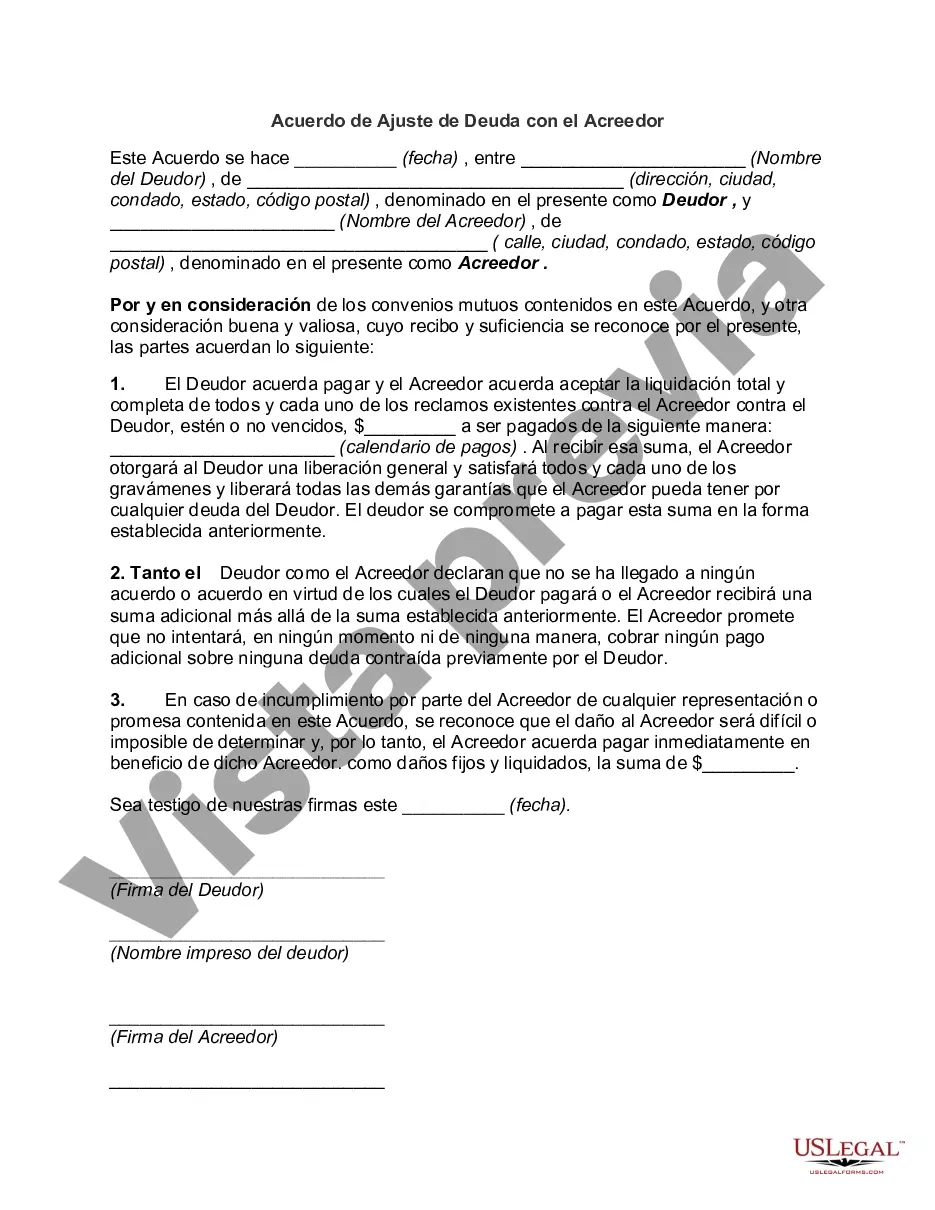

Keywords: Wake North Carolina, debt adjustment agreement, creditor, types A Wake North Carolina Debt Adjustment Agreement with a creditor is a legally binding contract between a debtor and a creditor that outlines the terms and conditions for the repayment of a debt. This agreement is designed to help debtors in Wake North Carolina who are struggling to meet their financial obligations by providing a structured repayment plan that is agreed upon by both parties. The agreement typically addresses various aspects, including: 1. Parties involved: The agreement identifies the debtor, who owes the debt, and the creditor, who holds the debt. 2. Debt details: It includes specific details about the debt, such as the amount owed, the nature of the debt (credit card, personal loan, medical bills, etc.), and any interest or fees associated with it. 3. Repayment terms: The agreement specifies the repayment plan, which may involve reducing interest rates, extending the repayment period, or lowering the monthly payments to make them more manageable for the debtor. 4. Negotiated settlement: In some cases, the debtor and creditor may agree to settle the debt for a reduced amount, allowing the debtor to make a lump sum payment to clear the debt entirely. 5. Legal protection: The agreement outlines any legal protections offered to the debtor, ensuring that the creditor will not pursue aggressive collection efforts like wage garnishment, lawsuits, or foreclosure during the repayment period. Types of Debt Adjustment Agreements in Wake North Carolina: 1. Personal Loan Debt Adjustment Agreement: This type of agreement is tailored to individuals who struggle with personal loan repayments and need a revised payment plan to avoid default. 2. Credit Card Debt Adjustment Agreement: This agreement is specifically designed to help individuals who are burdened with credit card debt and require a structured repayment plan to regain financial stability. 3. Medical Bill Debt Adjustment Agreement: This agreement provides a structured repayment plan for individuals who are unable to pay off their medical bills in a lump sum, allowing them to make affordable monthly payments. 4. Retail Debt Adjustment Agreement: This type of agreement pertains to debts incurred from retail purchases, such as store credit cards or installment plans. A Wake North Carolina Debt Adjustment Agreement with a creditor aims to alleviate financial stress for debtors by providing them with a clear path towards debt repayment while protecting their rights. It is essential for debtors to carefully review and understand the terms of the agreement and seek legal advice if needed before entering into any contractual commitments with creditors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Wake North Carolina Acuerdo De Ajuste De Deuda Con El Acreedor?

Draftwing documents, like Wake Debt Adjustment Agreement with Creditor, to take care of your legal affairs is a tough and time-consumming task. Many cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for a variety of cases and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Wake Debt Adjustment Agreement with Creditor template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Wake Debt Adjustment Agreement with Creditor:

- Make sure that your template is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Wake Debt Adjustment Agreement with Creditor isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our website and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is all set. You can try and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!