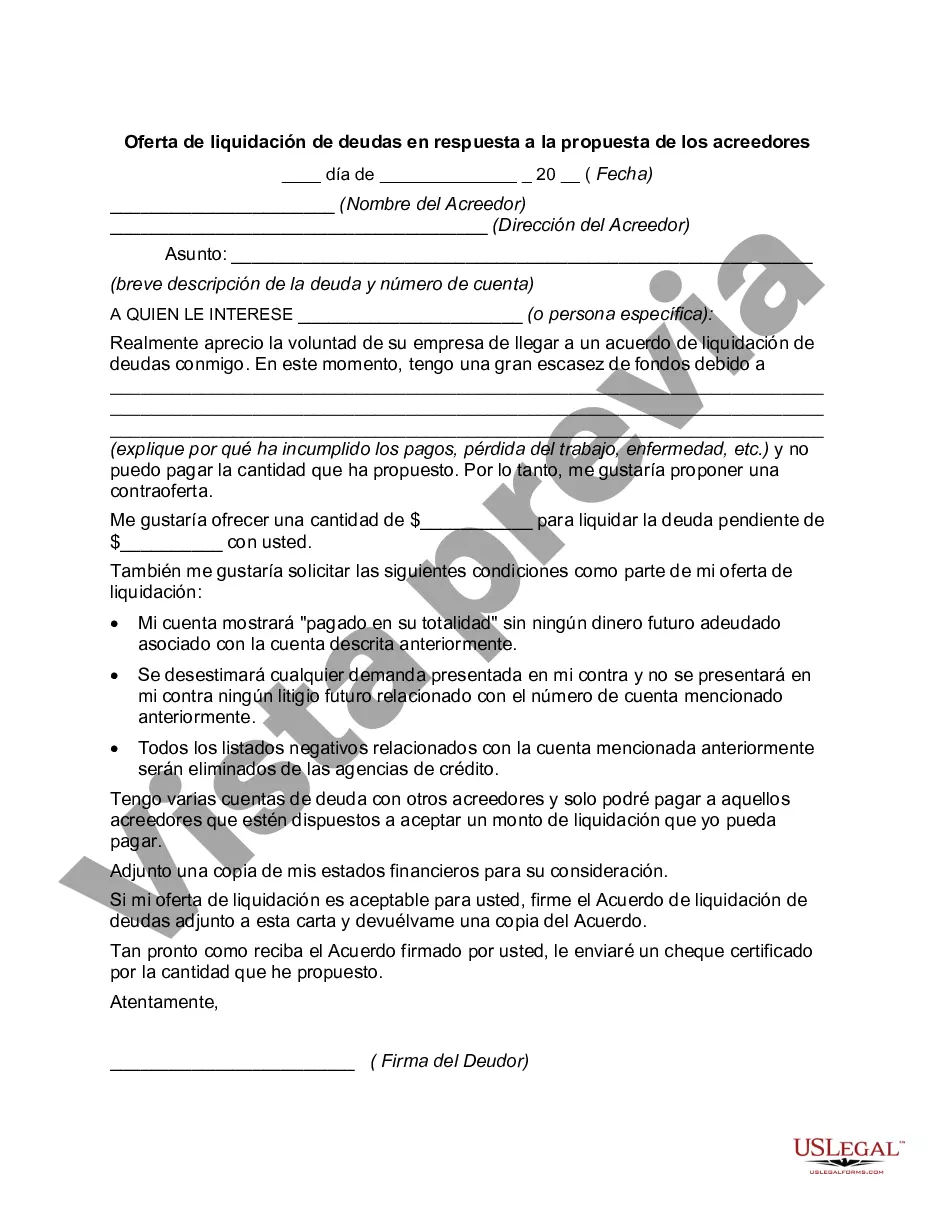

Maricopa Arizona Debt Settlement Offer in Response to Creditor's Proposal: A Maricopa Arizona debt settlement offer in response to a creditor's proposal refers to a negotiation process between a debtor and creditor to reach a mutually agreed-upon settlement of debts. This offer is typically made by individuals or businesses in Maricopa, Arizona, who are facing financial challenges and are unable to repay their debts in full. The debt settlement process entails presenting a counterproposal to the original offer made by the creditor. It is a vital step toward achieving a more manageable debt repayment plan for the debtor. By proposing a settlement offer, debtors aim to alleviate their financial burden while satisfying the creditor's desire to receive at least a portion of the outstanding debt. Maricopa Arizona debt settlement offers in response to creditor proposals can vary depending on several factors, such as the specific circumstances of the debtor, the type of debt involved, and the negotiating skills of both parties. Here are a few different types of Maricopa Arizona debt settlement offers that debtors may consider: 1. Lump-Sum Settlement Offer: This type of debt settlement offer involves proposing a one-time payment to the creditor, usually at a reduced amount compared to the total outstanding debt. Debtors who have access to a lump sum of money may choose this option as it enables them to settle the debt quickly. 2. Installment Payment Plan: Some debtors may negotiate with their creditors to set up a structured payment plan where they make regular installments over an agreed period. The total debt may be reduced or the interest charges may be waived to make the repayment more feasible for the debtor. 3. Percentage Reduction Offer: Debtors may propose a settlement offer that involves a percentage reduction of the total debt amount. This option allows debtors to significantly decrease their debt burden while offering the creditor an opportunity to recoup at least a portion of the owed money. 4. Professional Debt Settlement Assistance: Debtors may seek the assistance of debt settlement companies or attorneys that specialize in negotiating with creditors on their behalf. These professionals can help structure a suitable settlement offer that aligns with the debtor's financial situation and goals. When making a Maricopa Arizona debt settlement offer in response to a creditor's proposal, it is crucial to gather all relevant financial information, understand the creditor's terms, and consider seeking professional guidance if needed. Negotiating a debt settlement offer can be a complex process, but it offers debtors a chance to regain financial stability and avoid more severe consequences of bankruptcy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Maricopa Arizona Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

If you need to find a reliable legal document supplier to get the Maricopa Debt Settlement Offer in Response to Creditor's Proposal, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to find and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Maricopa Debt Settlement Offer in Response to Creditor's Proposal, either by a keyword or by the state/county the document is intended for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Maricopa Debt Settlement Offer in Response to Creditor's Proposal template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less costly and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Maricopa Debt Settlement Offer in Response to Creditor's Proposal - all from the convenience of your sofa.

Sign up for US Legal Forms now!