Los Angeles California Debt Settlement Offer in response to a creditor's proposal is a negotiation process where individuals or businesses in Los Angeles seek to resolve their outstanding debts with creditors by offering a reduced payment in exchange for debt forgiveness. It is a common strategy utilized to avoid filing for bankruptcy and to regain financial stability. Key aspects of a Los Angeles California Debt Settlement Offer include: 1. Debt Negotiation: A creditor's proposal outlines the terms of the proposed settlement, usually involving a reduced lump sum payment or installment plan. Debtors in Los Angeles can counter-propose alternative terms, such as a lower payment, extended payment period, or reduced interest rates. 2. Financial Evaluation: Prior to submitting a settlement offer, individuals or businesses in Los Angeles must conduct a thorough evaluation of their financial situation. This includes assessing income, expenses, assets, and liabilities to determine a realistic settlement amount they can afford. 3. Creditor Communication: Debtors must engage in open and honest communication with their creditors during this process. They should inform the creditor about their financial hardships and provide supporting documentation if necessary. Consistent and proactive communication is crucial for successfully negotiating a settlement. 4. Offer Acceptance: Once a settlement offer is proposed, creditors have the option to accept, reject, or provide a counteroffer. Negotiations may continue until an agreement is reached by both parties. It is important to ensure that any settlement agreement is documented in writing for legal purposes. Types of Los Angeles California Debt Settlement Offers in Response to Creditor's Proposals: 1. Lump Sum Settlement: This type of settlement involves offering a one-time, reduced payment to the creditor as a final settlement of the debt. Debtors in Los Angeles can negotiate specific percentages of the outstanding balance to be paid off, usually in cash or through a cashier's check. 2. Installment Settlement: Debtors can propose a repayment plan to their creditors, outlining a schedule for regular monthly payments over an agreed-upon period. The settlement amount is typically less than the full debt owed, and the plan allows debtors in Los Angeles to satisfy their debts gradually. 3. Negotiated Debt Reduction: In some cases, debtors may need to negotiate with the creditor for a reduced debt amount. This option is particularly beneficial when individuals or businesses are experiencing significant financial hardship and cannot afford to pay the full amount owed. By presenting evidence of financial distress, debtors in Los Angeles may convince creditors to forgive a portion of the debt. In conclusion, a Los Angeles California Debt Settlement Offer in response to a creditor's proposal is a strategic approach used to resolve outstanding debts. Whether through a lump sum payment, installment plan, or negotiated debt reduction, debtors in Los Angeles can negotiate with their creditors to achieve a mutually agreeable settlement, alleviating financial burdens and working towards a fresh start.

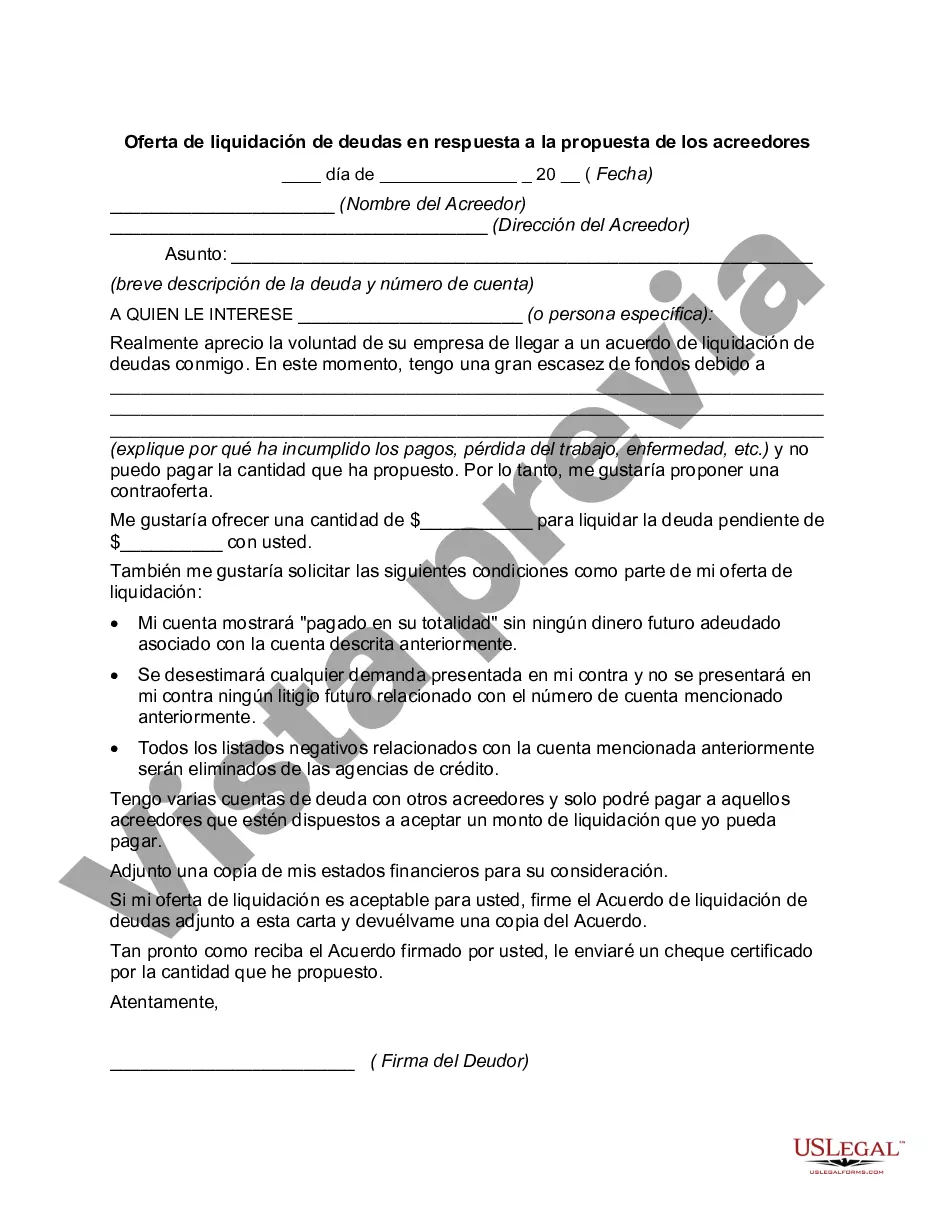

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Los Angeles California Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Los Angeles Debt Settlement Offer in Response to Creditor's Proposal is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to get the Los Angeles Debt Settlement Offer in Response to Creditor's Proposal. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Debt Settlement Offer in Response to Creditor's Proposal in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!