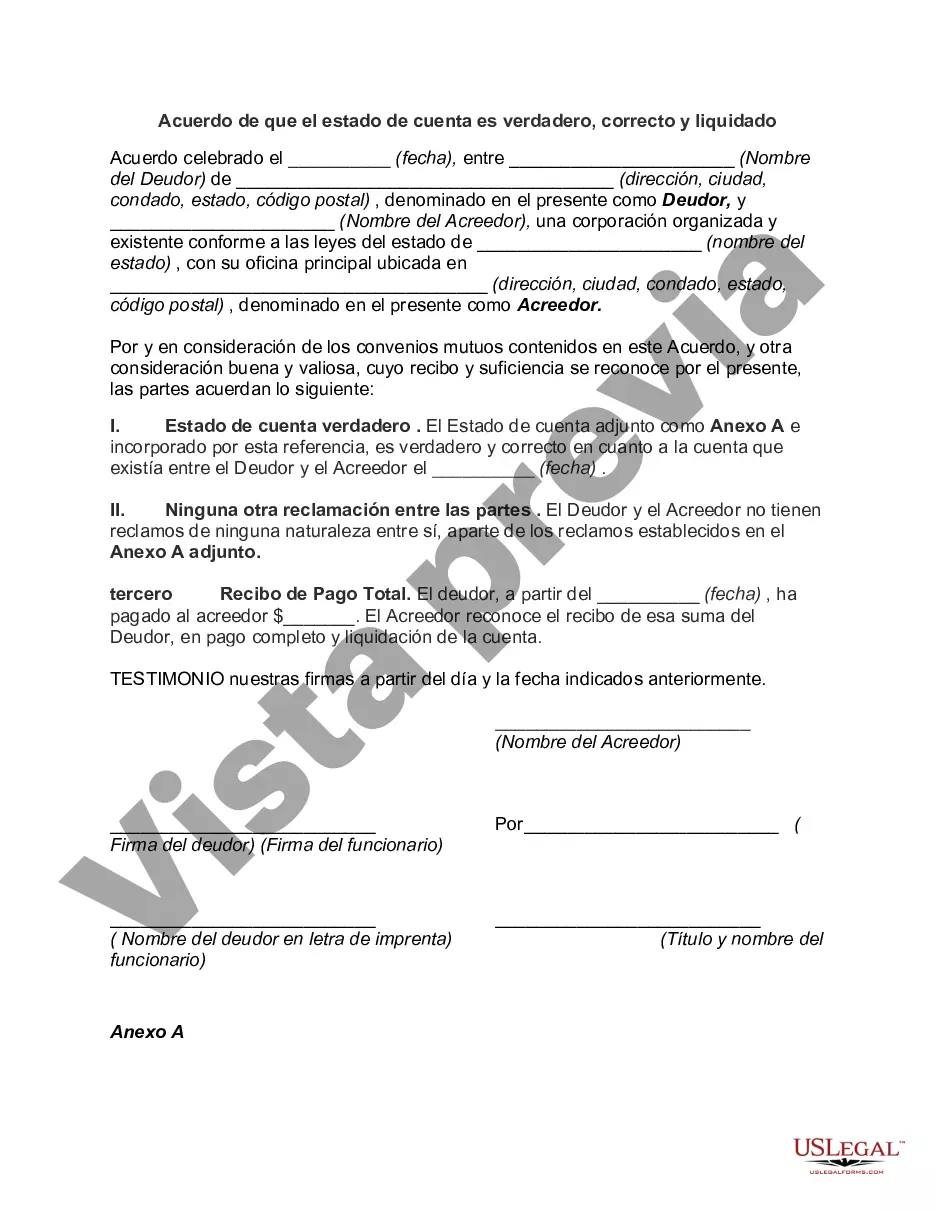

The Phoenix Arizona Agreement that Statement of Account is True, Correct and Settled refers to a legal document that confirms the accuracy and finality of a financial statement. This agreement is commonly utilized in various business transactions and contractual obligations to ensure transparency and clarity in account settlements. In simpler terms, it acts as a confirmation and resolution in cases where there might have been disputes or discrepancies regarding financial records. The Phoenix Arizona Agreement offers reassurance to both parties involved in the transaction, serving as an official acknowledgment that the statement of account is accurate and all outstanding balances have been resolved. This agreement holds significant value in maintaining trust and fostering good business relationships between parties. There are different types of Phoenix Arizona Agreements related to the Statement of Account is True, Correct and Settled, primarily differentiated by the nature of the transaction or contract. Some common types include: 1. Loan Agreement: This type of agreement is prevalent in cases where a borrower settles outstanding loans or debts with a financial institution or lender. It confirms that the statement of account, including the principal amount, interest, and any additional charges, is true, correct, and settled. 2. Purchase Agreement: In the business realm, a purchase agreement may be established between a buyer and seller. When settling the final payment for a product or service, this agreement ensures that the statement of account accurately reflects the agreed-upon price, any applicable taxes or fees, and that all financial obligations have been fulfilled. 3. Service Agreement: When engaging in service-based contracts, such as consulting or professional services, a service agreement becomes crucial. After the completion of services and the associated charges, the agreement confirms that the statement of account is true, correct, and settled. 4. Rental Agreement: In the realm of property rentals, a rental agreement may incorporate the Statement of Account is True, Correct and Settled clause. This ensures that the tenant has fulfilled all financial obligations, including rent payments, utility bills, and any additional fees, as mentioned in the statement of account. 5. Partnership Agreement: For business partnerships, an agreement may be developed to outline the financial responsibilities and rights of each partner. This agreement includes provisions for the accurate statement of account, ensuring transparency, and confirming that all financial matters are settled. To summarize, the Phoenix Arizona Agreement that Statement of Account is True, Correct and Settled plays a crucial role in various business transactions and contractual relationships. By certifying the accuracy and resolution of financial statements, this agreement promotes transparency, trust, and compliance among parties involved, ultimately maintaining a strong foundation for continued collaboration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo de que el estado de cuenta es verdadero, correcto y liquidado - Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Phoenix Arizona Acuerdo De Que El Estado De Cuenta Es Verdadero, Correcto Y Liquidado?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Phoenix Agreement that Statement of Account is True, Correct and Settled, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various types varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any tasks associated with document execution straightforward.

Here's how you can purchase and download Phoenix Agreement that Statement of Account is True, Correct and Settled.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the similar document templates or start the search over to locate the right file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Phoenix Agreement that Statement of Account is True, Correct and Settled.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Phoenix Agreement that Statement of Account is True, Correct and Settled, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you have to deal with an exceptionally challenging situation, we recommend using the services of a lawyer to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!

Form popularity

FAQ

Una cuenta de cheques es una cuenta de banco con la que puede hacer cheques, o acceder a esta de varias maneras, lo que la convierte en su cuenta de banco a la que recurre para hacer sus transacciones cotidianas.

Un extracto bancario o estado de cuenta: dicese de aquel documento personal que detalla nuestros movimientos bancarios y el saldo de nuestras cuentas mediante lo que parecerian ser numerosas cifras, letras, apartados y abreviaciones dificiles de descifrar.

Para poder comprobar una cuenta bancaria, existe, ademas del codigo IBAN, otro codigo: el BIC o SWIFT. Este codigo se conforma con una serie de digitos mediante los cuales se define la sucursal en concreto de la que depende la cuenta.

Los 4 primeros digitos corresponden al banco, los siguientes 4 a la sucursal, los 2 siguientes son los digitos de control, y los ultimos 10 son el numero de cuenta dentro de la sucursal.

Todos los numeros de cuentas bancarias se componen de un codigo y 20 digitos, cada uno con un significado o funcion determinada.

Un estado de cuenta o extracto es un documento que te envia el banco o entidad financiera de forma periodica -trimestral o mensual- donde se indican todos los movimientos que ha tenido el producto -cuenta de ahorros, cuenta corriente, o tarjeta de credito- durante dicho periodo.

¿Como averiguo a quien pertenece una cuenta de un desconocido? Si la cuenta sobre la que desean averiguar la titularidad es de un desconocido u existe otro tipo de situacion, lo mejor es presentarse ante el banco de la cuenta en el que deben pedir que los atienda para poder explicar la situacion.

Si bien los bancos son los encargados de gravar el impuesto sobre el deposito en efectivo, en caso de inconsistencias o montos superiores a 15,000 pesos el SAT puede auditarte para aclarar la procedencia de esos recursos.

El digito de control se calcula en funcion del codigo del banco, del codigo de la sucursal y el numero de cuenta a traves de una formula matematica. Por tanto a partir del numero de control puede comprobase si un numero de cuenta es correcto o no.

En general el estado de cuenta debe contar con la siguiente informacion: Nombre del titular (persona fisica) o la razon social (persona moral), numero de la tarjeta, numero de cuenta, CLABE. Fecha de vencimiento y monto minimo de pago. Periodo al que corresponde dicho estado de cuenta.