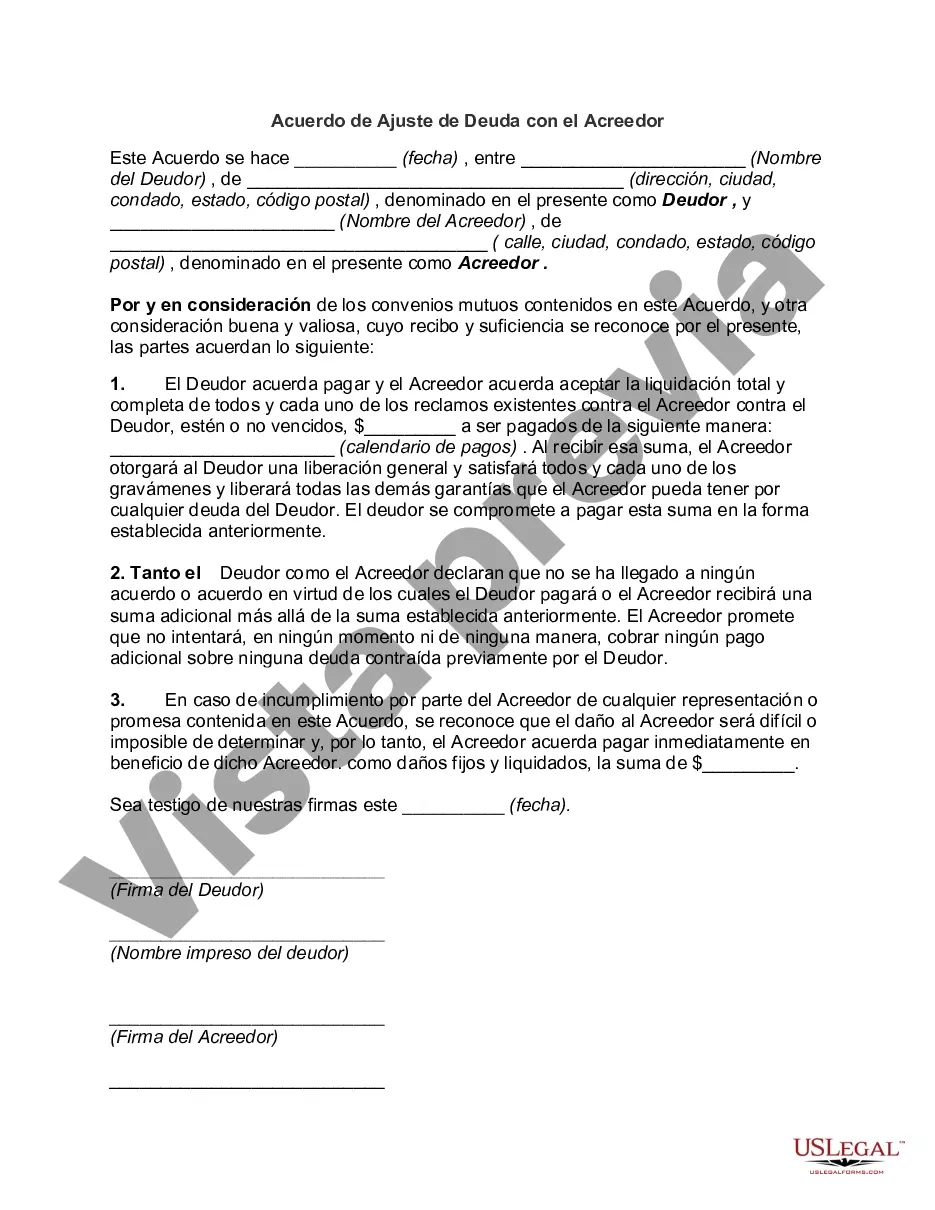

Travis Texas Debt Adjustment Agreement with Creditor is a legally binding contract entered into by a debtor and a creditor to help the debtor manage their outstanding debts. This agreement allows the debtor to negotiate new terms for their existing debt with the creditor, ensuring a more affordable repayment plan. In the Travis Texas Debt Adjustment Agreement with Creditor, the debtor and creditor agree upon a revised payment schedule that suits the debtor's financial situation. This agreement aims to provide debtors with a structured plan to gradually pay off their outstanding balances, minimizing the risk of default or bankruptcy. The terms of the Travis Texas Debt Adjustment Agreement with Creditor may vary depending on the specific circumstances and the creditor involved. While the primary objective is to create a manageable repayment plan, there may be different types of debt adjustment agreements. Some common variations include: 1. Interest Rate Reduction: The creditor may agree to lower the interest rate on the outstanding debt, helping the debtor save money in the long run and make repayment more feasible. 2. Principal Reduction: In certain cases, the creditor may agree to reduce a portion of the principal owed by the debtor. This reduction decreases the total debt burden and enables the debtor to repay the remaining balance more easily. 3. Extended Repayment Schedule: To accommodate the debtor's financial constraints, the creditor may agree to extend the repayment period. This can result in lower monthly payments, allowing the debtor to gradually settle their debt without significant financial strain. 4. Lump-Sum Settlement: In some instances, debtors may negotiate a lump-sum settlement in which they agree to pay a reduced amount to settle their outstanding debt in full. This option is beneficial for debtors who can access a substantial sum of money at once. Regardless of the type of Travis Texas Debt Adjustment Agreement with Creditor, it is crucial for debtors to thoroughly review and understand the terms before signing. Seeking legal advice or assistance from debt counseling services can help individuals navigate these agreements and make informed decisions about managing their debt effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Travis Texas Acuerdo De Ajuste De Deuda Con El Acreedor?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Travis Debt Adjustment Agreement with Creditor, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Consequently, if you need the latest version of the Travis Debt Adjustment Agreement with Creditor, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Travis Debt Adjustment Agreement with Creditor:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Travis Debt Adjustment Agreement with Creditor and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!