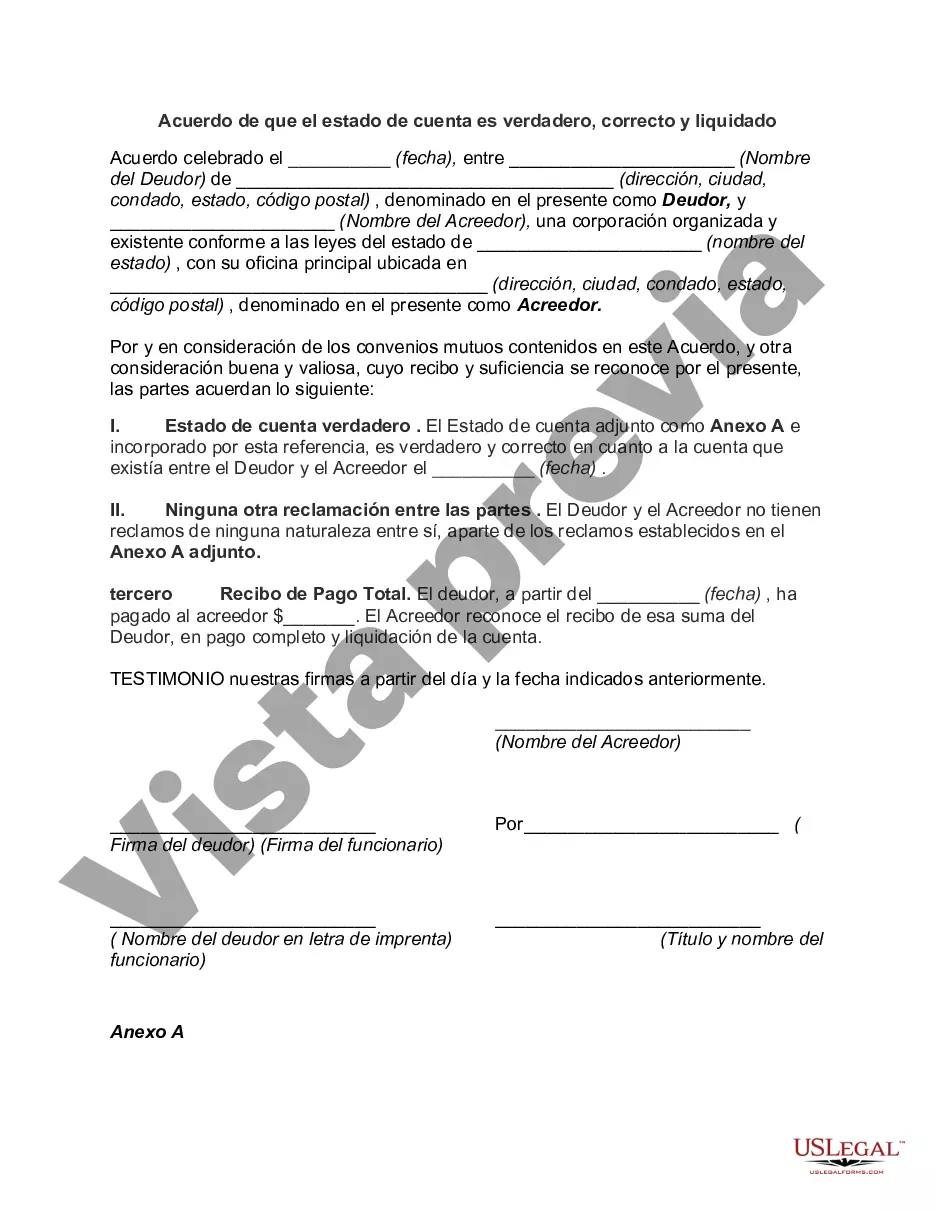

The Montgomery Maryland Agreement is a legal contract that signifies the acceptance and acknowledgment that a Statement of Account is deemed true, correct, and settled. This agreement holds significant importance in financial matters such as business transactions, loans, or any form of credit arrangement. The Montgomery Maryland Agreement serves as a binding document between the parties involved, typically the creditor and the debtor. It ensures that there is a mutual understanding and agreement regarding the balance or outstanding amount mentioned in the Statement of Account, and that upon signing, both parties agree that the amount provided is accurate and no further claims or disputes will be made. There are several types of Montgomery Maryland Agreement that Statement of Account is True, Correct and Settled, each serving a specific purpose. Some common types include: 1. General Agreement: This is the most basic form of the Montgomery Maryland Agreement, where the debtor and creditor agree that the Statement of Account provided is accurate and settled. This type is often used in regular business transactions or loans. 2. Settlement Agreement: When there are outstanding debts or disputes, this type of agreement is used to settle the issues between the parties involved. It involves negotiation and compromise, and upon reaching an agreement, the Statement of Account is considered true, correct, and settled. 3. Debt Repayment Agreement: In cases where the debtor agrees to repay the outstanding amount over a specific period, a debt repayment agreement is used. This agreement outlines the terms and conditions of the repayment plan, and upon successful completion, the Statement of Account is considered true, correct, and settled. 4. Legal Release Agreement: This type of agreement is used when there are legal claims or disputes involved. Upon signing, it releases the creditor from any further claims or actions against the debtor, as long as the Statement of Account is considered true, correct, and settled. It is crucial for both parties to thoroughly review the Statement of Account before signing the Montgomery Maryland Agreement. Any discrepancies or concerns should be addressed and rectified before considering the account as true, correct, and settled. Seeking legal advice is recommended to ensure a fair and valid agreement is reached.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Acuerdo de que el estado de cuenta es verdadero, correcto y liquidado - Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Montgomery Maryland Acuerdo De Que El Estado De Cuenta Es Verdadero, Correcto Y Liquidado?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Montgomery Agreement that Statement of Account is True, Correct and Settled meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. In addition to the Montgomery Agreement that Statement of Account is True, Correct and Settled, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Montgomery Agreement that Statement of Account is True, Correct and Settled:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Montgomery Agreement that Statement of Account is True, Correct and Settled.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!