Allegheny, Pennsylvania, Debt Settlement Offer in Response to Creditor's Proposal When facing overwhelming debts and struggling to make ends meet, exploring debt settlement options can provide some relief and help achieve financial stability. Allegheny, Pennsylvania, offers debtors a chance to settle their debts through negotiated agreements with creditors. These settlement offers are tailored to the specific circumstances of the debtor and aim to alleviate the burden of debt while avoiding more severe measures such as bankruptcy. Debt settlement offers in Allegheny, Pennsylvania, are responses made by debtors to the proposals put forth by creditors. Creditors often present initial settlement proposals in an attempt to recover a portion of the debt owed. However, these initial proposals may not always be ideal for the debtor. In response, debtors can put forward their own counter-offers, negotiating new terms that are more feasible and affordable for their financial situation. The primary goal of Allegheny, Pennsylvania, debt settlement offers is to reduce the total debt amount owed to creditors. By presenting a well-thought-out response to the creditor's proposal, debtors can seek to decrease the outstanding balance and potentially negotiate a more manageable repayment plan. Debt settlement can provide significant relief for individuals struggling with high-interest rates, late fees, and monthly payments that have become unaffordable. There are different types of debt settlement offers that debtors in Allegheny, Pennsylvania, can consider: 1. Lump Sum Settlement: This type of offer involves the debtor proposing a one-time payment to the creditor, generally at a reduced amount compared to the total debt owed. This option can be suitable for individuals who have access to a lump sum of money or have the ability to liquidate assets to fund the settlement. 2. Extended Repayment Plan: In this type of settlement offer, debtors propose an extended repayment period to the creditor, allowing them to pay off the debt in affordable monthly installments over an extended time frame. This can be a viable option for individuals who cannot afford to make a lump sum payment but can manage smaller monthly payments over a more extended period. 3. Partial Debt Forgiveness: Sometimes, debtors may request partial debt forgiveness as part of their settlement offer. This approach involves negotiating with creditors to waive a portion of the debt in exchange for a full or partial payment. It can be a helpful strategy for debtors who are experiencing severe financial hardships and are unable to repay the entire debt amount. 4. Interest Rate Reduction: Debtors can propose an interest rate reduction to make their debt more manageable. By negotiating for a lower interest rate, debtors can reduce the overall amount they owe and make it easier to pay down the debt over time. When considering a debt settlement offer in Allegheny, Pennsylvania, debtors should consult with a reputable credit counseling agency or an attorney specializing in debt settlement to ensure they understand their rights and options. It is essential to have a clear understanding of the creditor's proposal, assess personal financial circumstances, and craft a well-prepared response that aligns with one's ability to repay. In conclusion, Allegheny, Pennsylvania, debt settlement offers in response to creditor proposals aim to provide relief to debtors burdened by overwhelming debts. By negotiating terms that reduce the overall debt amount, propose extended repayment plans, or request partial forgiveness, debtors can work towards achieving financial stability and regain control over their financial future.

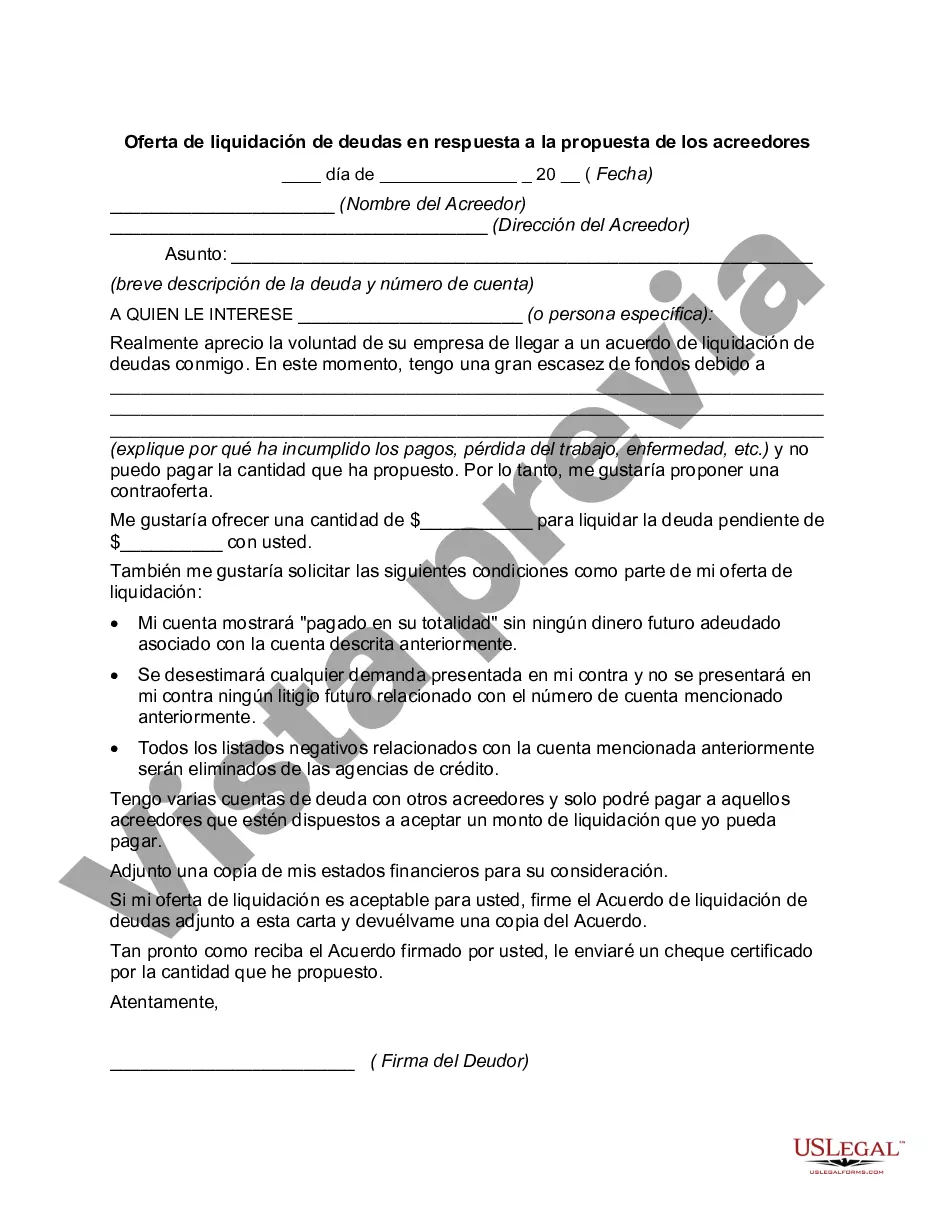

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Allegheny Pennsylvania Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Allegheny Debt Settlement Offer in Response to Creditor's Proposal.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Allegheny Debt Settlement Offer in Response to Creditor's Proposal will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Allegheny Debt Settlement Offer in Response to Creditor's Proposal:

- Make sure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Allegheny Debt Settlement Offer in Response to Creditor's Proposal on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!