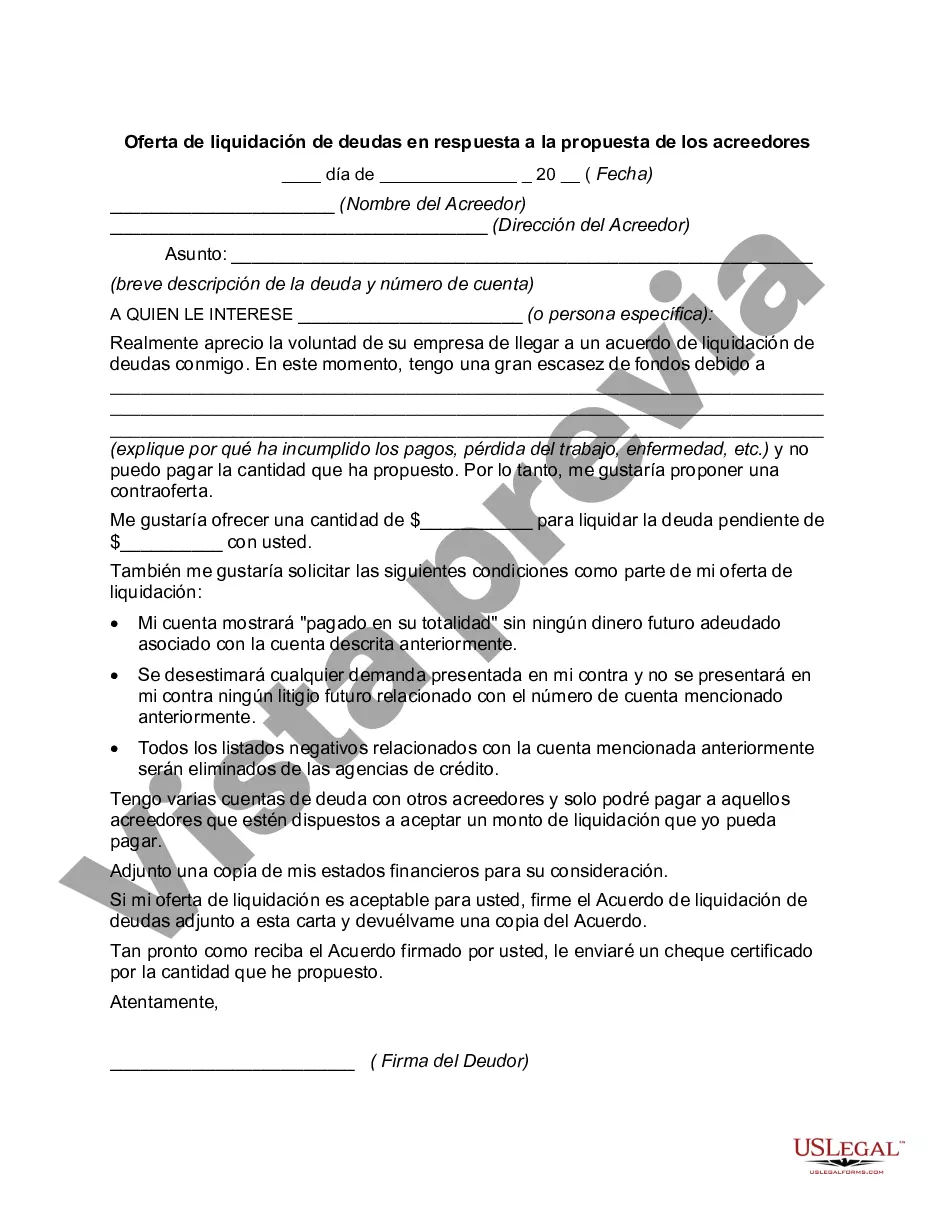

Harris Texas Debt Settlement Offer in Response to Creditor's Proposal refers to the process by which a debtor in Harris County, Texas, responds to their creditor's proposal for a debt settlement. This offer aims to negotiate and reach a mutual agreement on resolving the outstanding debt. One type of Harris Texas Debt Settlement Offer in Response to Creditor's Proposal is a lump-sum settlement offer. In this scenario, the debtor proposes a one-time payment to settle the debt entirely, often at a reduced amount compared to the original outstanding balance. The debtor may argue that this lump-sum payment is a more viable option for both parties, as it helps the creditor avoid the costs and potential risks associated with prolonged collection efforts. Another type of Harris Texas Debt Settlement Offer in Response to Creditor's Proposal is a structured settlement offer. This offer involves the debtor proposing a repayment plan to settle the debt over a specified period. The debtor may suggest a reduced interest rate or lower monthly payments, making it more manageable for both parties. Structured settlement offers are suitable for debtors who are unable to make a lump-sum payment but can commit to regular payments over time. In both cases, the Harris Texas Debt Settlement Offer in Response to Creditor's Proposal should include key elements. Firstly, the offer should clearly state the debtor's intention to settle the outstanding debt. It should identify the creditor, the debtor, and provide relevant account information to ensure accurate communication and record-keeping. Additionally, the offer should outline the proposed terms and conditions. For a lump-sum settlement offer, the debtor should specify the exact amount being offered and provide reasoning backing up its feasibility. If a structured settlement offer is being made, the offer should detail the proposed repayment schedule, monthly payments, and any adjustments to interest rates or penalties. The Harris Texas Debt Settlement Offer in Response to Creditor's Proposal should also mention the benefits for the creditor. It is crucial to emphasize the advantages of accepting the offer, such as avoiding potential losses from further collection efforts, mitigating prolonged legal actions, and recovering a significant portion of the debt swiftly. In conclusion, a Harris Texas Debt Settlement Offer in Response to Creditor's Proposal serves as an opportunity for debtors in Harris County, Texas, to negotiate a favorable resolution to their outstanding debts. It enables them to propose either a lump-sum settlement offer or a structured repayment plan. By carefully crafting such an offer, debtors can increase their chances of reaching a mutually beneficial agreement with their creditors, minimizing financial strain and paving the way for debt recovery.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Harris Texas Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Harris Debt Settlement Offer in Response to Creditor's Proposal suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Apart from the Harris Debt Settlement Offer in Response to Creditor's Proposal, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Harris Debt Settlement Offer in Response to Creditor's Proposal:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Debt Settlement Offer in Response to Creditor's Proposal.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!