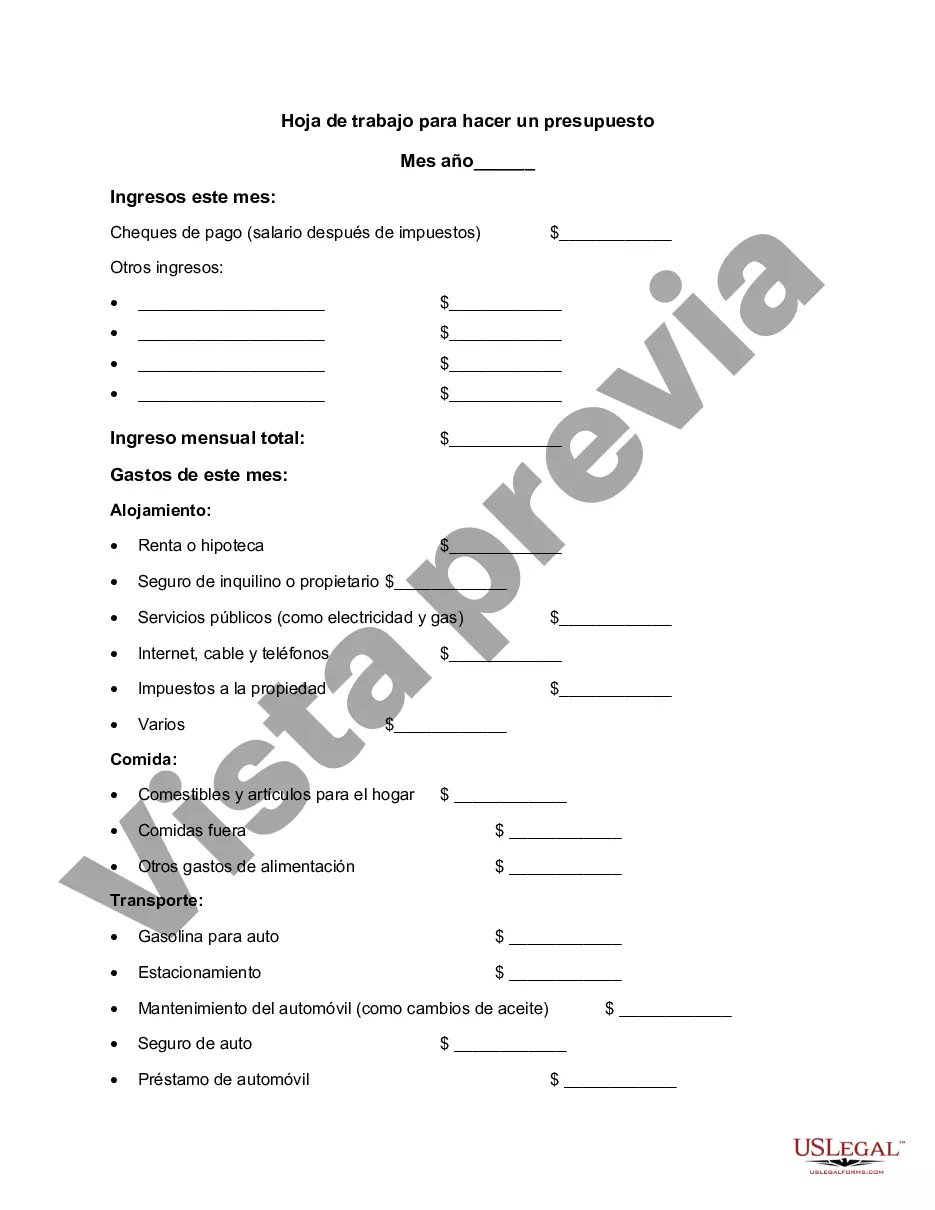

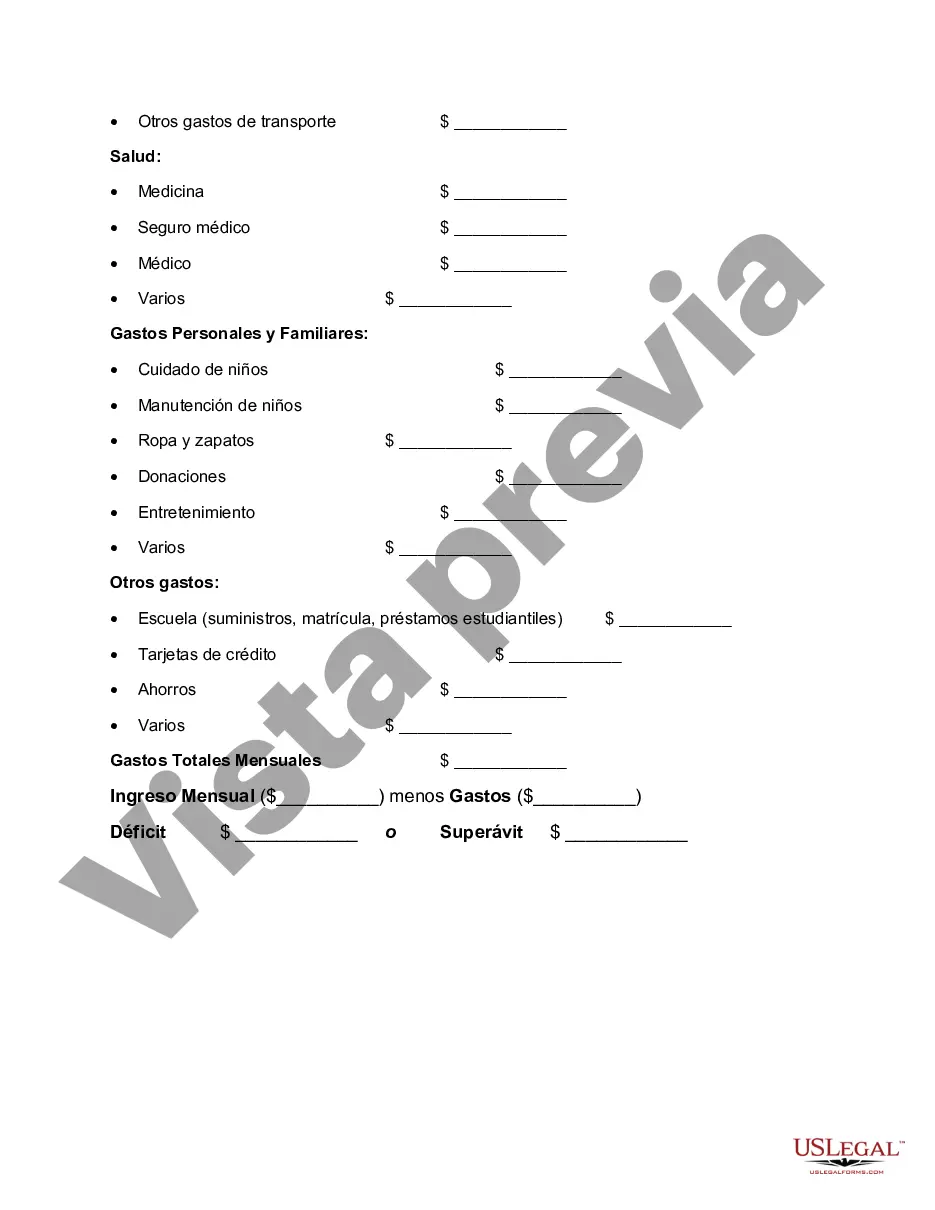

Hennepin County, Minnesota is a county located in the state of Minnesota, United States. It is the most populous county in the state and encompasses the bustling city of Minneapolis, along with several other cities and townships. One of the crucial tools in financial planning and managing personal finances is a budget worksheet. A Hennepin Minnesota Worksheet for Making a Budget is a detailed document that helps individuals or families analyze their income and expenses, enabling them to create a comprehensive budget plan. The Hennepin Minnesota Worksheet for Making a Budget typically includes several key sections and categories to track expenses and income accurately. These categories may include: 1. Income Sources: This section allows individuals to list all the sources of income, such as salaries, wages, investments, and other forms of earnings. 2. Fixed Expenses: These are recurring expenses that remain relatively constant each month. Examples of fixed expenses include rent or mortgage payments, insurance premiums, loan repayments, and utility bills. 3. Variable Expenses: These are expenses that can vary from month to month. They may include groceries, dining out, entertainment, transportation, clothing, and other discretionary spending. 4. Savings and Investments: This section encourages individuals to allocate a portion of their income towards savings or investments, helping them achieve their financial goals in the long run. 5. Debt Management: Here, individuals can track their existing debts, such as credit card balances, student loans, or car loans. This section helps individuals review and manage their debt repayment strategies effectively. 6. Financial Goals: In this section, individuals can outline their short-term and long-term financial goals, such as saving for a down payment on a home, starting a business, or planning for retirement. By setting clear goals, individuals can align their budget accordingly. Additionally, Hennepin County may provide specific budget worksheets tailored to different purposes or demographics. These may include: 1. Hennepin Minnesota Worksheet for Making a Household Budget: This worksheet is designed specifically for households, taking into consideration the collective income and expenses of all members living together. 2. Hennepin Minnesota Worksheet for Making a Student Budget: This worksheet caters specifically to students, helping them manage their finances throughout their educational journey. 3. Hennepin Minnesota Worksheet for Making a Small Business Budget: This worksheet assists small business owners in budgeting their revenues, expenses, and investments, ensuring the financial stability and growth of their business. 4. Hennepin Minnesota Worksheet for Making a Retirement Budget: This specialized worksheet focuses on budgeting during retirement, ensuring individuals can enjoy their golden years with financial security. Using a Hennepin Minnesota Worksheet for Making a Budget allows individuals and households in Hennepin County to analyze their financial situation, make informed decisions, and ultimately achieve their financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Hennepin Minnesota Hoja De Trabajo Para Hacer Un Presupuesto?

Draftwing documents, like Hennepin Worksheet for Making a Budget, to take care of your legal matters is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms created for different scenarios and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Hennepin Worksheet for Making a Budget form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Hennepin Worksheet for Making a Budget:

- Ensure that your document is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Hennepin Worksheet for Making a Budget isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!