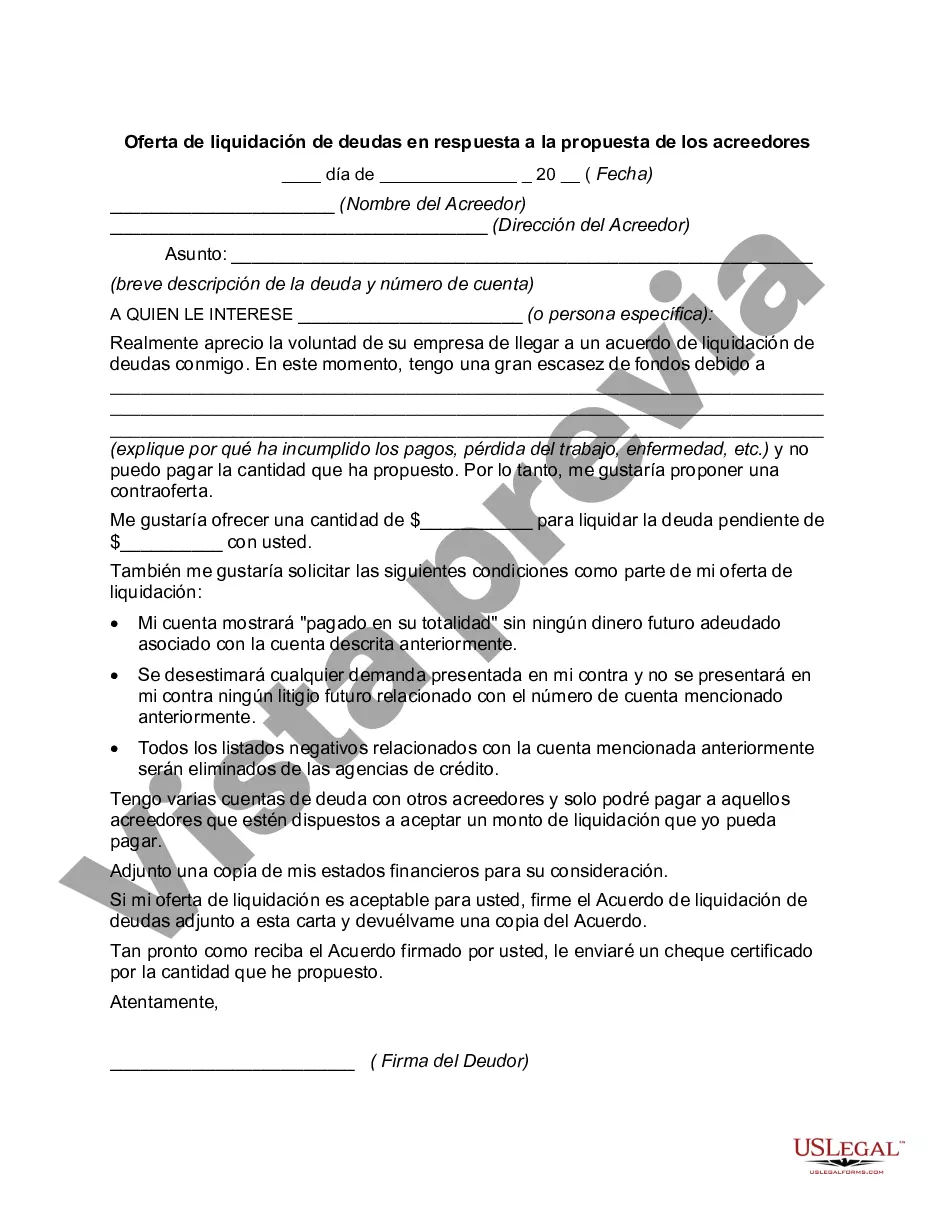

Queens New York Debt Settlement Offer in Response to Creditor's Proposal: Explained and Different Types Keywords: Queens New York, debt settlement offer, creditor's proposal, types Description: A debt settlement offer in response to a creditor's proposal is a negotiation strategy employed by individuals or businesses in Queens, New York, who are seeking to resolve their outstanding debts. This process involves making a formal proposal to the creditor, suggesting an alternative payment amount or terms that the debtor believes will be more manageable or affordable. If accepted, this offer provides an opportunity for individuals to potentially reduce their debt burden and establish a pathway towards financial stability. There are various types of Queens New York debt settlement offers in response to a creditor's proposal, each serving different purposes and catering to various financial situations. These include: 1. Lump-sum settlement offer: This type of offer involves proposing a one-time payment to the creditor, usually significantly lower than the total outstanding debt. Debtors who can afford to make a single substantial payment upfront often prefer this option to eliminate their debts quickly. 2. Installment-based settlement offer: Debtors who cannot afford to make a lump-sum payment may propose an installment-based settlement offer. This involves suggesting a structured payment plan where the debtor agrees to pay a fixed amount over a predetermined period, typically monthly, until the debt is satisfied. 3. Percentage-based settlement offer: In this type of settlement offer, the debtor proposes paying a certain percentage of the total outstanding debt. For example, they may offer to pay 50% of the debt while requesting the creditor to consider the remaining 50% as forgiven or settled. 4. Hardship-based settlement offer: This type of offer is designed for debtors experiencing severe financial hardship, such as job loss or medical emergencies. Debtors can present documentation and evidence of their financial struggles to demonstrate that they are unable to pay the full debt amount. They may propose a reduced payment amount based on their current financial limitations. 5. Specialty debt settlement offer: Some debtors may have unique circumstances that require a specialized debt settlement offer. This could include situations where the debtor is arguing the legality or validity of the debt, exploring options for debt consolidation, or seeking alternative arrangements such as debt restructuring or refinancing. It's important to note that the acceptance of a debt settlement offer is at the creditor's discretion. Creditors assess the debtor's financial situation, the legitimacy of the claims made, and their own risk before deciding whether to accept or counteroffer the proposed settlement. Seeking professional advice from debt settlement agencies or attorneys in Queens, New York, can provide guidance and improve the chances of a successful negotiation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Oferta de Liquidación de Deuda en Respuesta a la Propuesta del Acreedor - Debt Settlement Offer in Response to Creditor's Proposal

Description

How to fill out Queens New York Oferta De Liquidación De Deuda En Respuesta A La Propuesta Del Acreedor?

Do you need to quickly create a legally-binding Queens Debt Settlement Offer in Response to Creditor's Proposal or probably any other form to take control of your personal or business matters? You can select one of the two options: hire a legal advisor to draft a legal paper for you or create it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific form templates, including Queens Debt Settlement Offer in Response to Creditor's Proposal and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, double-check if the Queens Debt Settlement Offer in Response to Creditor's Proposal is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by using the search bar in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Queens Debt Settlement Offer in Response to Creditor's Proposal template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!