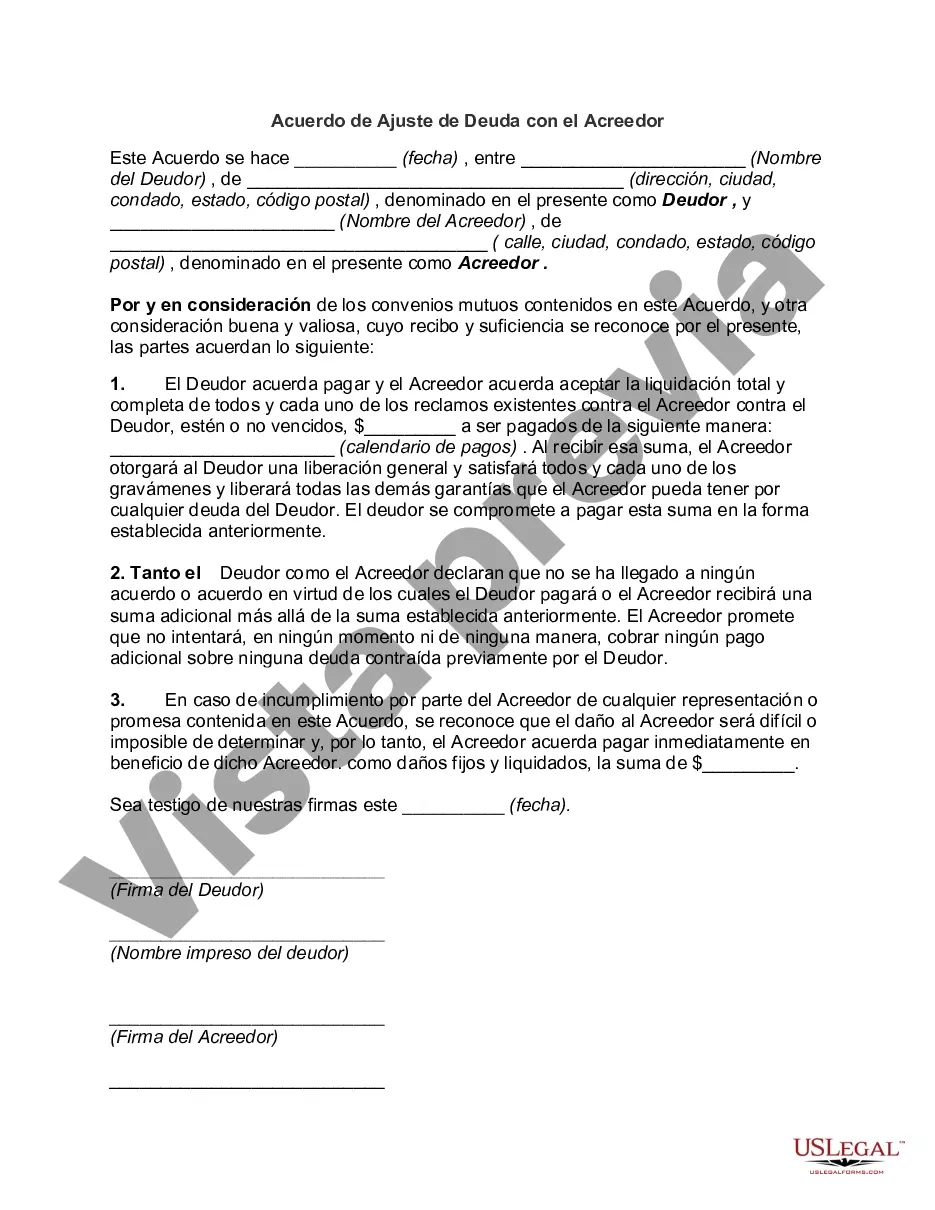

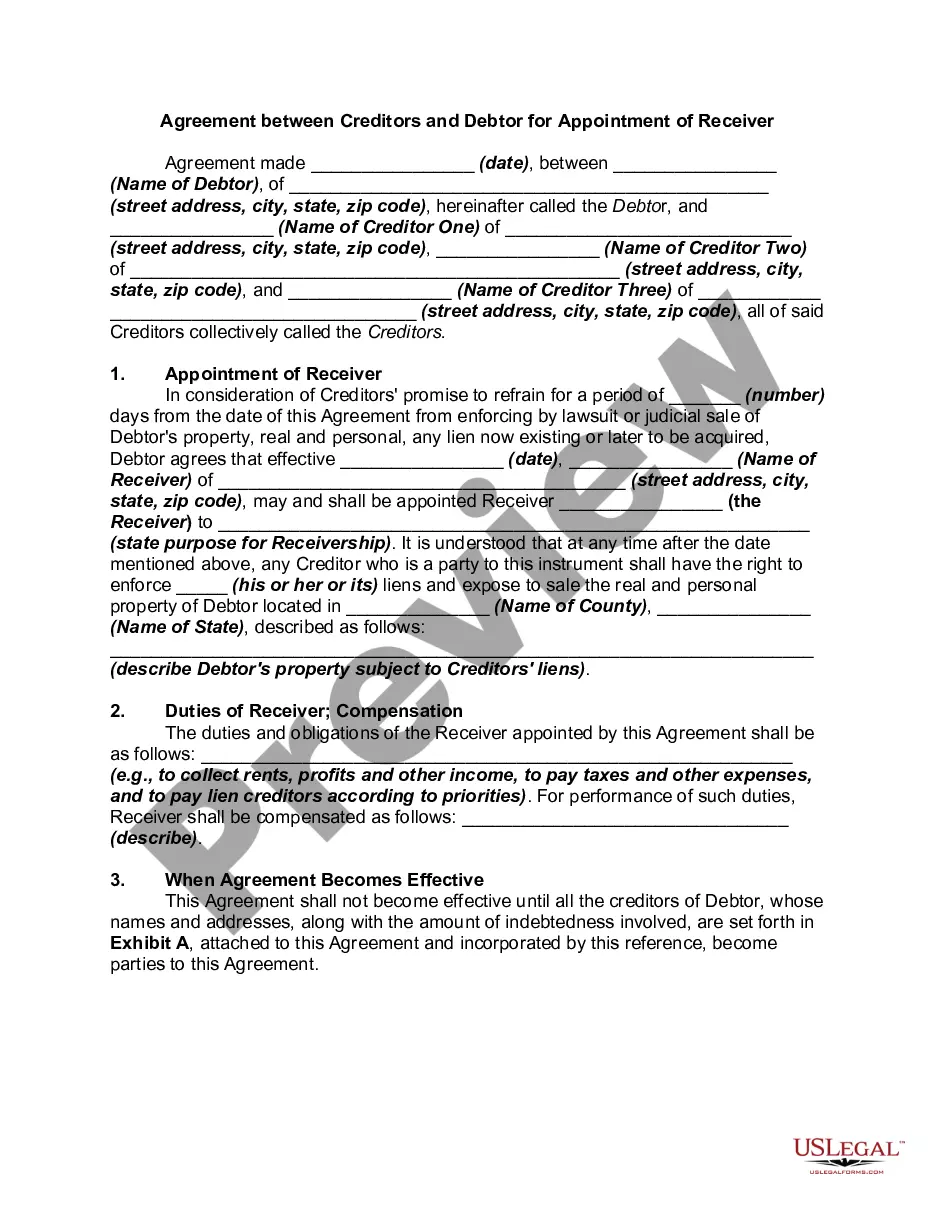

San Jose, California Debt Adjustment Agreement with Creditor: A Comprehensive Overview In San Jose, California, a Debt Adjustment Agreement with a Creditor is a legally binding arrangement entered into by debtors and their creditors to address outstanding debt issues. The purpose of such an agreement is to establish a structured repayment plan that is mutually beneficial for both parties, enabling debtors to alleviate their financial burden and creditors to recover the borrowed funds. This debt adjustment agreement involves negotiations between debtors and their creditors, aiming to find a feasible solution for both parties. It provides a legal framework for debtors to manage their outstanding debts and offers relief from overwhelming financial obligations. There are various types of San Jose, California Debt Adjustment Agreements with Creditors, including: 1. Individual Debt Adjustment Agreement: This type of agreement is entered into by an individual debtor and a creditor to address their specific debt-related issues. It offers debtors the opportunity to develop a repayment plan based on their financial circumstances, allowing them to pay off their debts gradually. 2. Business Debt Adjustment Agreement: This agreement is designed for businesses that are struggling with substantial debts. It allows business owners to negotiate with their creditors and formulate a comprehensive repayment plan tailored to the financial stability and growth of the business. 3. Consumer Debt Adjustment Agreement: Consumer debt adjustment agreements are specifically created for individuals facing overwhelming consumer debts, such as credit card debt, medical bills, or personal loans. This agreement enables debtors to make affordable monthly payments, reducing their debt burden over a predetermined period of time. 4. Consolidation Debt Adjustment Agreement: This type of agreement involves consolidating multiple debts into a single loan, which eliminates the need for multiple monthly payments. Debtors negotiate with their creditors to combine their debts and establish a repayment plan with more manageable terms. During the process of negotiating a Debt Adjustment Agreement with a Creditor in San Jose, specific keywords and phrases play a crucial role in understanding the terms and conditions. Some relevant keywords to consider include: — Debnegotiationio— - Debt restructuring - Repayment plan — Financiahardshiphi— - Creditor cooperation — Interest ratreductionio— - Late payment forgiveness — Grace perio— - Consent to collection actions — Credit scorimpactac— - Legal implications — Debt counseling service— - Debt relief program — Debt settlement In conclusion, a San Jose, California Debt Adjustment Agreement with a Creditor is an essential tool for debtors facing financial challenges. By establishing structured repayment plans and negotiating with creditors, debtors can regain control over their finances and move towards a debt-free future. It is crucial to consult with legal professionals or debt counseling services to ensure that the agreement is legally binding and protects the best interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out San Jose California Acuerdo De Ajuste De Deuda Con El Acreedor?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Jose Debt Adjustment Agreement with Creditor, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the latest version of the San Jose Debt Adjustment Agreement with Creditor, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Jose Debt Adjustment Agreement with Creditor:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your San Jose Debt Adjustment Agreement with Creditor and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!