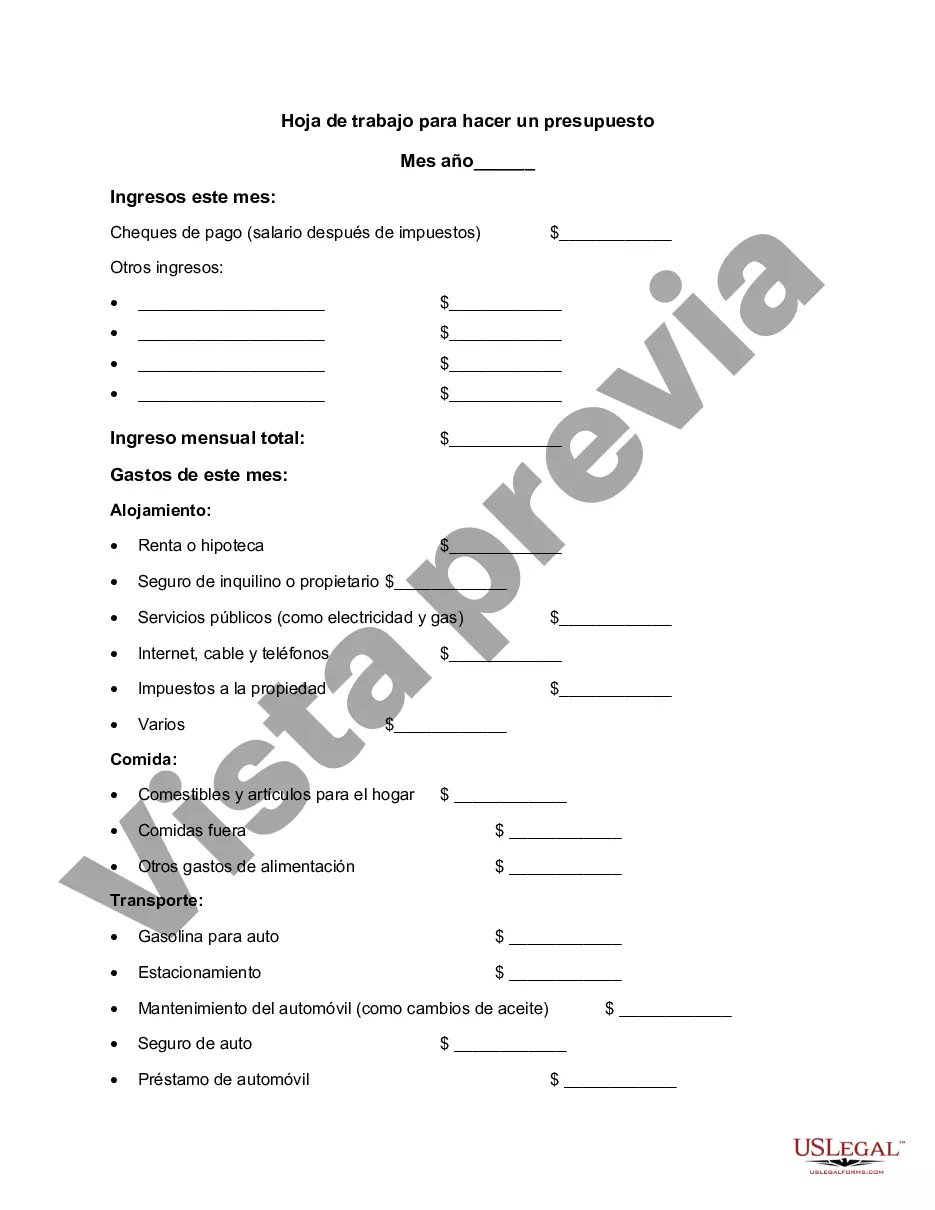

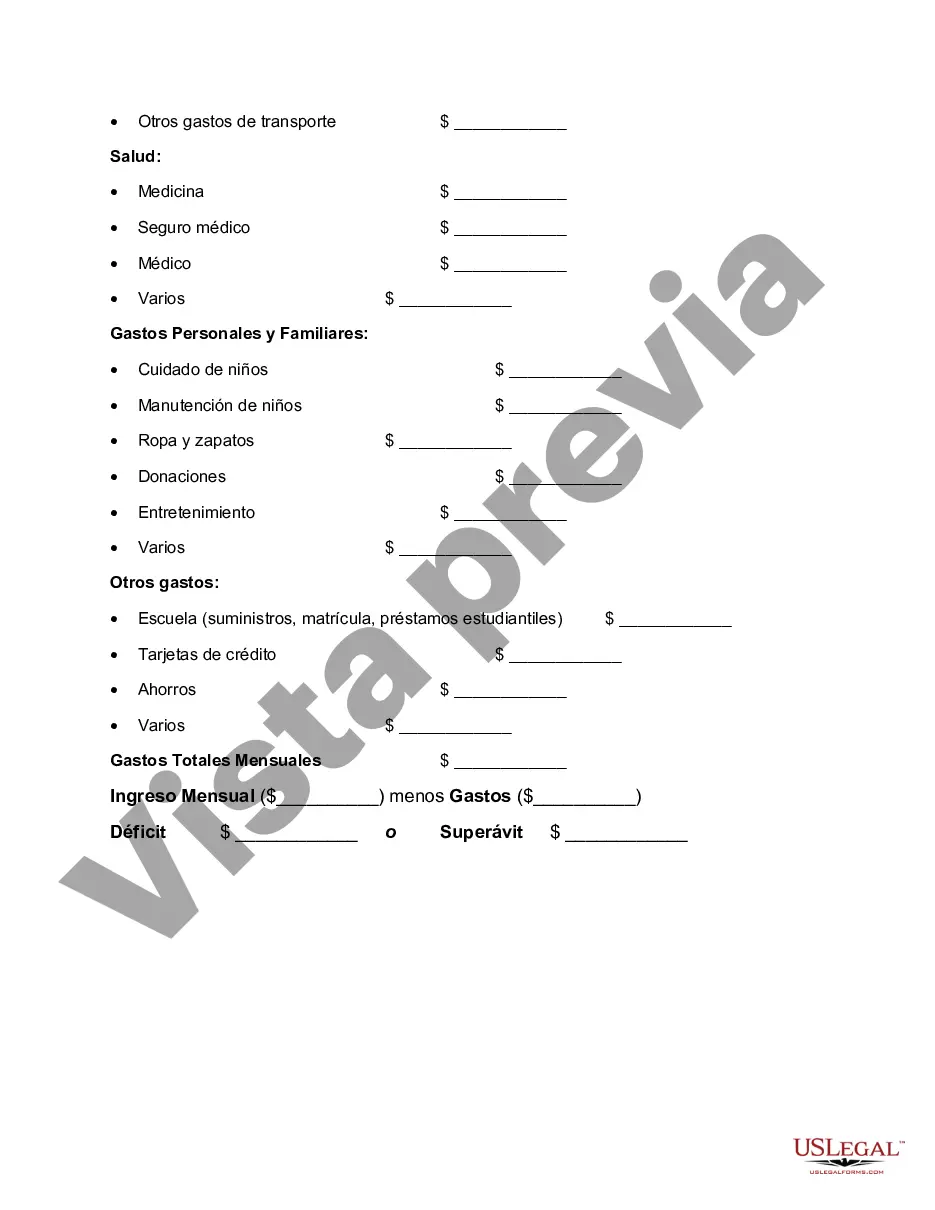

Oakland, Michigan Worksheet for Making a Budget: A Comprehensive Guide Are you looking to gain control over your finances and improve your financial well-being? Look no further. The Oakland, Michigan Worksheet for Making a Budget is here to assist you in effectively managing your expenses and achieving your financial goals. In order to provide a detailed description of what the Oakland, Michigan Worksheet for Making a Budget entails, let's delve into its key components and benefits. 1. Tracking Income and Expenses: The Oakland, Michigan Worksheet aids in tracking both your income and expenses accurately. By meticulously documenting your sources of income, such as salary, investments, or side hustles, you will gain a clear understanding of your financial inflow. Additionally, it enables you to record and categorize your expenses, including rent/mortgage, bills, groceries, transportation, entertainment, and savings. This feature helps you identify areas where you can potentially reduce expenses and allocate funds more efficiently. 2. Budget Planning: One of the primary purposes of the Oakland, Michigan Worksheet is to assist you in creating a comprehensive budget plan. It allows you to set realistic goals and prioritize your financial obligations effectively. Whether you want to save for a down payment on a house, pay off debts, or create an emergency fund, this worksheet enables you to allocate funds accordingly to achieve your objectives. By examining income and expense patterns, you can make informed decisions and take control of your financial situation. 3. Debt Management: Many individuals face the challenge of managing and paying off debts. The Oakland, Michigan Worksheet for Making a Budget provides dedicated sections for tracking and managing debt. It enables you to record the outstanding balances, interest rates, and minimum payments for each debt. By having a clear overview of your debts, you can create a strategy to pay them off systematically, saving money on interest payments and improving your credit score. Different Types of Oakland, Michigan Worksheets for Making a Budget: 1. Basic Monthly Budget Worksheet: This type of worksheet focuses on tracking monthly income and expenses. It helps you understand the overall financial health of your household and provides a foundation for financial planning. 2. Daily/Weekly Budget Worksheet: Ideal for those seeking a more detailed approach to budgeting, this worksheet breaks down expenses on a daily or weekly basis. By closely monitoring your daily spending habits, you can identify unnecessary expenditures and make adjustments accordingly. 3. Savings/Investment Budget Worksheet: Designed specifically for individuals looking to build their savings or investment portfolios, this worksheet emphasizes setting aside funds for these purposes. It assists in tracking progress towards savings goals and encourages responsible financial habits. In conclusion, the Oakland, Michigan Worksheet for Making a Budget offers a comprehensive solution for individuals seeking to take control of their finances. Whether you opt for a basic monthly budget worksheet, a daily/weekly breakdown, or a savings/investment-oriented approach, these worksheets provide a practical and organized method for managing your money. Empower yourself with the tools needed to achieve financial stability and improve your overall financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Oakland Michigan Hoja De Trabajo Para Hacer Un Presupuesto?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Oakland Worksheet for Making a Budget.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Oakland Worksheet for Making a Budget will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Oakland Worksheet for Making a Budget:

- Ensure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Oakland Worksheet for Making a Budget on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!