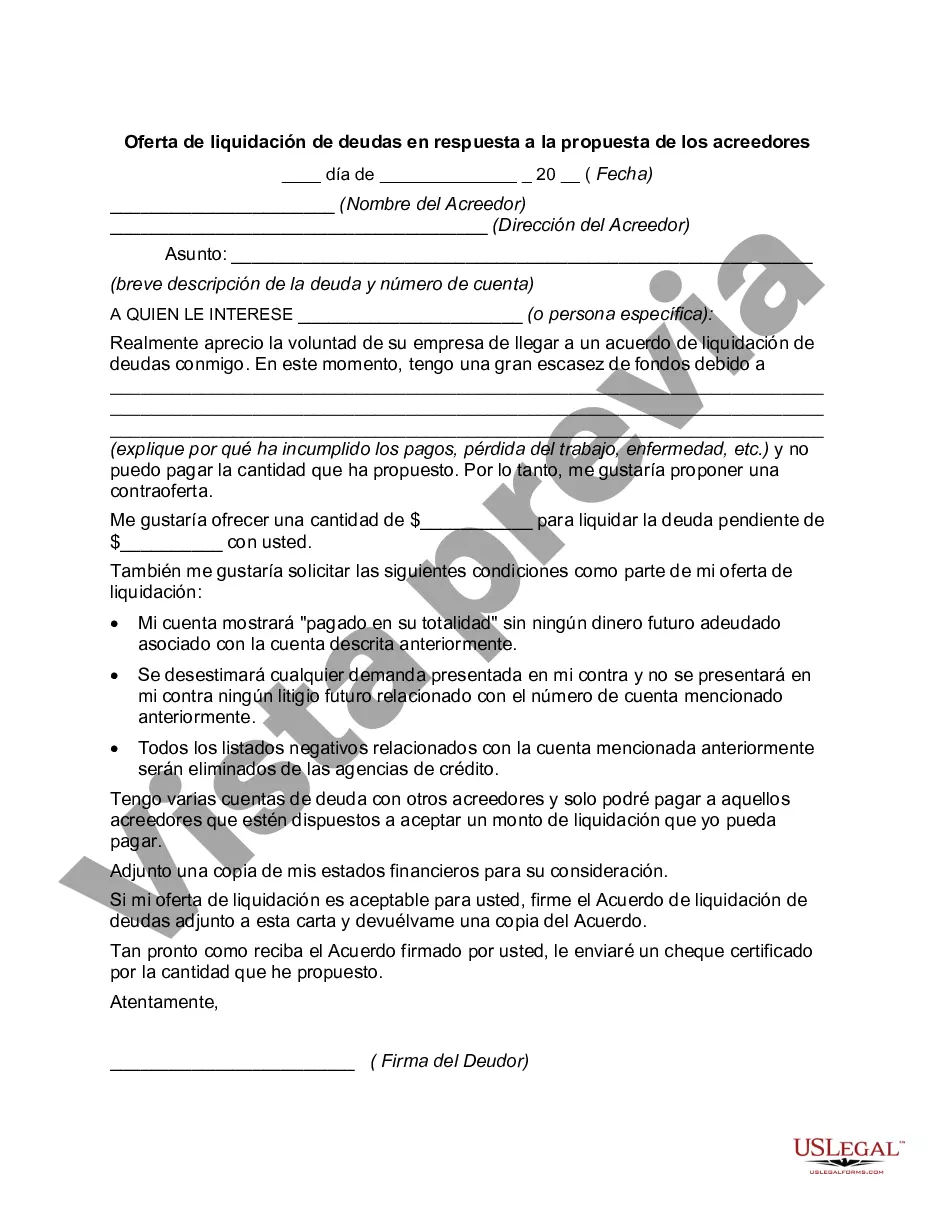

Cuyahoga Ohio Debt Settlement Offer in Response to Creditor's Proposal If you are facing overwhelming debt in Cuyahoga County, Ohio, you may find relief through a debt settlement offer in response to a creditor's proposal. A debt settlement offer is a negotiation strategy used by individuals or businesses to reach a compromise with their creditors and reduce the total amount owed. This approach can help debtors avoid bankruptcy while providing some financial stability. In Cuyahoga County, there are several types of debt settlement offers in response to creditor's proposals that debtors may consider: 1. Lump Sum Settlement: This type of settlement involves making a single, bulk payment to your creditor, which is usually lower than the original debt amount. In exchange, the creditor agrees to consider the debt paid in full, releasing you from any further obligations. 2. Structured Settlement: In this arrangement, debtors and creditors agree upon a modified payment plan to satisfy the debt gradually. Usually, debtors make monthly payments for a predetermined period until the debt is fully paid off. The structured settlement may involve lower monthly payments and potential interest rate reductions. 3. Percentage-Based Settlement: With this approach, debtors negotiate with their creditors to settle the debt by paying a percentage of what they owe. The actual percentage can vary depending on factors such as financial hardship, the age of the debt, and the creditor's willingness to negotiate. Regardless of the type of debt settlement offer in response to a creditor's proposal chosen, it is advisable to seek professional assistance from a reputable debt settlement company or attorney experienced in Cuyahoga County's specific laws and regulations. They can guide you through the negotiation process, advocate on your behalf, and help ensure fair and favorable outcomes for all parties involved. It's important to note that debt settlement offers may come with potential consequences, such as a negative impact on credit scores and the possibility of taxable income if debt forgiveness exceeds a certain threshold. However, for many debtors struggling with unmanageable debt, the benefits of a settlement offer often outweigh these drawbacks. If you are considering a debt settlement offer in response to a creditor's proposal in Cuyahoga County, Ohio, it is crucial to gather all relevant documentation, evaluate your financial situation thoroughly, and consult with professionals who can provide personalized advice. By taking proactive steps, you can regain control over your finances and move towards a debt-free future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Cuyahoga Ohio Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a Cuyahoga Debt Settlement Offer in Response to Creditor's Proposal meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

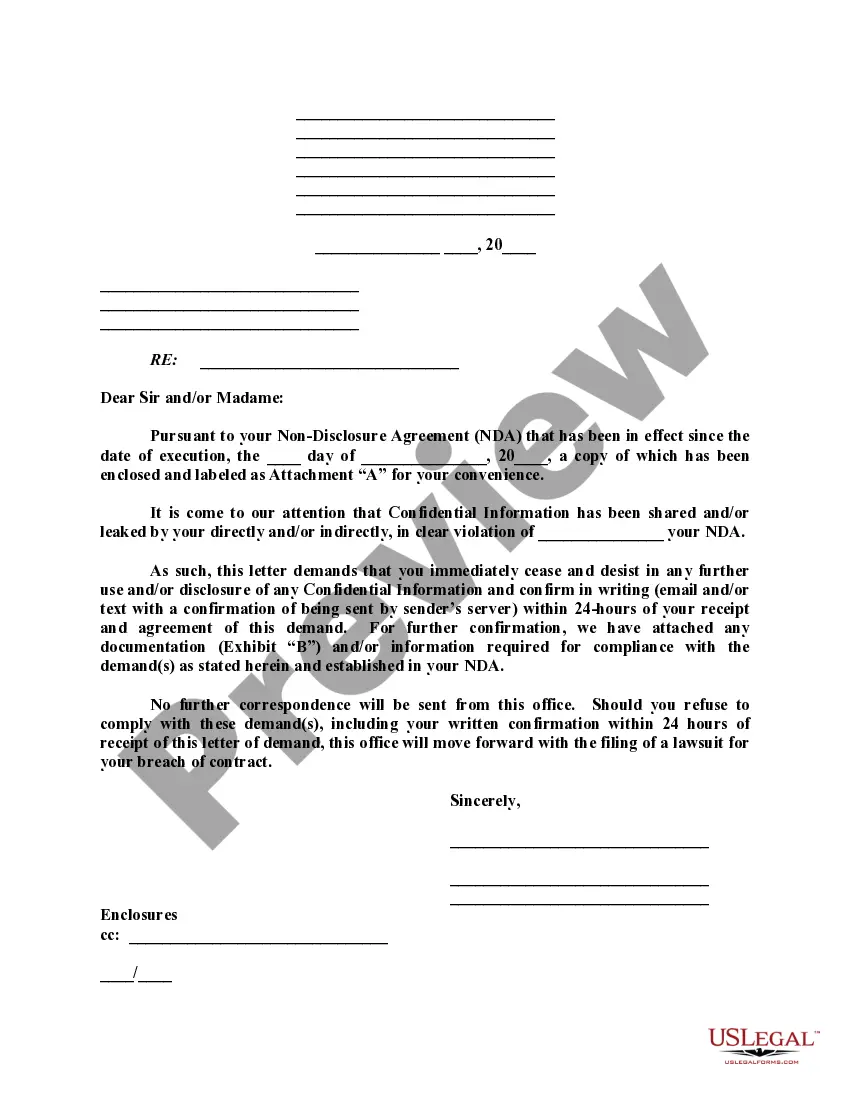

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Cuyahoga Debt Settlement Offer in Response to Creditor's Proposal, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Cuyahoga Debt Settlement Offer in Response to Creditor's Proposal:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Cuyahoga Debt Settlement Offer in Response to Creditor's Proposal.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Como liquidar una deuda mas rapido Pague mas del minimo.Pague mas de una vez por mes.Liquide su prestamo mas caro primero.Considere el metodo bola de nieve para liquidar deudas.Lleve un registro de las cuentas y paguelas en menos tiempo.Acorte el plazo de su prestamo.Consolide varias deudas.

La carta de propuesta de pago debe contener datos basicos como tu nombre, direccion, numero de cuenta, saldo pendiente y tasa de interes actual. Es recomendable que figuren en la parte superior de tu carta de propuesta de pago. Explica sinceramente por que no has sido capaz de hacer los pagos previamente discutidos.

¿Como salir de tus deudas? Aceptar que se tienen deudas y dejar de evadirlas.Calcula exactamente cuanto debes.Calcula tus gastos fijos.Limita el uso de tus tarjetas de credito.Elabora un plan.Deja de acumular deudas.Establece un fondo de emergencias.Aplica el efecto bola de nieve.

Te brindamos algunas recomendaciones: Ponte un plazo de tiempo para liquidar tus deudas. Paga siempre en tiempo y forma. Administra y optimiza el dinero para ellas. Prioriza y cubre las que generan mas intereses. Salda las pequenas deudas en un solo pago. Cubre mas de la cuota minima. No te atrases en tus pagos.

La liquidacion de deuda implica que el acreedor acuerda saldar la deuda por un monto menor que la suma total adeudada. En otras palabras, el prestatario paga una suma inferior a la que en realidad debe. El prestamista no le pide el dinero restante. No hay mas llamadas de cobro ni amenazas de avisos judiciales.

Desde una perspectiva estrictamente financiera, la mejor estrategia es priorizar la deuda por la Tasa de Porcentaje Anual (APR, por sus siglas en ingles). Si paga primero las deudas con la APR mas alta, ahorra dinero en general. Las deudas con una APR mas alta acumulan cargos de interes mensuales mas altos.

La carta de propuesta de pago debe contener datos basicos como tu nombre, direccion, numero de cuenta, saldo pendiente y tasa de interes actual. Es recomendable que figuren en la parte superior de tu carta de propuesta de pago. Explica sinceramente por que no has sido capaz de hacer los pagos previamente discutidos.

Los elementos imprescindibles de un acuerdo de pago son: Datos del acreedor y del deudor: El nombre y los apellidos, asi como el documento nacional de identidad deben estar presentes en los documentos. Clausulas: Deben establecerse las clausulas o declaraciones que modifican o cumplimentan al acuerdo original.

¿Que tiene que decirme el cobrador de deudas sobre la deuda? Un cobrador tiene que darle informacion de validacion sobre la deuda, ya sea durante su primera llamada de telefono o por escrito dentro de los cinco dias siguientes a la fecha en que se comunico con usted por primera vez.