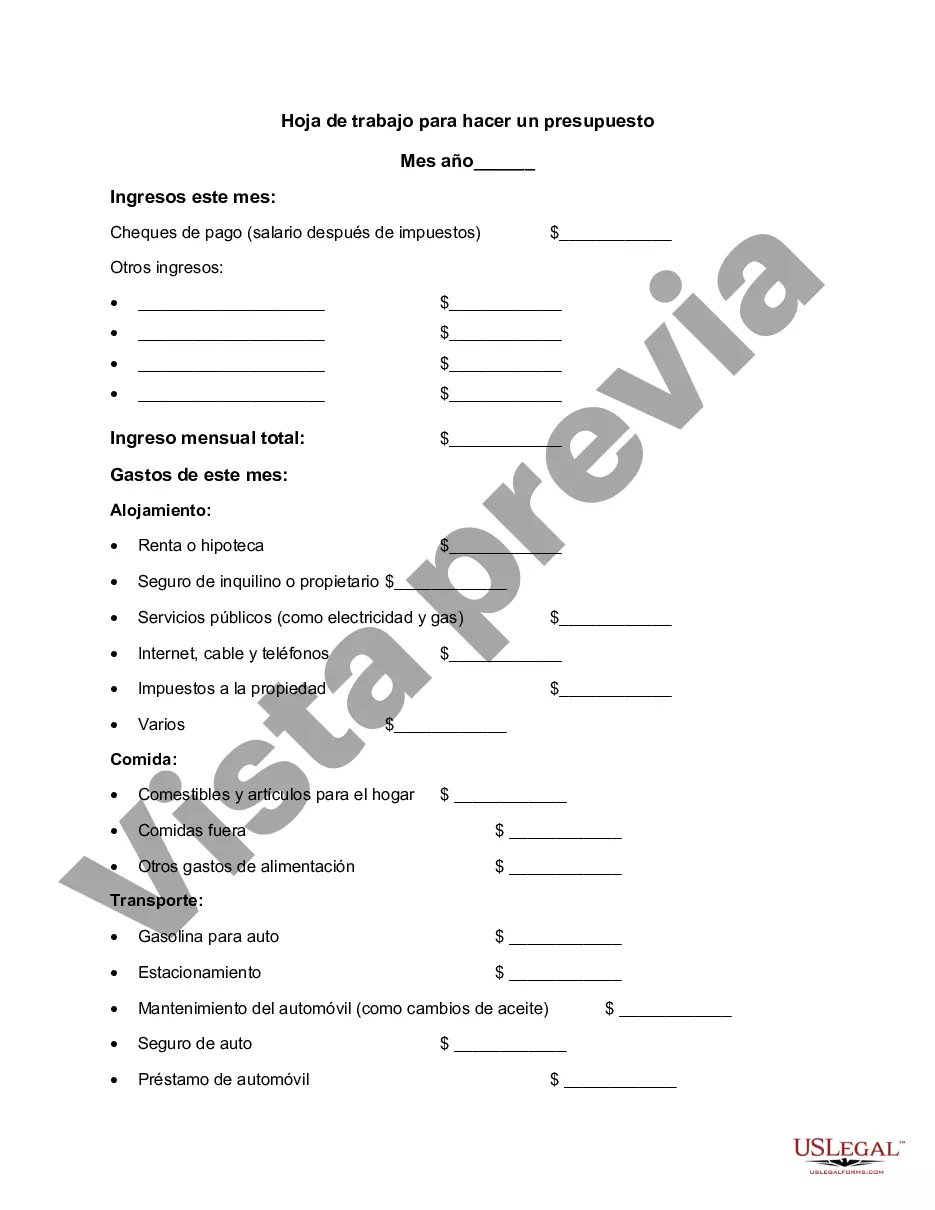

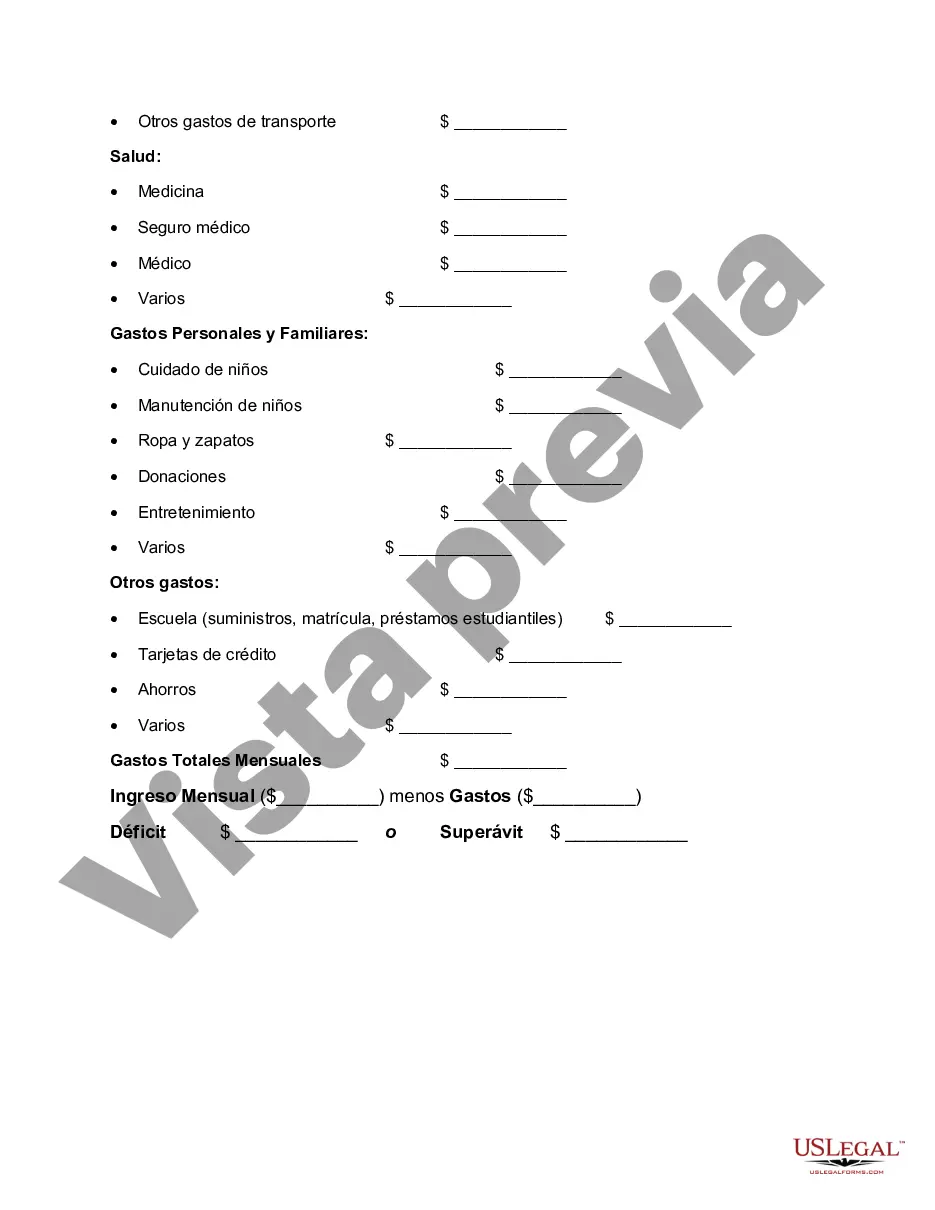

Contra Costa County, located in California, offers a variety of helpful resources and worksheets for creating a budget. These worksheets are designed to assist individuals and families in managing their finances effectively. Whether you are a resident of Contra Costa or someone interested in improving your budgeting skills, these worksheets can provide valuable insights and practical tools to help you achieve your financial goals. One commonly available worksheet in Contra Costa is the "Monthly Income vs. Expenses" worksheet. This worksheet allows you to list your monthly income sources, such as employment wages, investments, or side hustles. It then prompts you to track and categorize your expenses, including but not limited to housing costs, transportation expenses, groceries, entertainment, debt repayments, and savings contributions. By comparing your income and expenses side by side, you can gain a clear understanding of your financial situation and identify areas where adjustments may be necessary. Another popular worksheet offered in Contra Costa is the "Savings and Debt Reduction" worksheet. This worksheet focuses on helping you plan and manage your savings goals while also tackling any existing debt. It encourages you to set specific savings targets, whether it's for emergencies, a down payment on a home, or a dream vacation. Additionally, it provides a framework for organizing and prioritizing your debt payments, allowing you to create an effective repayment strategy. In Contra Costa, you may also find a "Budgeting for Irregular Income" worksheet. This particular worksheet is tailored to individuals who have irregular income streams, such as freelancers, contractors, or commission-based earners. It helps you anticipate varying income amounts and guides you in budgeting for months when your earnings may fluctuate. By creating a flexible budgeting plan that accommodates these income fluctuations, you can ensure financial stability and avoid potential overspending or inadequate savings during leaner months. Lastly, Contra Costa offers a "Financial Goals and Timeline" worksheet. This worksheet is designed to help you establish short-term and long-term financial objectives, such as paying off a student loan, saving for retirement, or purchasing a new vehicle. By setting clear goals and establishing a timeline to achieve them, you can make your financial aspirations more attainable. This worksheet prompts you to break down your goals into smaller, actionable steps, enabling you to stay focused and motivated on your journey to financial success. In summary, the various Contra Costa California worksheets for making a budget cater to different individuals' needs and financial circumstances. Whether you're looking for a comprehensive monthly income vs. expenses worksheet, a savings and debt reduction worksheet, a budgeting tool for irregular income, or a worksheet to help you set and achieve your financial goals, Contra Costa offers valuable resources to assist you in managing your finances effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Contra Costa California Hoja De Trabajo Para Hacer Un Presupuesto?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Contra Costa Worksheet for Making a Budget is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Contra Costa Worksheet for Making a Budget. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Contra Costa Worksheet for Making a Budget in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!