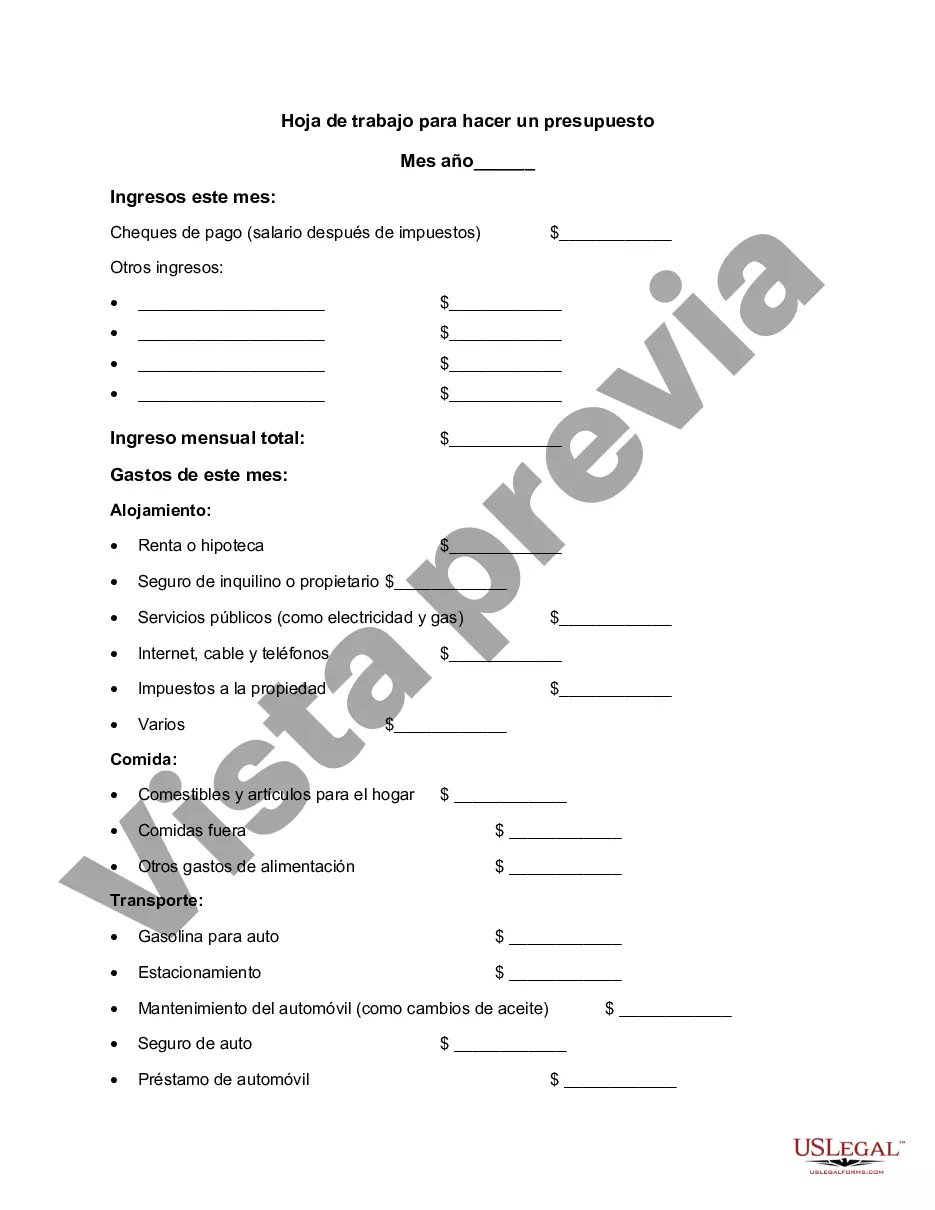

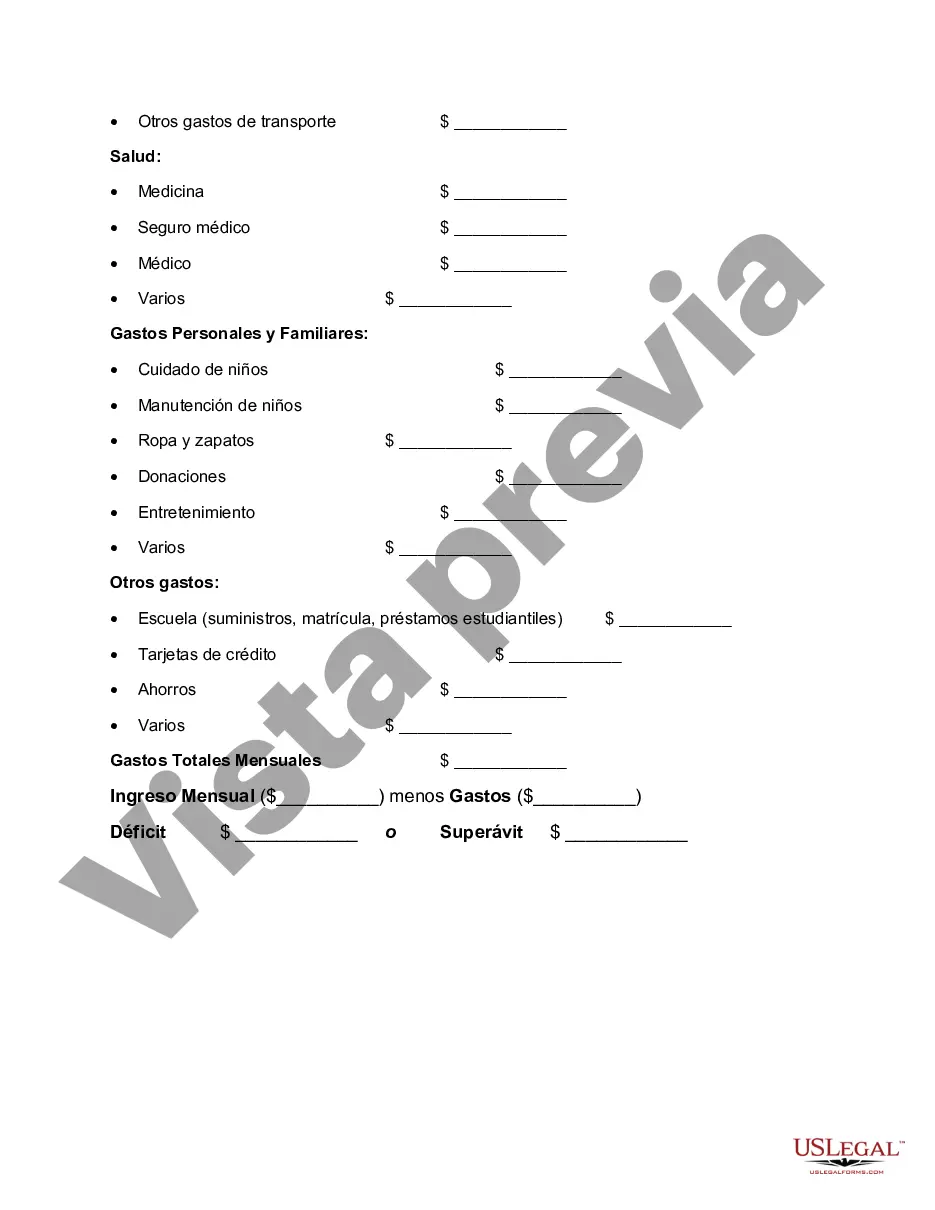

Houston Texas Worksheet for Making a Budget: A Detailed Description Are you living in Houston, Texas, and struggling to manage your finances effectively? If so, a Houston Texas Worksheet for Making a Budget can be a useful tool to gain control over your expenses and track your income. This comprehensive worksheet serves as a guiding template to help you plan and organize your budget successfully, allowing you to save money, reduce debt, and achieve your financial goals. The Houston Texas Worksheet for Making a Budget is tailored specifically for individuals residing in the vibrant city of Houston. It takes into account various factors that are unique to this location, such as local costs of living, average incomes, and specific financial considerations relevant to Houston residents. By utilizing this specific worksheet, you can create a budget that accurately reflects your financial situation and helps you make informed decisions about your expenses. This budget worksheet typically features several sections, each designed to address different financial aspects. These sections may include: 1. Income: This section allows you to list all your sources of income, such as salary, investments, or side gigs. It helps you understand your earning capacity and ensures that you capture all possible income streams. 2. Expenses: In this section, you can enumerate your regular expenses, such as housing costs (rent or mortgage), utilities, transportation, groceries, healthcare, entertainment, and more. It encourages you to be thorough and specific when listing your expenditures, ensuring that you do not overlook any essential categories. 3. Savings and Investments: This section aims to prioritize your future financial goals. It helps you allocate a portion of your income toward savings, emergencies, retirement plans, and investments. Focusing on long-term financial stability is crucial, and this section guides you in setting aside a suitable amount for your savings each month. 4. Debt Repayment: If you have existing debts, such as student loans, credit card debts, or car loans, this section allows you to outline your repayment plan. It helps you allocate funds to pay off your debts systematically, ensuring that you prioritize reducing financial liabilities. 5. Miscellaneous Expenses: Sometimes unexpected expenses pop up, and this section helps you plan for those unpredictable costs. It can include categories like home repairs, car maintenance, emergency medical expenses, and other unexpected events. By utilizing various Houston Texas Worksheet for Making a Budget templates, you can find options that suit your specific needs. For example: 1. Basic Budget Worksheet: This type of worksheet is the foundation for creating a budget and provides a simple overview of income and expenses. It is perfect for beginners. 2. Detailed Budget Worksheet: If you prefer a more comprehensive approach, this worksheet breaks down your expenses into specific categories, allowing you to track your spending in detail. 3. Monthly Budget Worksheet: Ideal for those who want to adjust their budget monthly, this template helps you make necessary changes as circumstances evolve without the need to start over from scratch. 4. Annual Budget Worksheet: This type of worksheet allows you to plan your finances for an entire year, helping you set long-term financial goals and strategize accordingly. Remember, the key to successful budgeting lies in regularly maintaining and updating your worksheet. By diligently tracking your income and expenses, you can gain insight into your financial habits, identify areas where you can cut back, and ultimately achieve financial stability in Houston, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Houston Texas Hoja De Trabajo Para Hacer Un Presupuesto?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Houston Worksheet for Making a Budget, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Houston Worksheet for Making a Budget, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Worksheet for Making a Budget:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Houston Worksheet for Making a Budget and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!