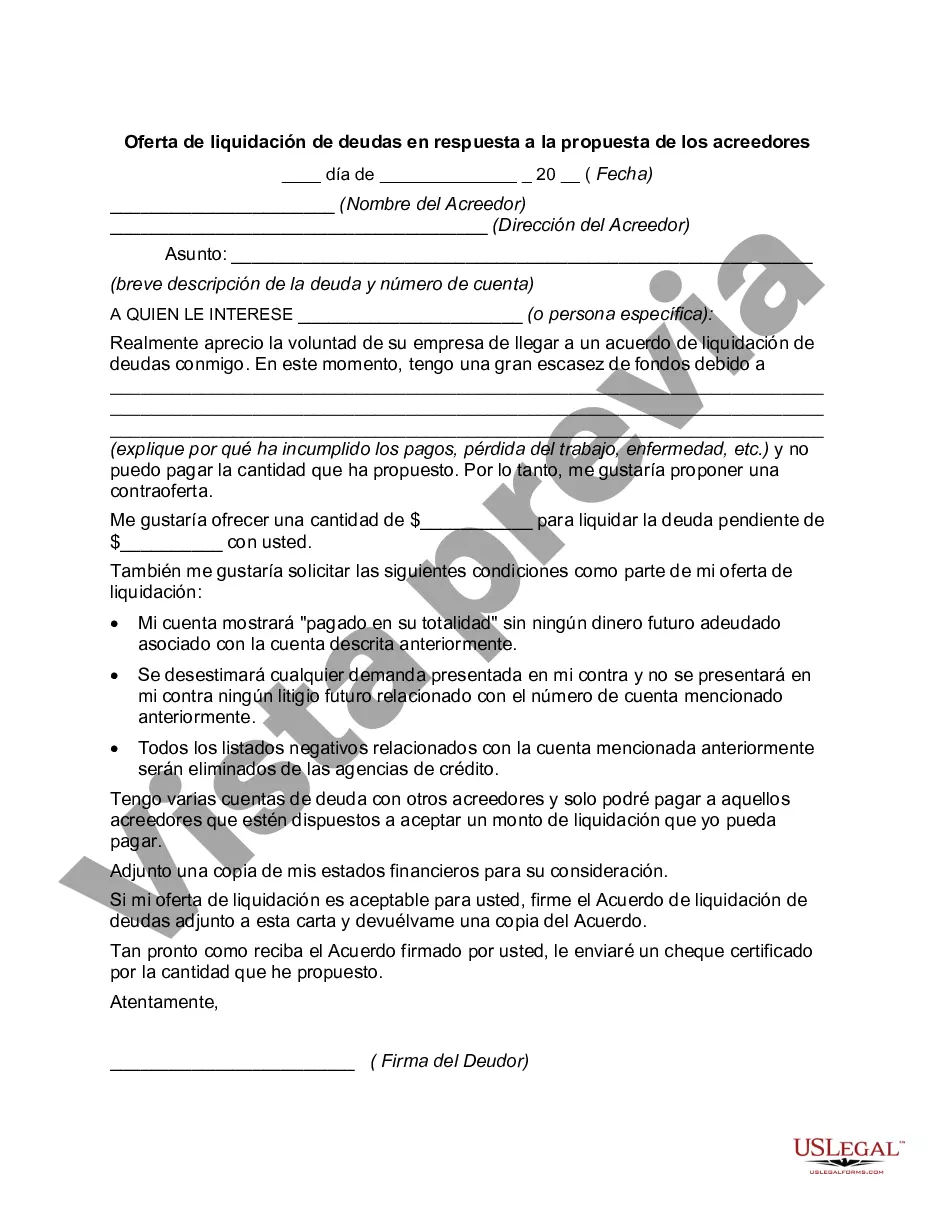

Chicago Illinois Debt Settlement Offer in Response to Creditor's Proposal: When faced with mounting debt and financial hardships, individuals in Chicago, Illinois often seek out debt settlement options to find a feasible solution to their situation. One such option is the Chicago Illinois Debt Settlement Offer in Response to Creditor's Proposal. A Debt Settlement Offer is a negotiation process between a borrower and their creditors to reach a mutually acceptable agreement on the repayment of owed debt. In Chicago, Illinois, this offer is a response to a proposal put forward by the creditor regarding a debtor's outstanding debts. The purpose of this Chicago Illinois Debt Settlement Offer is to present a counterproposal that aims to settle the debt for less than the initial owed amount, providing a debtor with an opportunity to repay their debts in a more manageable way. This offer serves to alleviate the debtor's financial burden while ensuring that creditors receive a portion of the debt owed. Different types of Chicago Illinois Debt Settlement Offers in Response to Creditor's Proposal may exist, targeting various types of debts or financial situations. These may include: 1. Credit Card Debt Settlement Offer: This type of settlement offer focuses on negotiating with credit card companies to reduce outstanding credit card debts. It allows Chicago individuals to potentially pay a reduced amount or establish a repayment plan that suits their financial capacity. 2. Medical Debt Settlement Offer: This settlement offer pertains to outstanding medical bills and aims to negotiate a lower amount or an affordable payment plan that accommodates a debtor's financial situation. This offer enables individuals struggling with medical debts in Chicago, Illinois, to resolve their obligations without further strain on their finances. 3. Personal Loan Debt Settlement Offer: When faced with personal loan debts, individuals in Chicago, Illinois, can respond to a creditor's proposal with a personalized settlement offer. This type of offer seeks to renegotiate the terms, potentially reducing the principal amount, lowering interest rates, or restructuring the repayment plan. The Chicago Illinois Debt Settlement Offer in Response to Creditor's Proposal serves as a valuable tool for individuals seeking debt relief. It allows debtors to assert their financial stability and negotiate more favorable terms with creditors, alleviating the burden of overwhelming debt. By exploring debt settlement options, Chicago residents can take proactive steps towards financial freedom and a brighter future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Chicago Illinois Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Chicago Debt Settlement Offer in Response to Creditor's Proposal is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Chicago Debt Settlement Offer in Response to Creditor's Proposal. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Debt Settlement Offer in Response to Creditor's Proposal in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!