Houston Texas is a bustling city located in the southern region of the United States. Known for its diverse population, rich culture, and thriving economy, Houston is the fourth-largest city in the country and is often referred to as the "Space City" due to its connection with the NASA's Johnson Space Center. Inquiry of credit cardholder concerning billing error is a common occurrence in Houston, considering the city's massive consumer base and the extensive use of credit cards for various purchases. When faced with billing errors, credit cardholders in Houston have the right to inquire about the discrepancies and seek resolution. This inquiry process typically involves contacting the credit card issuer or the customer service department to report the issues and request further investigation or correction. Keywords: Houston Texas, inquiry, credit cardholder, billing error, credit card, consumer, resolution, discrepancies, customer service, investigation, correction. Types of Houston Texas Inquiry of Credit Cardholder Concerning Billing Error: 1. Unauthorized Charges Inquiry: This type of inquiry involves credit cardholders reporting charges on their billing statements that they did not authorize or make. It could be a result of identity theft or fraudulent activities, where someone gains unauthorized access to the cardholder's credit card information. 2. Double Charges Inquiry: In this case, credit cardholders notice duplicate charges for the same transaction on their billing statements. This could be a technical glitch or an error on the merchant's part, where they unintentionally charge the customer multiple times for the same purchase. 3. Incorrect Amount Inquiry: This type of inquiry arises when credit cardholders find discrepancies in the amount charged on their billing statements compared to the actual purchase transaction. It could be due to a typographical or data entry error, resulting in an incorrect amount being charged. 4. Billing Dispute Inquiry: This type of inquiry is common when there is a disagreement between the credit cardholder and the merchant regarding the product or service provided. It could involve issues such as unsatisfactory quality, non-delivery of goods or services, or misleading advertising. 5. Fraudulent Transaction Inquiry: When credit cardholders identify transactions on their billing statements that they didn't make, it could indicate fraudulent activity. These inquiries involve reporting potential instances of credit card fraud and seeking assistance to resolve the issue and protect themselves from further unauthorized charges. 6. Billing Statement Explanation Inquiry: Sometimes, credit cardholders may have general questions or need clarification regarding specific charges or fees mentioned in their billing statements. These inquiries seek a detailed explanation of the charges and aim to gain a better understanding of the transaction history. Keywords: unauthorized charges, double charges, incorrect amount, billing dispute, fraudulent transaction, billing statement explanation.

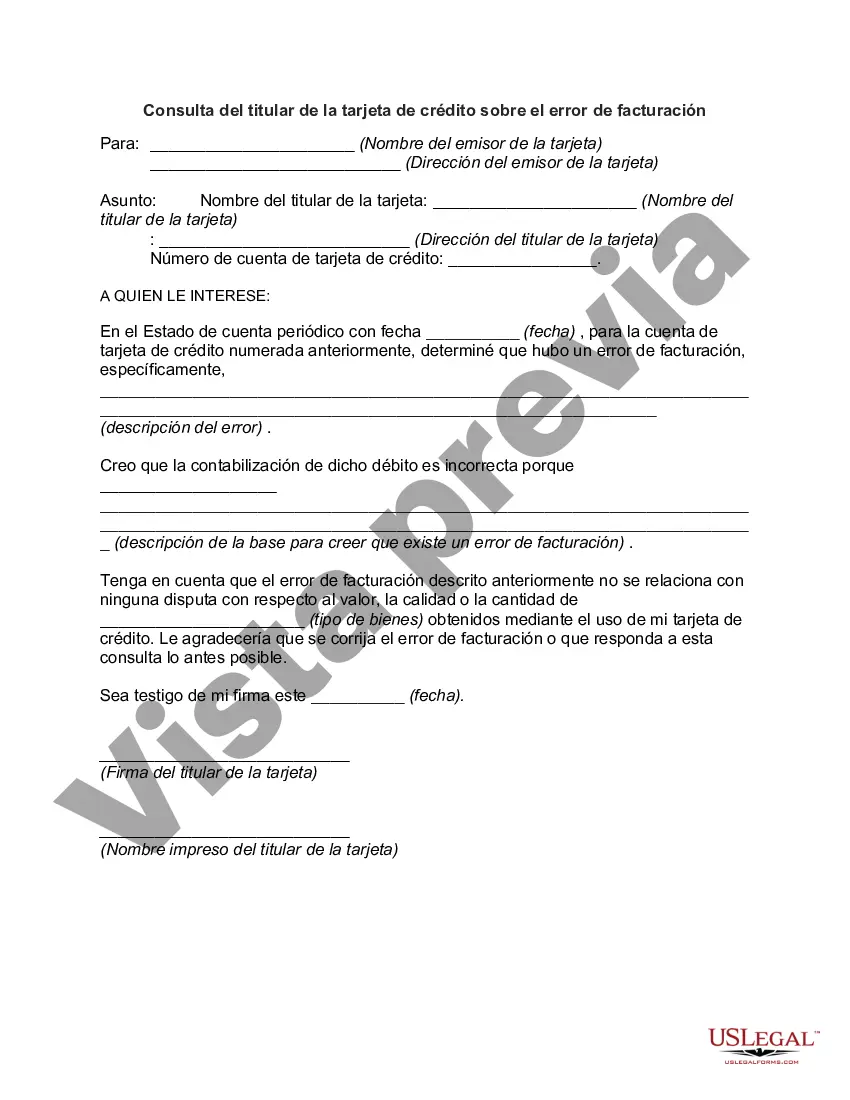

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Consulta del titular de la tarjeta de crédito sobre un error de facturación - Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out Houston Texas Consulta Del Titular De La Tarjeta De Crédito Sobre Un Error De Facturación?

Preparing paperwork for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Houston Inquiry of Credit Cardholder Concerning Billing Error without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Houston Inquiry of Credit Cardholder Concerning Billing Error by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Houston Inquiry of Credit Cardholder Concerning Billing Error:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

Recuerda que aunque la compra la haya hecho otra persona, ya sea con tu tarjeta o con una adicional, Tu seras el responsable de pagar, y en caso de que quien la uso no quiera o no pueda pagar, legalmente eres responsable de la deuda ante el banco.

CVV: para las tarjetas Visa, MasterCard y Discover, el CVV es el numero de tres digitos en el reverso de tu tarjeta. Para tarjetas America Express, el CVV es el numero de cuatro digitos en el frente de tu tarjeta.

Son codigos o mejor dicho claves que pertenecen al nuevo esquema de administracion recurrido por el SAT para poder categorizar y clasificar productos y/o servicios que engloban actividades financieras en el pais.

En tu factura, arriba del todo a mano derecha, encontraras definidos todos los datos importantes que se le han asignado. Aqui encontraras tanto tu numero de cliente como el numero de identificacion de tu factura.

La forma en que el banco investiga esos cargos no reconocidos es mediante la informacion que le compartas, como el monto, concepto y la fecha en que se efectuo, de esta manera ellos podran llevar a cabo la investigacion necesaria, como saber en que lugar se realizo la compra, cual fue el modo en el que comprobaron la

Por atrasos recientes en el pago de algunos de otros creditos. Porque el nuevo credito solicitado rebasa tu capacidad de pago. Porque el ingreso que el banco infiere a partir de su informacion en buro de credito es inferior al ingreso que requiere el producto que solicitaste.

1-Informa a tu banco. Contacta con tu entidad bancaria para pedirle que anule esa tarjeta de credito y la sustituya por otra. Esto impedira que se siga utilizando. Para comunicarselo, puedes llamar por telefono al numero habilitado para todo tipo de incidencias con las tarjetas (esta activo durante las 24 horas).

Una cuestion basica para evitar problemas de credito, y que muchos no se dan cuenta, es no adquirir otras deudas. Pagar deudas con deudas, o hacer lo que hacen los estados es solamente para aquellos que no pueden declararse en bancarrota y que tampoco perderan sus ingresos por falta de trabajo.

Si el titular de la tarjeta de credito o debito desconoce en su entidad emisora una compra realizada en tu comercio y solicita un reembolso del dinero, se genera un contracargo y se hace un debito que vas a ver reflejado en tus depositos diarios.

Como puedo saber quien uso mi tarjeta de credito en Internet Lo unico que puedes averiguar es donde se realizo la compra, ya que esa informacion aparece en las anotaciones de la cuenta bancaria asociada a tu tarjeta.

More info

We offer an easy and intuitive way to resolve issues, dispute debts, file the correct tax, account information and file documents. All of our services are provided without pressure because we know our clients depend on us. How do I register on your website for assistance with my taxes? Visit the “Registering for Assistance” page before writing to us. Where do I submit the payment in order to submit to your office? Anytime you are ready to file, submit the information you need. To prevent a delay in your account opening due to long credit card delays, please read “Why it's important to pay off the Credit Cards quickly” before writing to us if you are already in the delinquency process, or have a credit card that has exceeded 90 days. Our office will work with you through your situation. What if I don't have the documentation? If your circumstances are exceptional, we may send you a letter stating that you had the documentation, but it was incomplete.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.