Lima, Arizona Debt Settlement Offer in Response to Creditor's Proposal If you find yourself overwhelmed by mounting debt in Lima, Arizona, a debt settlement offer in response to a creditor's proposal could be a viable solution to regain control of your finances. Debt settlement, also known as debt negotiation, is a process where you negotiate with your creditors to reduce the total amount you owe, typically for a lump sum payment. The Lima, Arizona Debt Settlement Offer in Response to Creditor's Proposal entails presenting a counter offer to your creditor's initial proposed settlement terms. This offer may include different options depending on your financial situation and the creditor's willingness to negotiate. Some common Lima Arizona Debt Settlement Offer options include: 1. Lump Sum Settlement Offer: This involves offering a one-time payment, usually for a significantly reduced amount, to satisfy the debt in full. This option can be particularly helpful if you have access to a lump sum of cash or if you have saved up funds specifically for debt settlement purposes. 2. Installment Plan: In some cases, creditors may be open to accepting a structured payment plan. You can propose monthly payments over a fixed period, usually at a reduced interest rate or without additional fees or penalties. An installment plan allows you to spread your payments over time, potentially making it more manageable for your financial situation. 3. Partial Settlement: If paying the full amount is not feasible, creditors may accept a partial settlement as a compromise. This involves offering a lump sum that is less than the total owed, with the understanding that it will be considered as payment in full. Be prepared for negotiations as creditors may counteroffer or request additional information before accepting. 4. Debt Reaffirmation: This option occurs when you negotiate with your creditor to reaffirm the debt but with modified terms. You might negotiate for a lower interest rate, smaller monthly payments, or a longer repayment period, making it more affordable and manageable in the long run. When considering a Lima, Arizona Debt Settlement Offer in Response to Creditor's Proposal, it is essential to understand the potential benefits and drawbacks. On the one hand, debt settlement can help you avoid bankruptcy and resolve your debts at a reduced amount. However, it may also have some adverse effects on your credit score and could involve a tax liability if the settled debt is considered taxable income. Before proceeding with any debt settlement offer, it is crucial to consult with a reputable debt settlement company or seek professional advice from a financial advisor or attorney experienced in debt negotiation. They can guide you through the process, assess your financial situation, and help craft a suitable Lima, Arizona Debt Settlement Offer in Response to Creditor's Proposal tailored to your specific needs. Remember to research and choose a trustworthy company or professional who has a track record of successfully negotiating debt settlements.

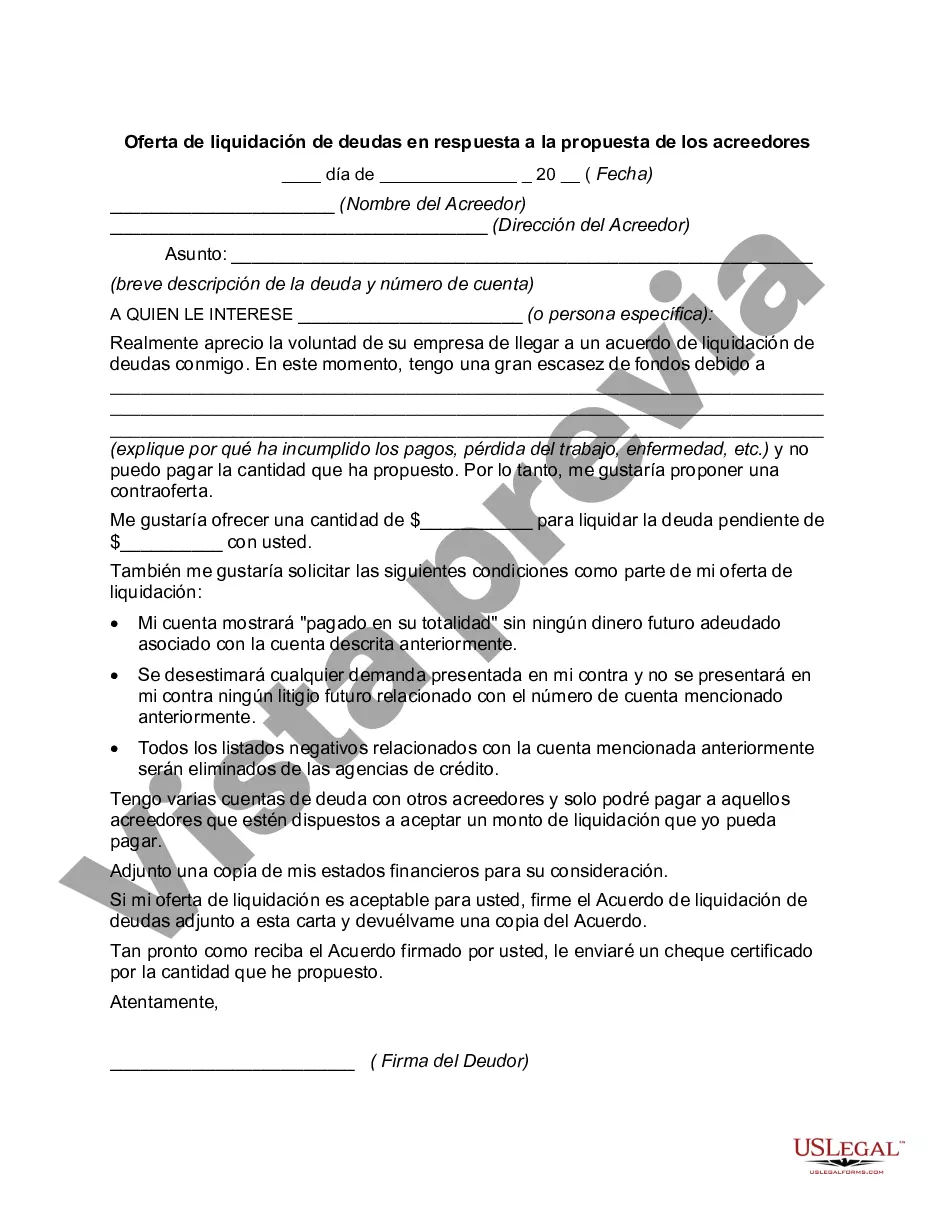

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Pima Arizona Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Pima Debt Settlement Offer in Response to Creditor's Proposal, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Pima Debt Settlement Offer in Response to Creditor's Proposal from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Pima Debt Settlement Offer in Response to Creditor's Proposal:

- Analyze the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!