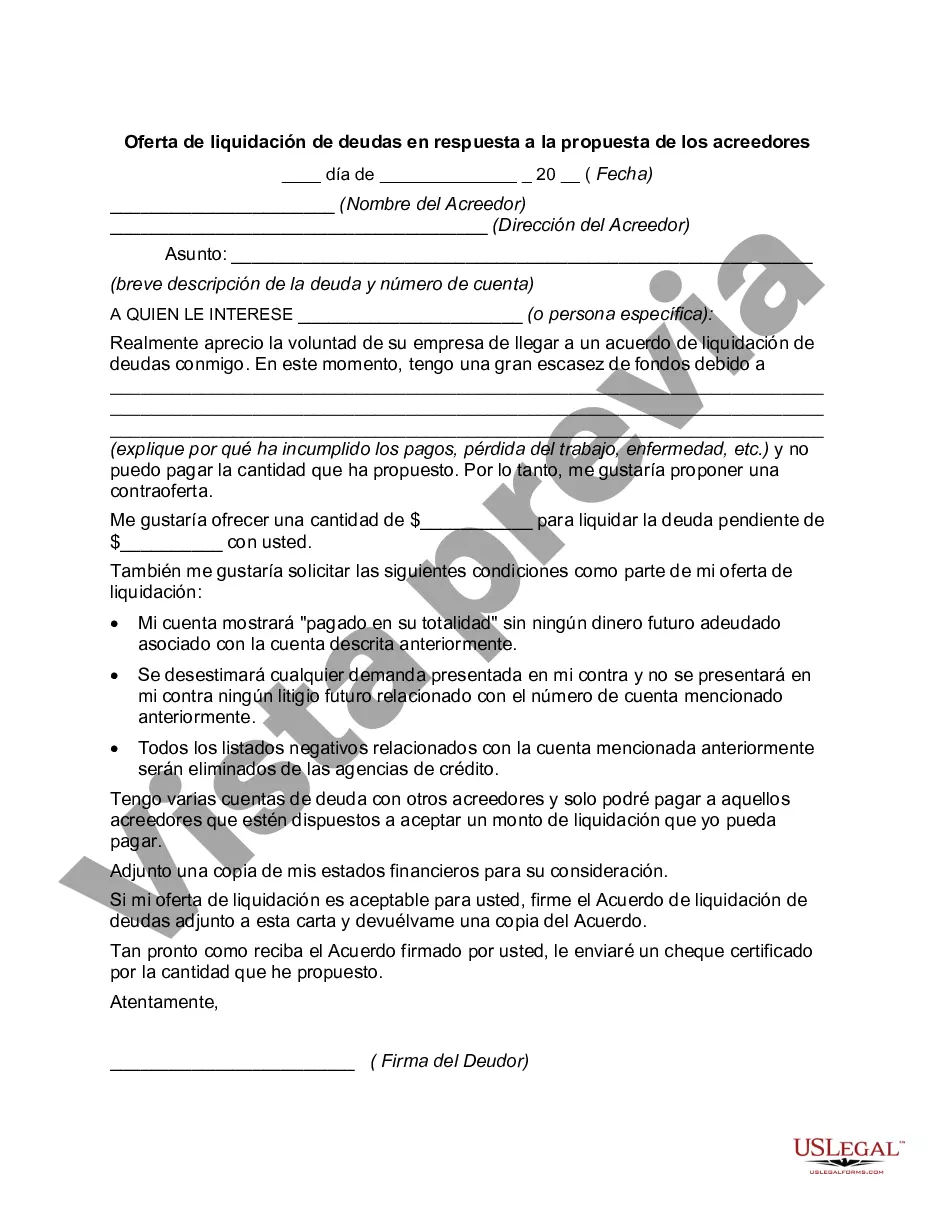

Collin, Texas Debt Settlement Offer in Response to Creditor's Proposal: A Detailed Description Dealing with mounting debt can be overwhelming and stressful, but residents of Collin, Texas have an option to consider — the Collin Texas Debt Settlement Offer in response to a creditor's proposal. This debt settlement offer aims to provide individuals with a feasible solution to resolve their financial challenges. In simple terms, a debt settlement offer is a negotiation process that allows debtors to reach an agreement with their creditors to settle outstanding debts for less than the total amount owed. This offer is typically made in response to a proposal put forth by the creditor, highlighting their terms and conditions. Various types of Collin Texas Debt Settlement Offers may be available, depending on the nature and extent of the debt. Here are a few types commonly seen: 1. Lump Sum Settlement Offer: In this type of settlement offer, the debtor proposes a one-time, reduced payment to the creditor to settle the debt entirely. If the creditor accepts this offer, the debtor makes a single payment, clearing the entire debt amount and concluding the obligation. 2. Installment Settlement Offer: Sometimes, debtors may find it challenging to pay off the debt in a lump sum but can negotiate an affordable installment plan with the creditor. With this offer, debtors propose a series of regular payments over an agreed-upon period, which results in the gradual elimination of the debt. 3. Percentage-Based Settlement Offer: This type of offer involves debtors proposing to pay a specific percentage of the total outstanding debt. For instance, they may offer to settle at 50% of the owed amount. If the creditor agrees to this offer, the debtor pays the agreed-upon percentage, and the remaining debt is considered resolved. When considering a Collin Texas Debt Settlement Offer, it is essential to evaluate the benefits and potential drawbacks carefully. Debtors should consider factors such as their financial situation, the impact on their credit score, and the likelihood of creditor acceptance before making any decisions. One crucial aspect to bear in mind is that debt settlement offers typically require proactive communication and negotiation with the creditor. It is essential to approach the negotiation process with professionalism, providing accurate financial information and a well-articulated proposal. To initiate the process, debtors can hire debt settlement companies or negotiate independently. Debt settlement companies offer expertise and experience in dealing with creditors, streamlining the negotiation process and increasing the likelihood of a successful settlement. In conclusion, a Collin Texas Debt Settlement Offer in response to a creditor's proposal presents an opportunity for individuals to resolve their debts by negotiating a reduced payment. Whether it involves a lump sum settlement, installment plan, or a percentage-based offer, careful consideration of the specific terms and potential implications is crucial. Seeking professional assistance and maintaining open communication with the creditor can aid in successfully navigating the debt settlement process and achieving financial relief.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Collin Texas Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Are you looking to quickly create a legally-binding Collin Debt Settlement Offer in Response to Creditor's Proposal or maybe any other document to manage your personal or business affairs? You can go with two options: hire a legal advisor to draft a valid paper for you or create it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant document templates, including Collin Debt Settlement Offer in Response to Creditor's Proposal and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, double-check if the Collin Debt Settlement Offer in Response to Creditor's Proposal is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the template isn’t what you were seeking by using the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Collin Debt Settlement Offer in Response to Creditor's Proposal template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!