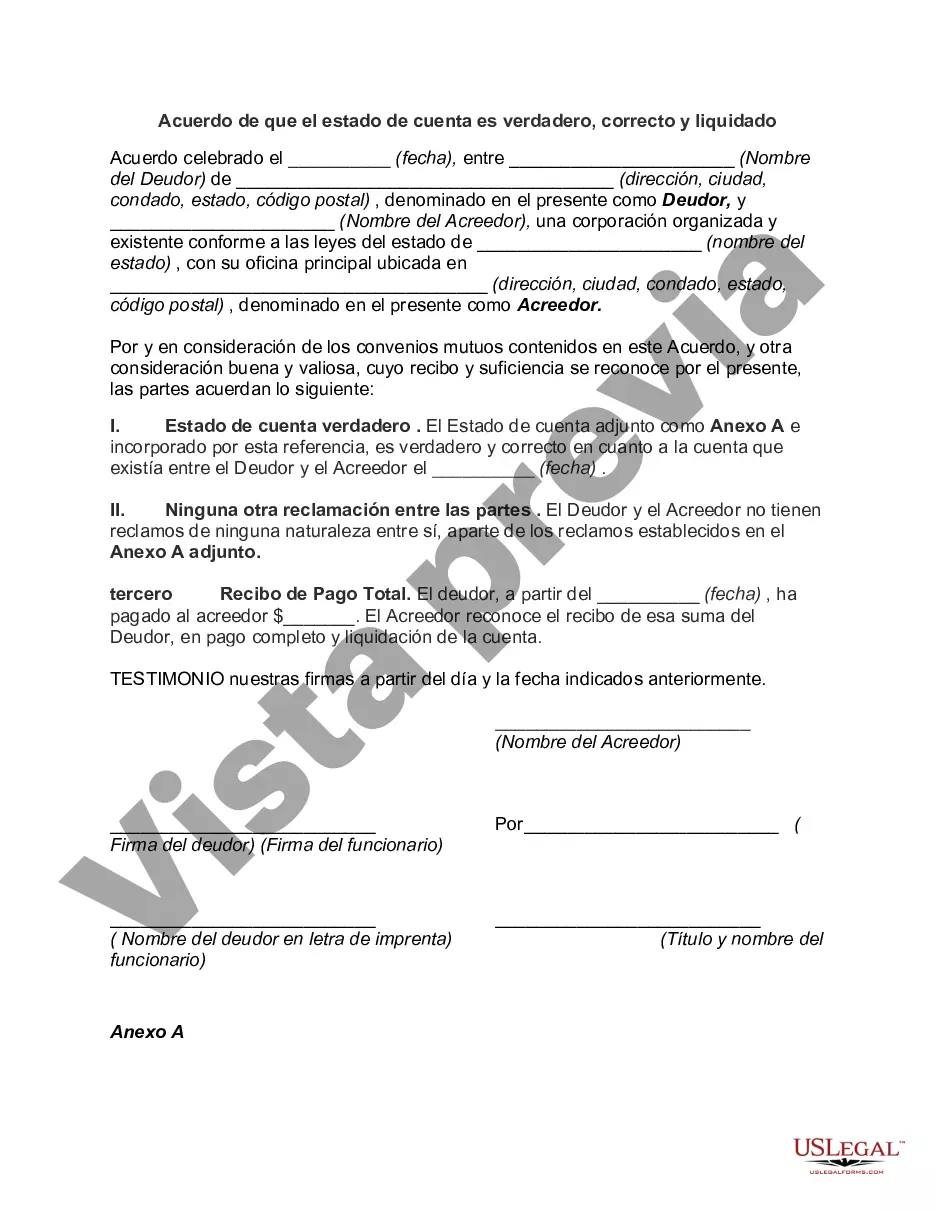

Dallas Texas Agreement is a legally binding document which affirms that the Statement of Account is True, Correct, and Settled. This agreement is commonly used in various industries and sectors to formalize the acknowledgment of outstanding debts, account balances, and the final settlement of financial obligations between two or more parties. It serves as evidence and ensures that all parties involved are in agreement regarding the accuracy of the account statement and the completion of monetary transactions. The Dallas Texas Agreement that Statement of Account is True, Correct, and Settled can be classified into different types based on the nature and purpose of the transactions. Some of these types include: 1. Business Account Settlement Agreement: This type of agreement is commonly used in commercial settings where businesses settle outstanding account balances. It ensures that all financial matters between the involved organizations are resolved, and accurate account statements are agreed upon. 2. Personal Account Statement Settlement Agreement: In personal finance scenarios, individuals or families may enter into this agreement to acknowledge the accuracy of account statements, resolve outstanding debts, and settle financial matters with creditors or lenders. 3. Legal Settlement Agreement: In legal disputes or lawsuits related to financial matters, parties may enter into a Dallas Texas Agreement to attest that the statement of account is true, correct, and settled as part of a negotiated settlement. This type of agreement helps in resolving legal conflicts and avoiding lengthy court procedures. 4. Debt Settlement Agreement: When individuals or businesses find themselves in debt, a Dallas Texas Agreement can be utilized to establish terms for the settlement of outstanding balances. It validates the accuracy of the statement of account and outlines agreed-upon payment plans or lump-sum settlement amounts. 5. Supplier Account Settlement Agreement: In business-to-business relationships, a supplier account settlement agreement ensures that both parties are in agreement regarding the statement of account and any outstanding balances. It serves as a record of their mutual understanding and final settlement. In conclusion, the Dallas Texas Agreement that Statement of Account is True, Correct, and Settled is a crucial legal instrument used across various sectors and industries to formalize the acknowledgment and settlement of financial obligations. Its diverse types cater to different contexts, such as business, personal, legal, debt settlement, and supplier accounts, ensuring accurate representation and resolution of financial matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de que el estado de cuenta es verdadero, correcto y liquidado - Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Dallas Texas Acuerdo De Que El Estado De Cuenta Es Verdadero, Correcto Y Liquidado?

Are you looking to quickly create a legally-binding Dallas Agreement that Statement of Account is True, Correct and Settled or maybe any other document to take control of your own or corporate affairs? You can go with two options: contact a legal advisor to write a legal document for you or draft it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific document templates, including Dallas Agreement that Statement of Account is True, Correct and Settled and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, double-check if the Dallas Agreement that Statement of Account is True, Correct and Settled is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were hoping to find by using the search bar in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Dallas Agreement that Statement of Account is True, Correct and Settled template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the templates we provide are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Los 4 primeros digitos corresponden al banco, los siguientes 4 a la sucursal, los 2 siguientes son los digitos de control, y los ultimos 10 son el numero de cuenta dentro de la sucursal.

El saldo a favor de mi tarjeta Para entenderlo de manera mas sencilla se puede hacer con un ejemplo: Imagina que tu saldo total es de $5,000 pesos y, cuando llega la fecha de pago, haces un deposito por $7,000 pesos. Esos 2 mil pesos extras que pagaste se tomaran como saldo a favor.

Adelanto o descubierto en cuenta corriente es un prestamo otorgado por una entidad financiera a muy corto plazo que se origina cuando el titular de la cuenta corriente utiliza mas del dinero que tiene depositado en dicha cuenta.

Para poder comprobar una cuenta bancaria, existe, ademas del codigo IBAN, otro codigo: el BIC o SWIFT. Este codigo se conforma con una serie de digitos mediante los cuales se define la sucursal en concreto de la que depende la cuenta.

Debes buscar siempre la siguiente informacion en tu estado de cuenta: Fechas que cubre este estado de cuenta. El saldo inicial debe ser el mismo que el saldo final del ultimo mes. El numero total de depositos que hiciste durante el mes y el total. El numero total de retiros que se hicieron durante el mes y el total.

El digito de control se calcula en funcion del codigo del banco, del codigo de la sucursal y el numero de cuenta a traves de una formula matematica. Por tanto a partir del numero de control puede comprobase si un numero de cuenta es correcto o no.

Si bien los bancos son los encargados de gravar el impuesto sobre el deposito en efectivo, en caso de inconsistencias o montos superiores a 15,000 pesos el SAT puede auditarte para aclarar la procedencia de esos recursos.

Saldo a Favor del Contribuyente (CR): Es el resultado que se obtiene cuando el credito de un impuesto es mayor que el debito; el saldo se traslada para compensarse en proximos periodos.

¿Como averiguo a quien pertenece una cuenta de un desconocido? Si la cuenta sobre la que desean averiguar la titularidad es de un desconocido u existe otro tipo de situacion, lo mejor es presentarse ante el banco de la cuenta en el que deben pedir que los atienda para poder explicar la situacion.

En general el estado de cuenta debe contar con la siguiente informacion: Nombre del titular (persona fisica) o la razon social (persona moral), numero de la tarjeta, numero de cuenta, CLABE. Fecha de vencimiento y monto minimo de pago. Periodo al que corresponde dicho estado de cuenta.