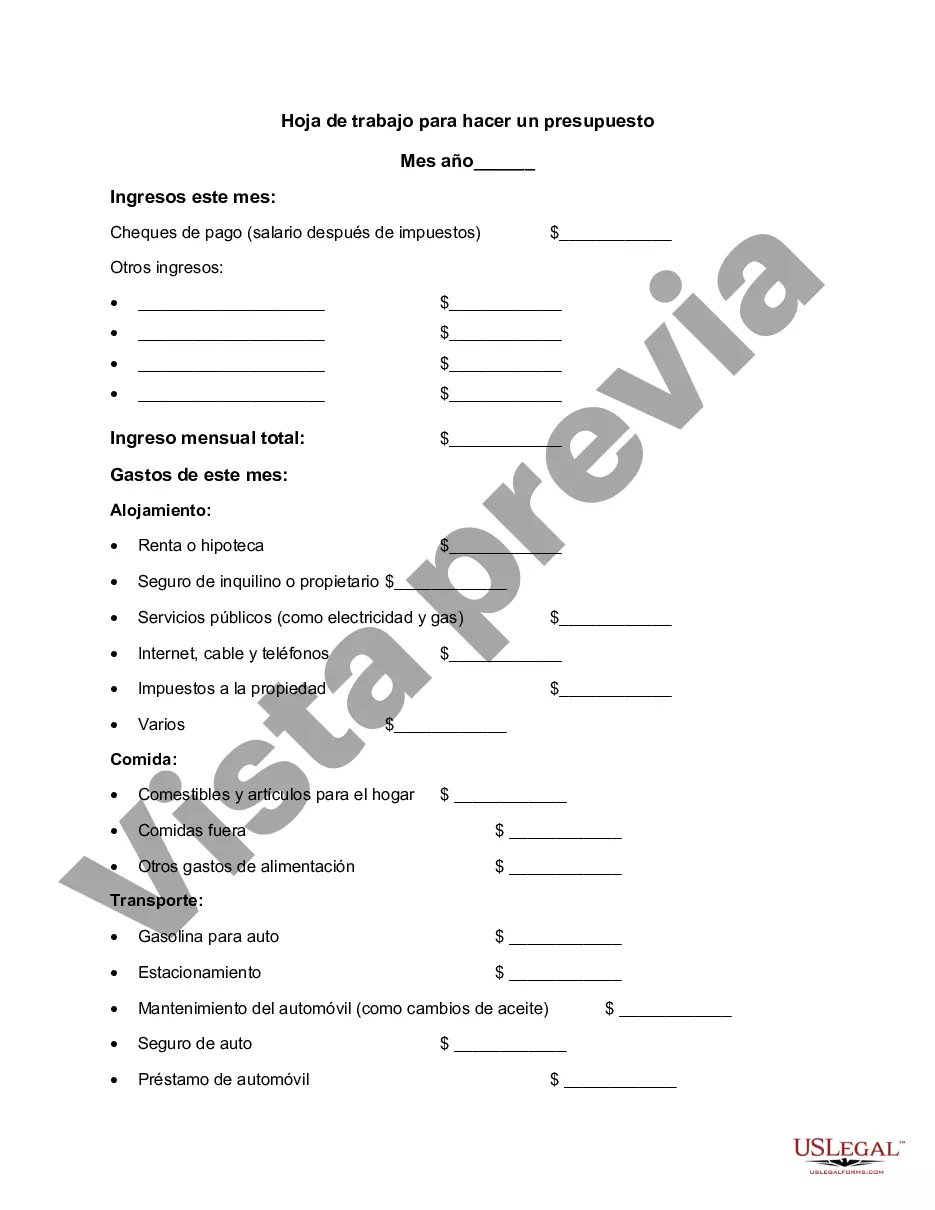

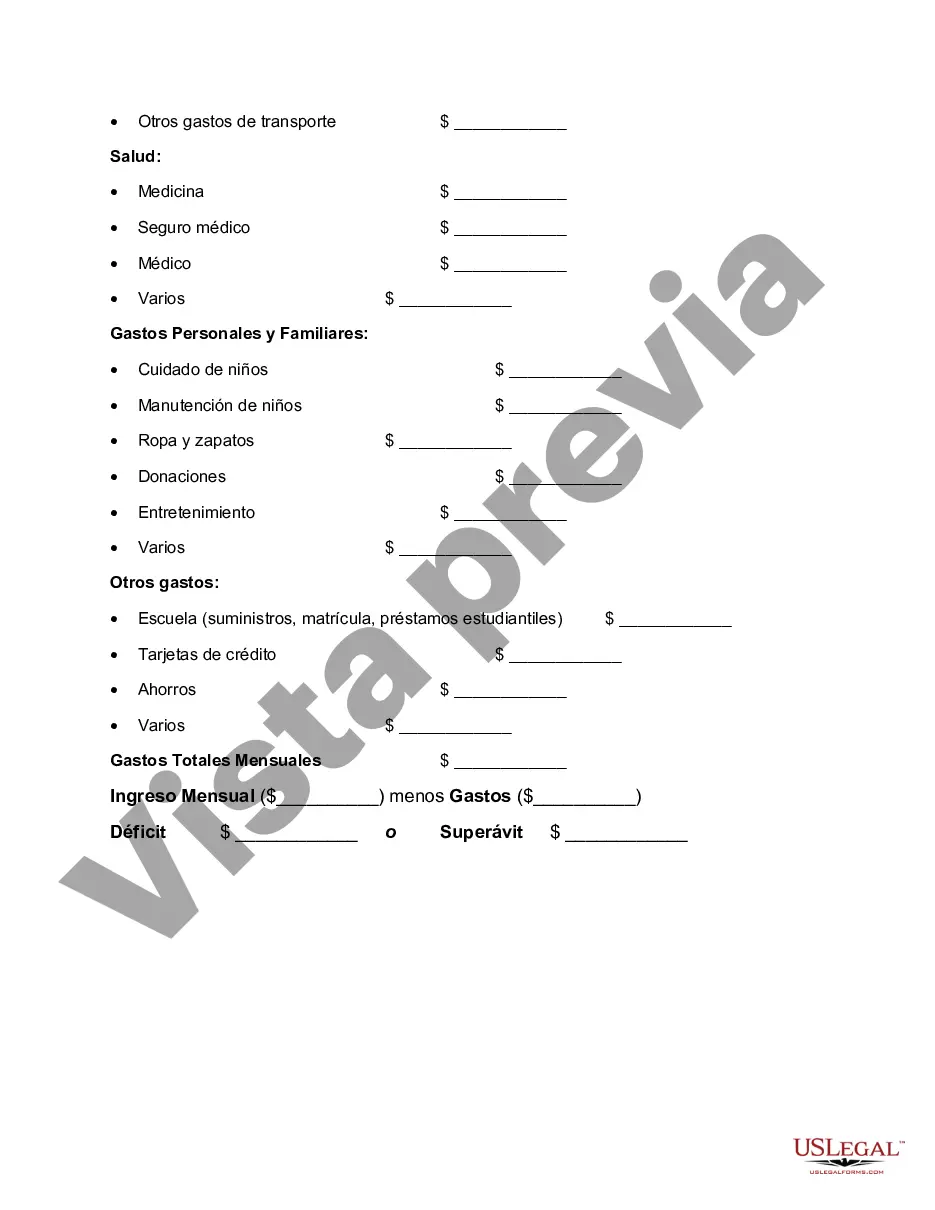

Nassau New York Worksheet for Making a Budget: A Comprehensive Tool to Manage Your Finances Are you struggling to keep track of your expenses and manage your finances effectively? Look no further than the Nassau New York Worksheet for Making a Budget. This detailed budgeting tool is specifically designed to help individuals and families in Nassau County, New York, gain control over their expenses, savings, and financial goals. Whether you are a seasoned budgeted or just starting your journey towards financial stability, this worksheet provides a comprehensive system to streamline your budgeting process. The Nassau New York Worksheet for Making a Budget is divided into various sections, which cover all essential aspects of budgeting. Let's explore some key components of this helpful tool: 1. Income and Expenses Tracking: To create a realistic budget, it's crucial to track both your sources of income and your regular expenses. This worksheet provides a dedicated section to record your monthly income from various sources such as salaries, investments, and side gigs. Additionally, it helps you track your recurring expenses, including rent or mortgage payments, utility bills, groceries, transportation costs, and any outstanding debts. 2. Categorization of Expenses: The worksheet offers predetermined categories to help you classify your expenses accurately. These categories may vary depending on your unique circumstances, but common ones include housing, transportation, food and groceries, health care, entertainment, savings, and debt payments. By organizing your expenses into specific categories, you can get a clear picture of where your money is going and identify areas where you can cut back. 3. Setting Financial Goals: Successful budgeting involves setting achievable financial goals. The Nassau New York Worksheet provides a space to define short-term and long-term objectives, such as saving for emergencies, paying off debt, or planning for a vacation or retirement. It prompts you to specify the desired timeline and target amounts required to reach these goals, enabling you to track your progress and adjust your budget accordingly. 4. Monthly Budget Overview: This section of the worksheet summarizes your monthly income, expenses, and discretionary income (the amount left after subtracting necessary expenses). It allows you to evaluate if you are living within your means and make informed decisions about your spending habits. This overview can also serve as a reference point for future budget planning. Different Types of Nassau New York Worksheet for Making a Budget: 1. Basic Worksheet: This variant is suitable for individuals or families with relatively straightforward financial situations. It covers all the essential elements of budgeting, providing a solid foundation for managing personal finances effectively. 2. Advanced Worksheet: Geared towards individuals with more complex financial arrangements, this version offers additional sections to track investments, retirement savings, college funds, and multiple income streams. It is ideal for those who require a higher level of detail in their budgeting process. 3. Debt Repayment Worksheet: Designed specifically for individuals struggling with debt, this variant focuses on tracking and prioritizing debt payments. It provides specialized sections to record outstanding balances, interest rates, and repayment strategies, empowering users to visualize their progress in becoming debt-free. In conclusion, the Nassau New York Worksheet for Making a Budget is a comprehensive and customizable tool to empower individuals and families in Nassau County to take control of their financial future. By utilizing this detailed worksheet and its differentiated versions, you can create a realistic budget, track your income and expenses, set and achieve financial goals, and ultimately pave the way towards financial stability and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Nassau New York Hoja De Trabajo Para Hacer Un Presupuesto?

Drafting papers for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Nassau Worksheet for Making a Budget without professional assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Nassau Worksheet for Making a Budget by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Nassau Worksheet for Making a Budget:

- Look through the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!