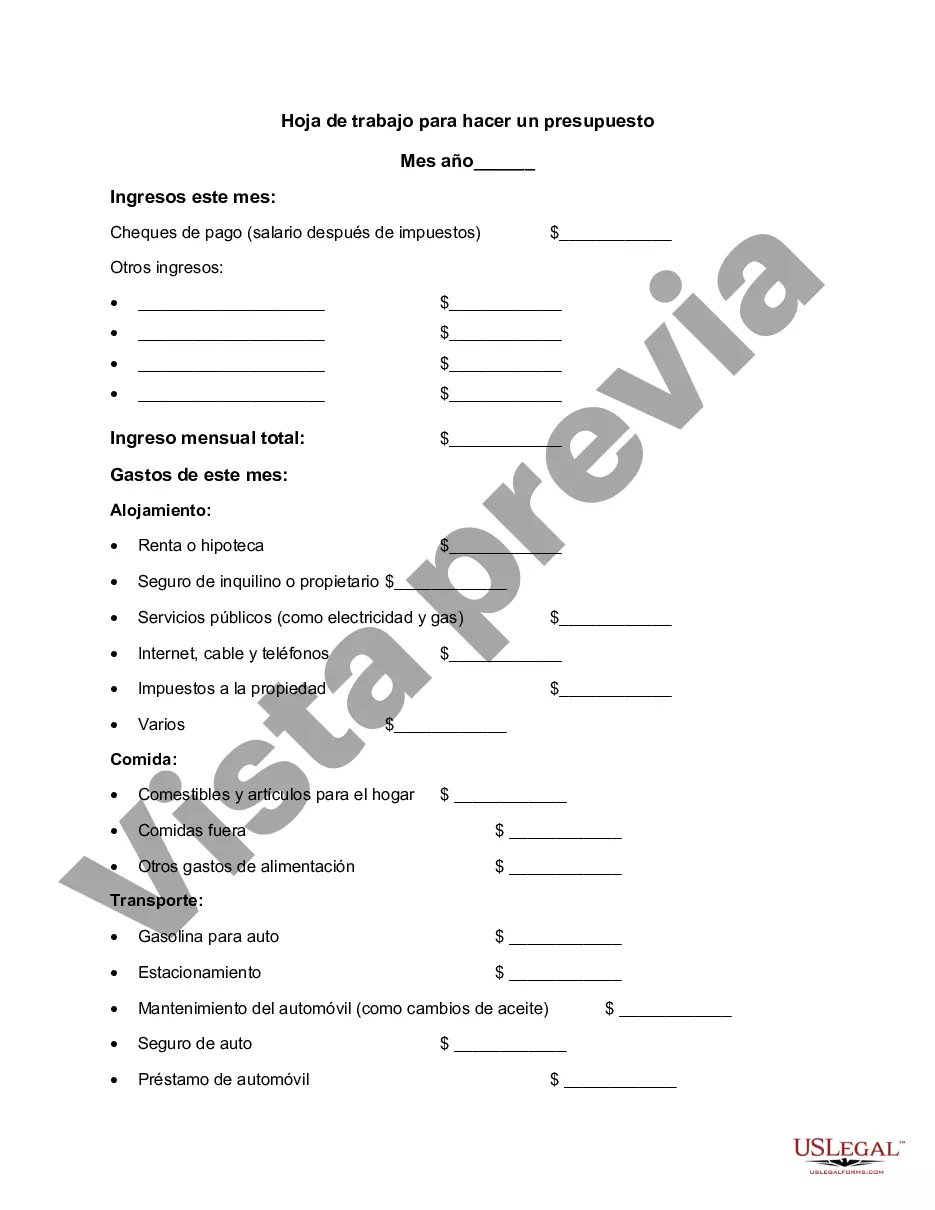

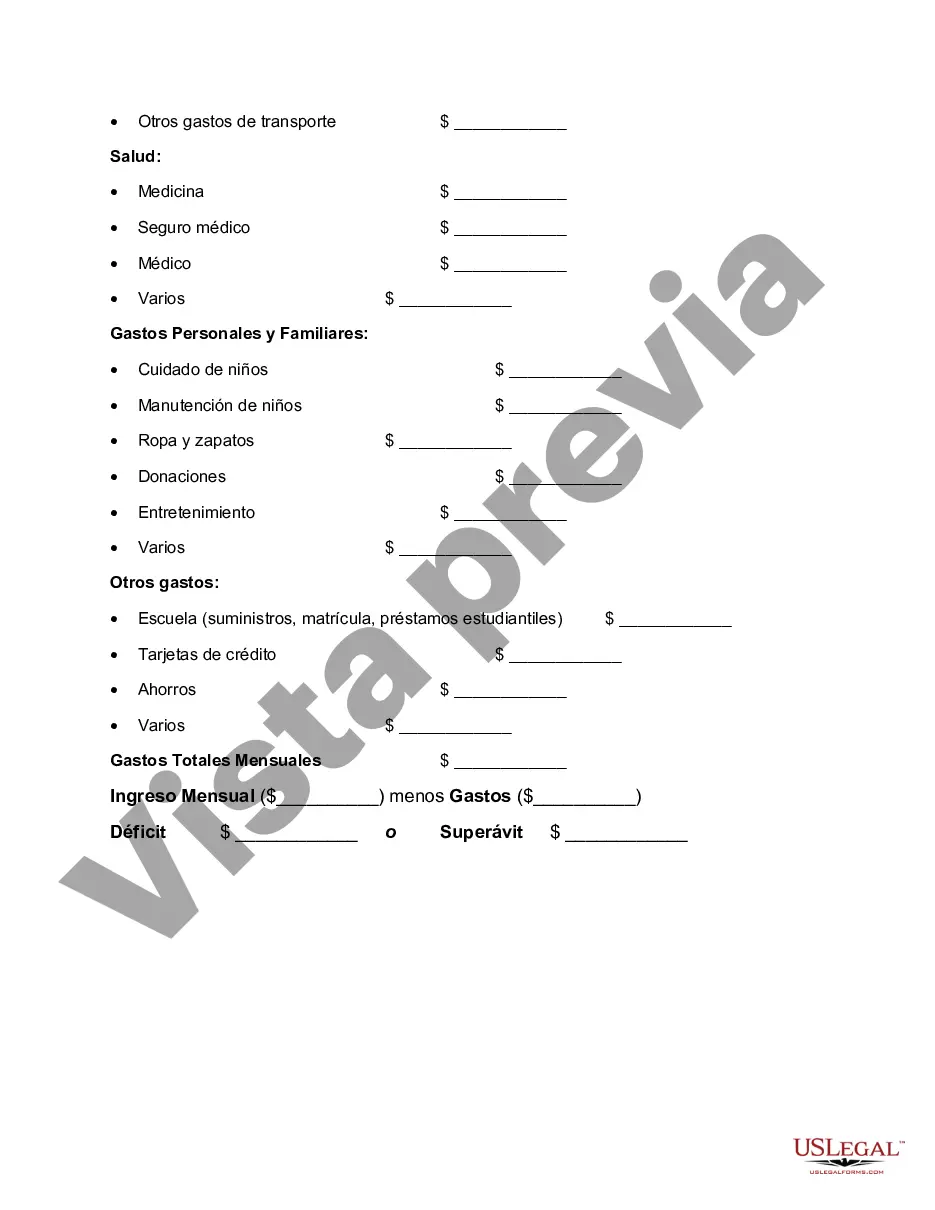

Fulton Georgia is a county located in the state of Georgia, United States. It is one of the most populous counties in Georgia and encompasses several cities, including Atlanta, the state's capital. A Fulton Georgia Worksheet for Making a Budget is a comprehensive tool designed to assist individuals or households in managing their finances effectively. It helps individuals track their income, expenses, and savings while offering insights into financial planning and goal-setting. The Fulton Georgia Worksheet for Making a Budget includes various sections to ensure a thorough analysis of one's financial situation. These sections might include: 1. Income: This section allows individuals to record all sources of income, including salaries, wages, bonuses, and any other forms of income. 2. Expenses: Here, individuals can list their monthly expenses, such as rent or mortgage payments, utilities, transportation costs, groceries, healthcare expenses, and other miscellaneous expenses. 3. Savings: This section acts as a reminder to allocate a portion of income towards savings, emergency funds, or retirement planning. 4. Debts: Individuals can list their outstanding debts, such as credit card balances, loans, or other financial obligations, along with their respective interest rates and monthly payments. 5. Financial Goals: The worksheet encourages individuals to set specific financial goals, like saving a certain amount each month or paying off debts by a specific deadline. 6. Budget Analysis: This section helps users analyze their budget by comparing actual expenses with budgeted amounts. It provides a clear picture of where adjustments might be needed to align with financial goals. Different types or variations of Fulton Georgia Worksheets for Making a Budget may exist, depending on various factors such as personal preferences or specific financial situations. For example, some variations might focus on specific aspects, such as budgeting for college expenses, managing business finances, or planning for retirement. Overall, utilizing a Fulton Georgia Worksheet for Making a Budget can play a crucial role in promoting financial well-being by providing individuals with a clear understanding of their income, expenses, and savings, ultimately enabling them to make informed financial decisions and work towards their financial goals effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Fulton Georgia Hoja De Trabajo Para Hacer Un Presupuesto?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Fulton Worksheet for Making a Budget.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Fulton Worksheet for Making a Budget will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Fulton Worksheet for Making a Budget:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Fulton Worksheet for Making a Budget on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!