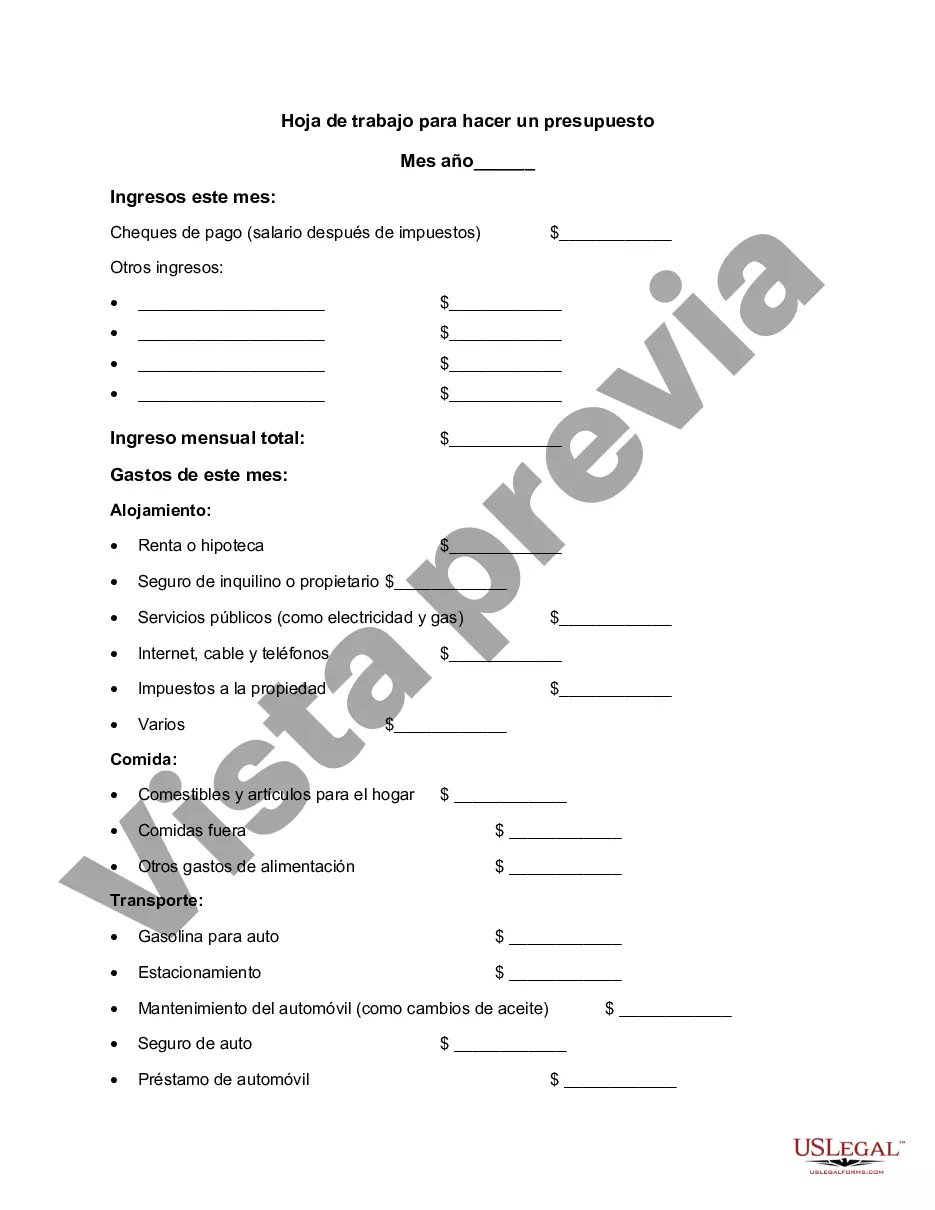

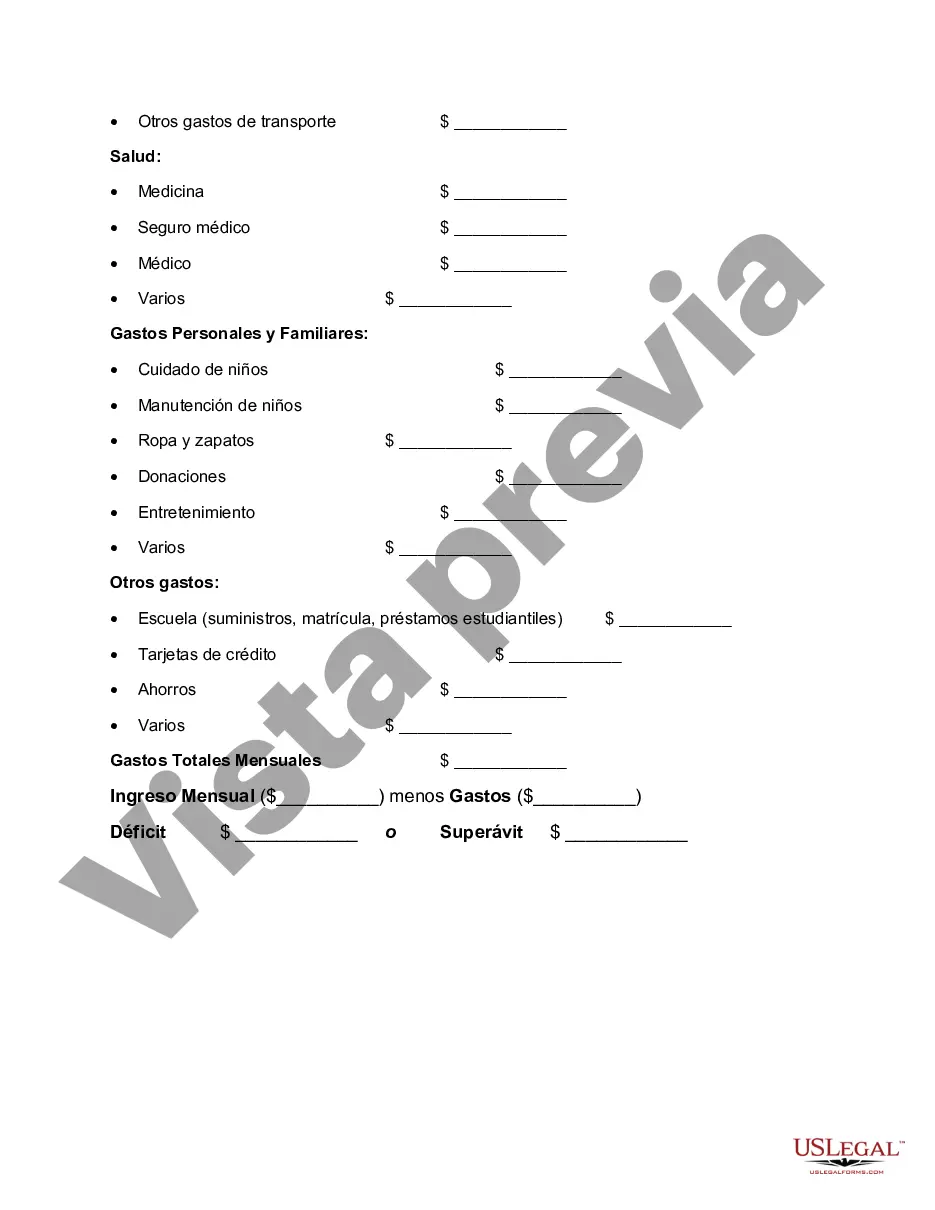

Salt Lake City, also known as Salt Lake Utah, is the capital city of the state of Utah in the United States. In order to effectively manage your finances and achieve financial goals, it is essential to create a budget. A Salt Lake Utah Worksheet for Making a Budget is a helpful tool that assists individuals in organizing their income, expenses, and savings. When it comes to budgeting, different types of Salt Lake Utah Worksheets for Making a Budget are available to cater to various needs and preferences: 1. Basic Budget Worksheet: This type of worksheet includes essential categories such as income, fixed expenses (rent/mortgage, utilities, insurance), variable expenses (groceries, transportation, entertainment), and savings. It provides a simple and comprehensive overview of income and expenses to help individuals gain control over their spending. 2. Detailed Budget Worksheet: As the name suggests, this worksheet is more extensive and includes additional categories to track different aspects of one's financial life. Apart from the basic budget categories, it may include sections for debt payments, investments, taxes, and miscellaneous expenses. This type of worksheet is suitable for individuals who want to have a more comprehensive understanding of their financial situation. 3. Monthly Budget Worksheet: This type of budget worksheet is designed to be used on a monthly basis. It helps individuals plan their finances for each month, considering the variation in income and expenses throughout the year. It allows individuals to align their budget with their monthly goals and adjust it as necessary. 4. Yearly Budget Worksheet: For individuals with a more long-term perspective, a yearly budget worksheet can be a valuable tool. It involves compiling income and expenses over the course of a year, considering seasonal variations and one-time expenses. This type of worksheet enables individuals to plan and prepare for major financial milestones such as vacations, home repairs, or tuition fees. 5. Savings Budget Worksheet: Saving money is an important aspect of financial planning. This worksheet specifically focuses on tracking and allocating funds towards savings goals. It may include sections for emergency funds, retirement savings, education funds, or specific short-term goals such as a down payment for a home or a vacation. This worksheet is ideal for those who prioritize saving and want a more detailed overview of their progress in this area. Regardless of the type of Salt Lake Utah Worksheet for Making a Budget used, it is crucial to determine one's financial goals and priorities. Creating a budget and regularly reviewing it can empower individuals to make informed financial decisions, reduce unnecessary expenses, and work towards achieving their financial objectives in Salt Lake City, Utah.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Salt Lake Utah Hoja De Trabajo Para Hacer Un Presupuesto?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Salt Lake Worksheet for Making a Budget, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Salt Lake Worksheet for Making a Budget from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Salt Lake Worksheet for Making a Budget:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!