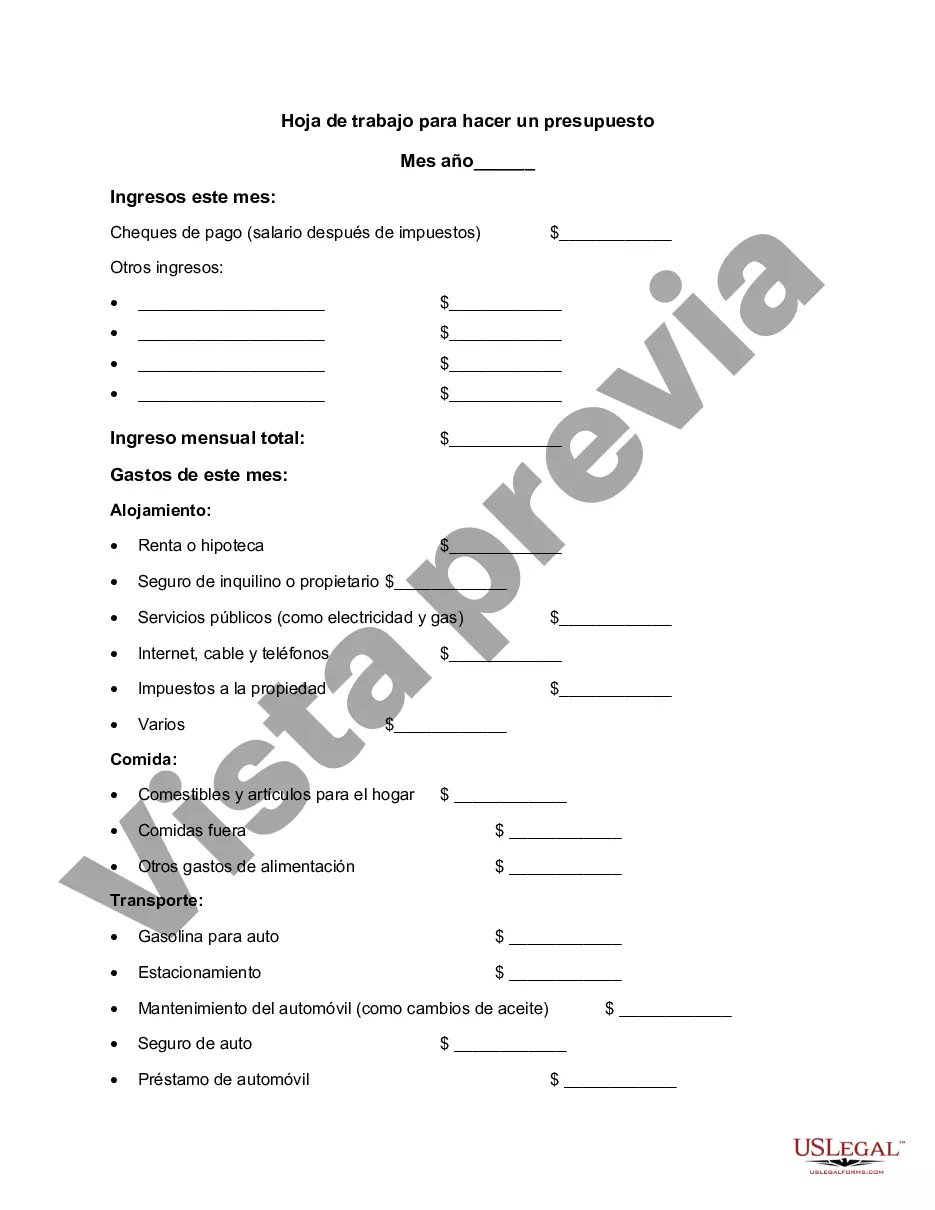

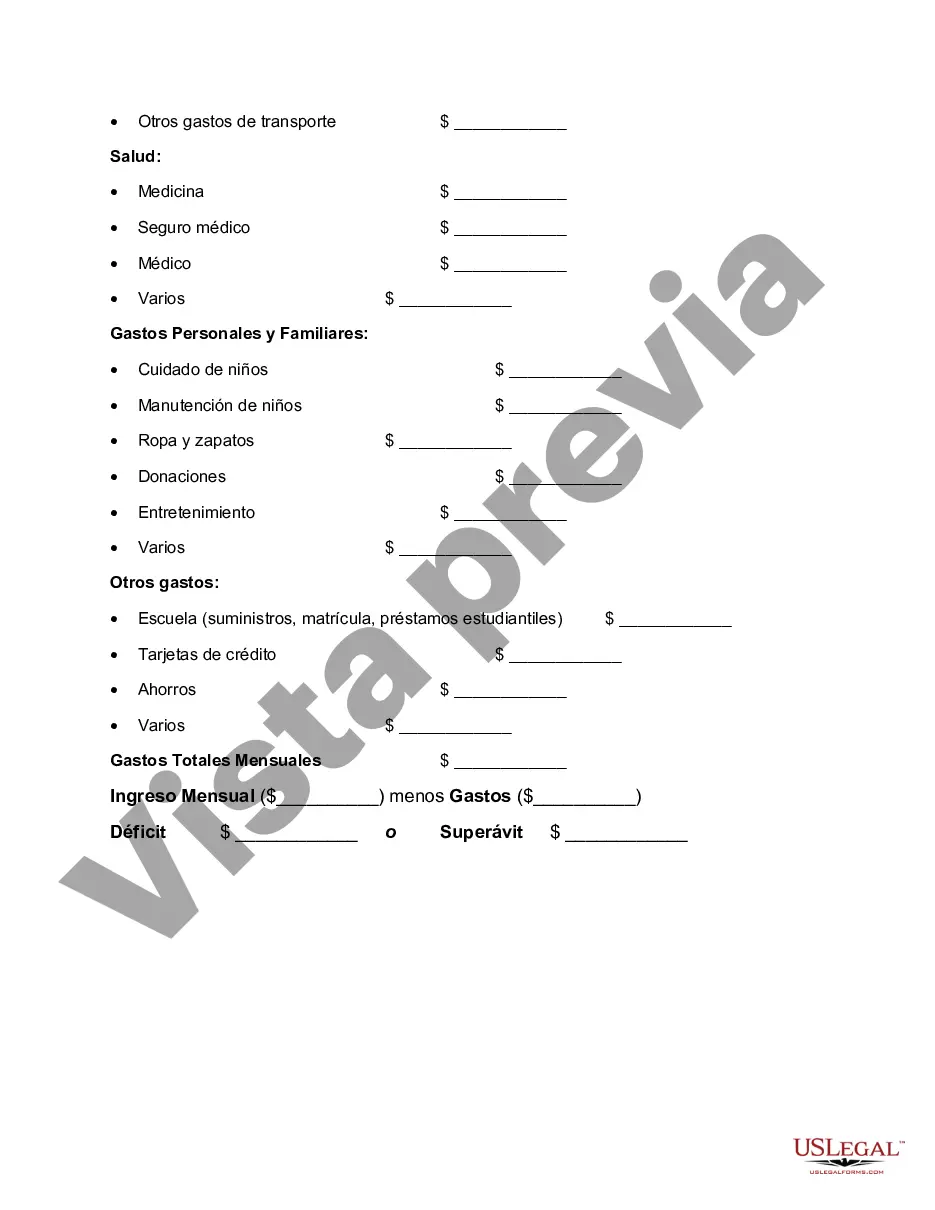

Harris Texas Worksheet for Making a Budget is a comprehensive tool designed to assist individuals, families, and businesses in effectively managing their finances. It provides a structured framework to track income, expenses, savings, and financial goals on a monthly or annual basis. This budgeting worksheet is widely recognized for its user-friendly format and accuracy, enabling users to gain a clear understanding of their financial situation and make informed financial decisions. With the Harris Texas Worksheet for Making a Budget, individuals and families have the ability to assess their income sources, whether it be from employment, investments, or other means. Users can input their total earnings, including regular paychecks, side hustles, or passive income, to have a holistic view of their cash inflow. Next, this budgeting worksheet emphasizes the division and categorization of expenses. Users can easily identify fixed expenses such as rent or mortgage payments, insurance premiums, and utility bills. Variable expenses like groceries, transportation, entertainment, and healthcare costs can also be tracked with precision. By organizing expenses in this manner, individuals can effectively evaluate their spending habits and identify areas where adjustments can be made. Moreover, the Harris Texas Worksheet for Making a Budget incorporates sections dedicated to tracking savings and debt payments. Users can monitor their progress in setting money aside for emergencies, retirement, or other financial goals. Additionally, it allows users to keep track of debt repayment plans, such as credit card balances, student loans, or mortgages, which aids in managing and reducing debt over time. This worksheet also provides opportunities for users to set financial goals and measure their progress. Whether it's saving for a down payment, planning for a vacation, or reducing debt, this tool allows individuals to set realistic objectives and monitor their attainment. By regularly reviewing these goals, individuals can stay motivated and adjust their budgeting strategies accordingly. Regarding variations in the Harris Texas Worksheet for Making a Budget, there may be customized versions tailored specifically for different entities. For instance, businesses may have access to worksheets that include sections to track revenue, expenses related to their industry, and profit margins. On the other hand, individuals may opt for a simplified version dedicated solely to personally budgeting. In conclusion, the Harris Texas Worksheet for Making a Budget is a comprehensive budgeting tool that assists individuals, families, and businesses in effectively managing their finances. It provides a structured approach to tracking income, expenses, savings, and financial goals, enabling users to make informed decisions and achieve financial stability. Whether it's the basic worksheet for personal use or a specialized version for businesses, this tool proves invaluable in fostering responsible financial planning and management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Harris Texas Hoja De Trabajo Para Hacer Un Presupuesto?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your county, including the Harris Worksheet for Making a Budget.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Harris Worksheet for Making a Budget will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Harris Worksheet for Making a Budget:

- Ensure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Harris Worksheet for Making a Budget on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!