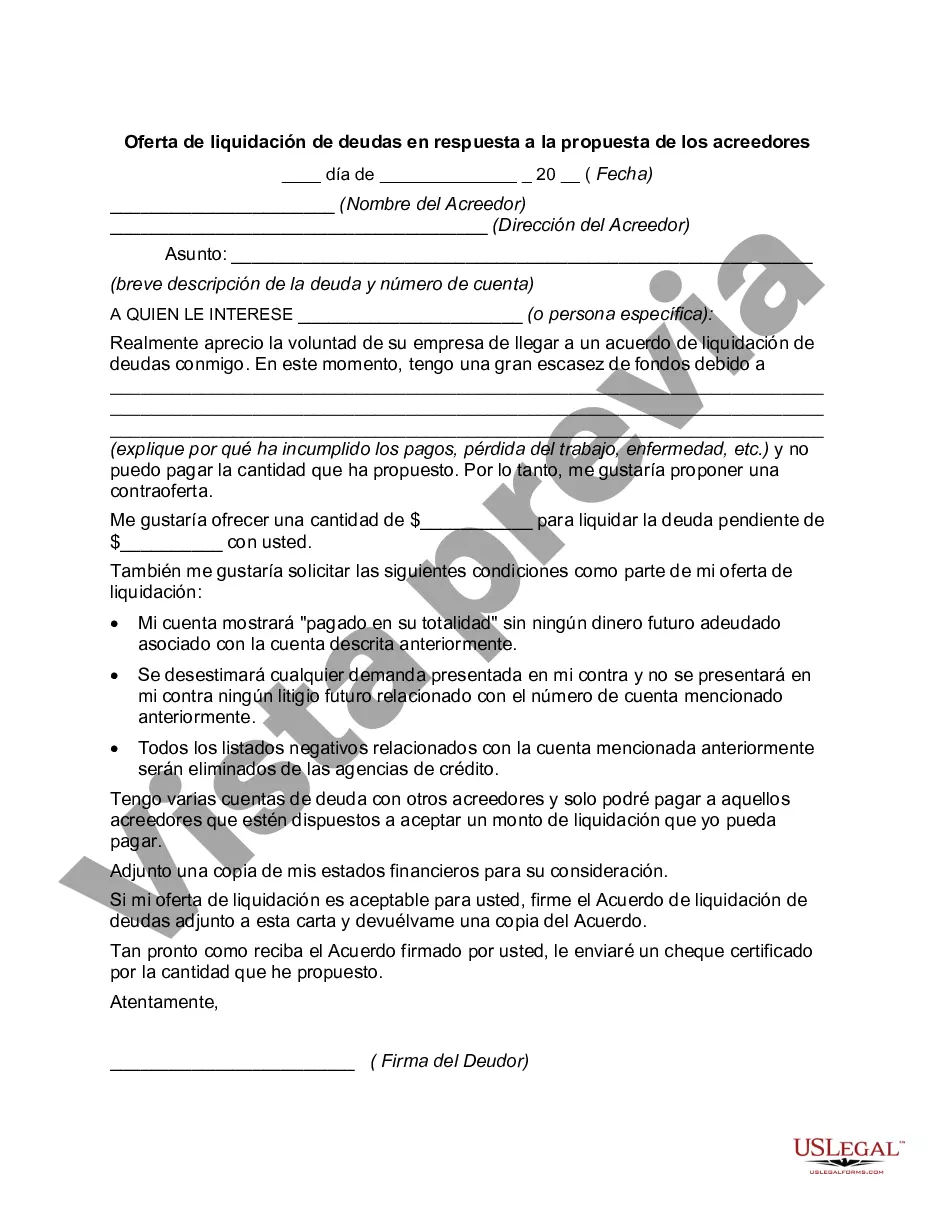

Fulton Georgia Debt Settlement Offer in Response to Creditor's Proposal When faced with mounting debt and challenges in meeting financial obligations, selecting the right debt settlement offer can be a crucial decision for individuals and businesses in Fulton, Georgia. Debt settlement is a negotiation process where debtors and creditors agree on a reduced amount that the debtor can pay to settle their outstanding debt, typically with a lump sum payment. In response to a creditor's proposal for debt settlement, Fulton Georgia offers various types of debt settlement options tailored to meet the debtor's specific financial circumstances. These debt settlement offers enable debtors to work towards resolving their debts and regaining control of their financial situation. Key factors considered in determining the type of settlement offer include the debtor's total debt amount, income level, and ability to make regular payments. 1. Lump Sum Settlement Offer: This type of debt settlement offer involves the debtor paying a one-time, reduced lump sum payment to the creditor to settle the entire outstanding debt. The negotiated lump sum amount is typically lower than the original debt owed, providing debtors with an opportunity to save money while eliminating their debts. 2. Installment Payment Plan: For debtors who cannot afford to make a lump sum payment, Fulton Georgia may propose an installment payment plan. This arrangement allows debtors to make regular monthly payments over an agreed-upon period, gradually reducing their debt until it is fully settled. The payment plan is established based on the debtor's financial capacity and typically aims to ensure the debt is resolved within a reasonable timeframe. 3. Debt Consolidation Offer: In some cases, Fulton Georgia may propose a debt consolidation plan as part of the debt settlement offer. This involves combining multiple outstanding debts into a single loan, often with lower interest rates, more manageable monthly payments, and an extended repayment period. Debt consolidation can simplify repayment and potentially save debtors money in the long run. 4. Partial Debt Forgiveness: In situations where debtors face extreme financial hardship, Fulton Georgia may negotiate a partial debt forgiveness offer. Under this arrangement, a portion of the outstanding debt is waived by the creditor, allowing the debtor to settle the remaining balance at a reduced amount. Partial debt forgiveness provides considerable relief to debtors burdened by overwhelming financial obligations. Fulton Georgia's debt settlement offers aim to facilitate a cooperative resolution between debtors and creditors, promoting financial stability and debt relief. It is crucial for debtors to carefully review and consider these settlement options, seeking professional advice when necessary, to select the most suitable offer that aligns with their financial capacity and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Fulton Georgia Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Fulton Debt Settlement Offer in Response to Creditor's Proposal, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any activities associated with paperwork completion simple.

Here's how to purchase and download Fulton Debt Settlement Offer in Response to Creditor's Proposal.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the similar document templates or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Fulton Debt Settlement Offer in Response to Creditor's Proposal.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Fulton Debt Settlement Offer in Response to Creditor's Proposal, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you need to deal with an extremely challenging situation, we advise getting a lawyer to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-compliant paperwork effortlessly!