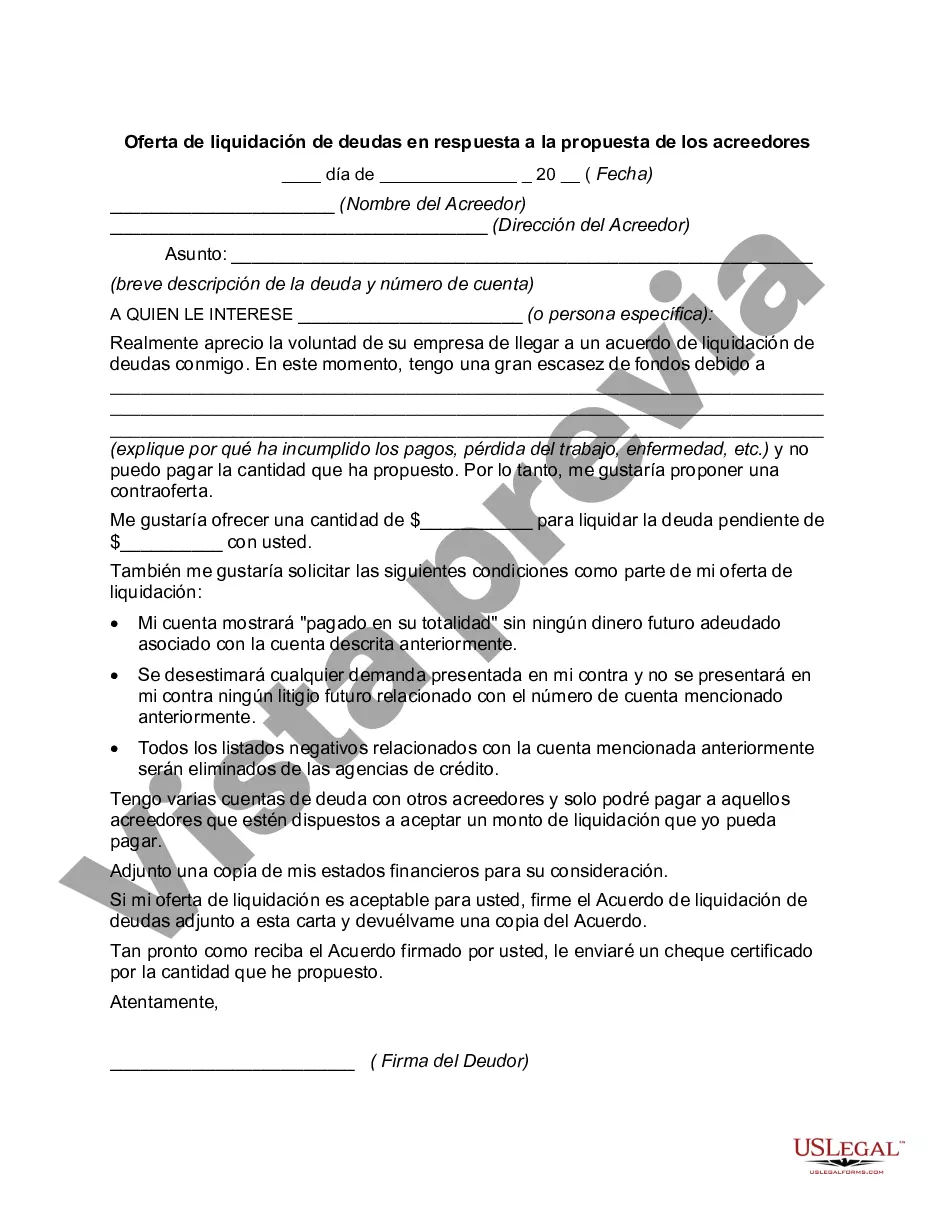

Montgomery Maryland Debt Settlement Offer in Response to Creditor's Proposal: A Comprehensive Guide to Resolving Financial Burdens Introduction: Dealing with overwhelming debt can be a distressing experience, but fortunately, Montgomery, Maryland offers debt settlement options to provide relief. When faced with creditor's proposals, individuals can respond with a structured debt settlement plan that aims to negotiate a reduced payment amount, eliminate or minimize interest charges, and ultimately achieve financial freedom. Types of Montgomery Maryland Debt Settlement Offers: 1. Lump-Sum Settlement Offer: A lump-sum settlement offer involves proposing to pay the creditor a lump sum amount, which is typically less than the total outstanding debt. This offer is beneficial for individuals who have access to a significant amount of funds and wish to resolve the debt quickly. 2. Installment Settlement Offer: For individuals facing financial constraints, an installment settlement offer allows them to propose a structured payment plan. This plan typically involves regular monthly payments over an agreed-upon period, providing a more manageable way to clear the debt. 3. Hybrid Settlement Offer: In certain situations, a hybrid settlement offer could be considered, combining both lump-sum and installment payments. This option can be valuable for individuals who are able to pay a considerable amount upfront but require additional time for complete debt resolution. Detailed Description of Montgomery Maryland Debt Settlement Offer in Response to Creditor's Proposal: When confronted with a creditor's proposal, it is crucial to develop a detailed debt settlement offer tailored to individual circumstances. Here's a step-by-step breakdown: 1. Careful Assessment: Begin by thoroughly assessing your financial situation. Understand the total debt amount, interest rates, and any other critical information pertaining to the debt. Evaluating your ability to make payments and determining a realistic settlement amount will assist in formulating a strong proposal. 2. Consultation with a Debt Settlement Expert: Consider seeking guidance from a debt settlement expert in Montgomery, Maryland. These professionals possess expertise in negotiating with creditors and can provide valuable insights, helping you create an effective debt settlement offer. 3. Formal Proposal: Compose a well-structured, written debt settlement offer that incorporates all relevant terms and conditions. Ensure clarity regarding proposed payment amounts, timelines, and any requests for interest reduction or elimination. Presenting a professional and comprehensive proposal increases the chances of acceptance. 4. Negotiation and Documentation: Once the proposal is submitted to the creditor, expect negotiation to occur. An open line of communication is crucial during this phase, as both parties work towards finding a mutually agreeable solution. All interactions and agreements should be documented for future reference and to ensure transparency. 5. Final Agreement and Debt Resolution: Upon successfully negotiating the settlement terms, reach a final agreement with the creditor. This agreement should outline all established terms and conditions, including the payment structure, any reductions, and the resolution timeframe. Adhering to these terms enables the final resolution of the debt. Conclusion: Montgomery Maryland's debt settlement offer in response to a creditor's proposal provides individuals with an opportunity to tackle their financial burdens effectively. Whether choosing a lump-sum settlement, installment plan, or a combination of both, constructing a well-thought-out proposal and engaging in productive negotiations are key steps in achieving debt resolution and reclaiming financial stability. Seek professional advice and take deliberate action to resolve debts and embark on a brighter financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Montgomery Maryland Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Montgomery Debt Settlement Offer in Response to Creditor's Proposal without expert help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Montgomery Debt Settlement Offer in Response to Creditor's Proposal on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Montgomery Debt Settlement Offer in Response to Creditor's Proposal:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!