The Travis Texas Agreement: Ensuring Truth, Accuracy, and Resolution — Explained In the realm of legal and financial matters, it is crucial for parties involved to establish a comprehensive understanding and acknowledgement of the accuracy of an account statement. To address this, the Travis Texas Agreement — also commonly referred to as the Travis Agreement of Account Settlement — comes into play. This agreement serves as a legally binding contract that declares the statement of account to be true, correct, and settled. Now, let's delve deeper into the details and explore the different types of Travis Texas Agreements. The Travis Texas Agreement is primarily designed to clear any uncertainties or disputes related to financial accounts between two or more parties. It acts as a final resolution, confirming that the provided statement of account is accurate, reflecting the exact financial transactions that have taken place. This agreement carries significant weight in legal proceedings and negotiations, providing a solid foundation for trust and transparency between the parties involved. There are several variations of the Travis Texas Agreement, geared towards accommodating different scenarios and addressing specific needs. Some key types include: 1. General Account Settlement Agreement: This form of the Travis Texas Agreement is widely used when parties involved in a financial transaction or business deal wish to terminate any existing monetary claims or disputes. It provides a comprehensive settlement of all outstanding balances and imposes an obligation on the parties to accept the account statement as true, correct, and settled. 2. Property Sale/Purchase Account Settlement Agreement: Particularly relevant in real estate transactions, this type of agreement is employed when a property is being sold or purchased. It allows both the buyer and seller to finalize the financial aspects of the transaction, ensuring that all financial obligations have been satisfied and the statement of account provided is accurate, thus culminating in a smooth property transfer. 3. Business Partnership Account Settlement Agreement: When partners dissolve their business arrangement or wish to reconcile any financial disagreements, this agreement variation comes into play. It serves as a final declaration that the statement of account is true and correct, enabling the parties to settle any outstanding balances or obligations. This agreement also establishes a firm foundation for the future conduct of the former partners. In conclusion, the Travis Texas Agreement proves to be an essential legal contract in situations where parties seek to establish the veracity, correctness, and settlement of a provided statement of account. Be it general account settlements, property transactions, or business partnerships, different types of Travis Texas Agreements cater to unique circumstances and assist in resolving financial disputes effectively. By utilizing these agreements, parties can ensure clarity, trust, and a firm foundation for their ongoing relationship or future endeavors.

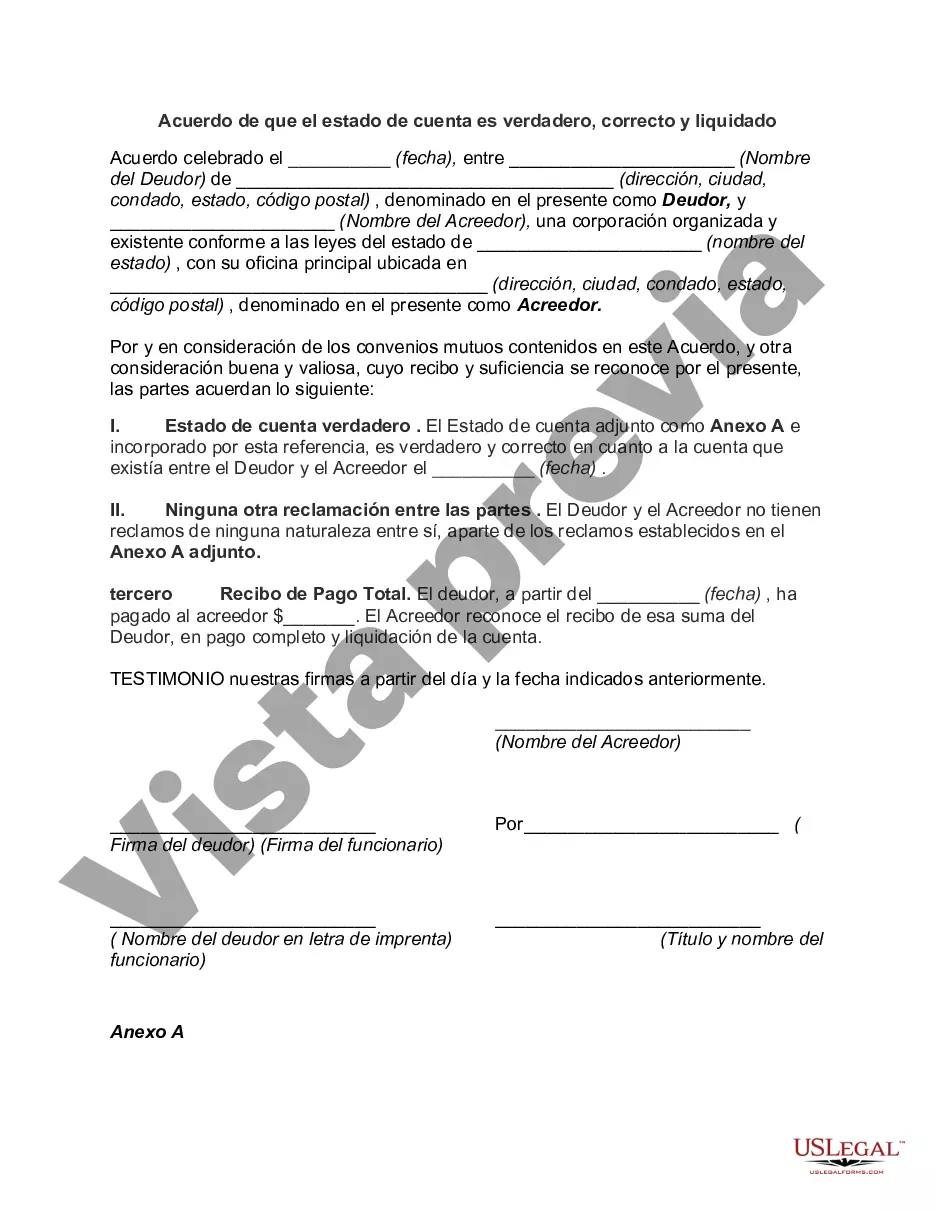

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de que el estado de cuenta es verdadero, correcto y liquidado - Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Travis Texas Acuerdo De Que El Estado De Cuenta Es Verdadero, Correcto Y Liquidado?

Do you need to quickly create a legally-binding Travis Agreement that Statement of Account is True, Correct and Settled or probably any other form to take control of your own or business affairs? You can go with two options: contact a professional to draft a valid document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific form templates, including Travis Agreement that Statement of Account is True, Correct and Settled and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, double-check if the Travis Agreement that Statement of Account is True, Correct and Settled is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by using the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Travis Agreement that Statement of Account is True, Correct and Settled template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Additionally, the templates we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!