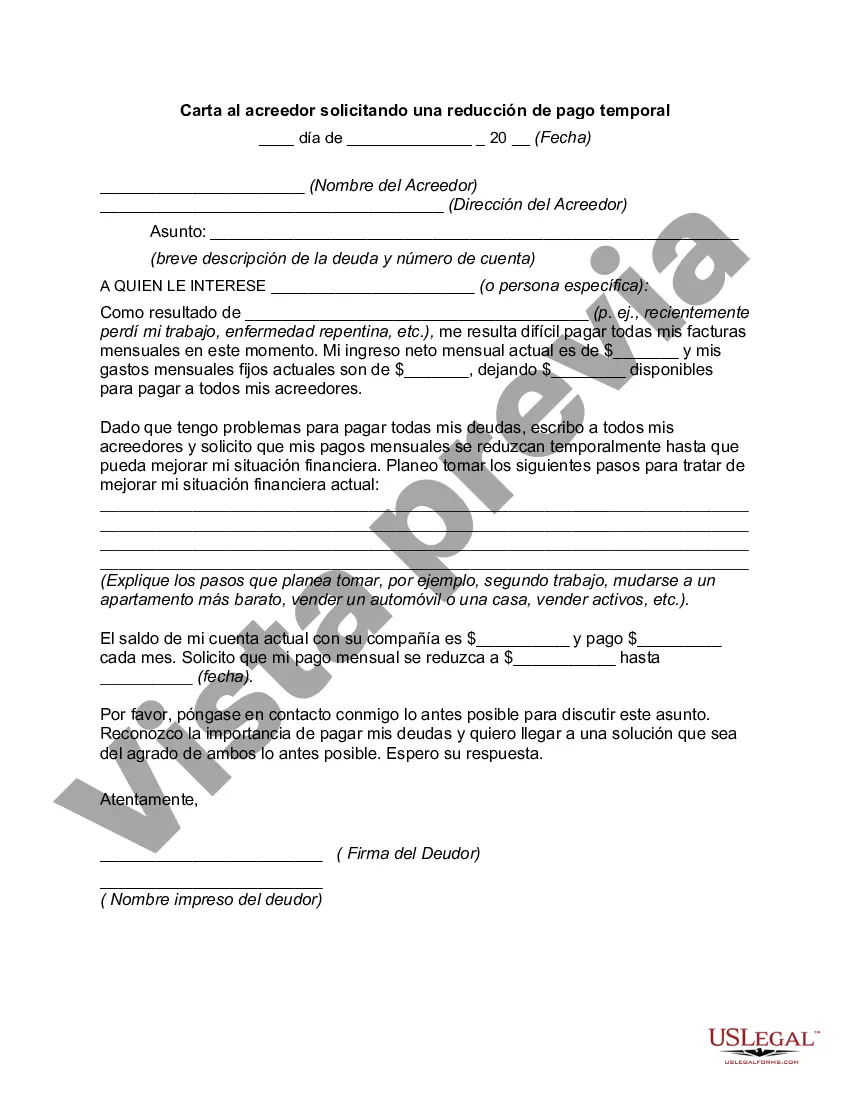

Cook Illinois is a renowned transportation company offering school bus services to various districts in the Illinois area. In certain circumstances, when facing financial difficulties, it may become necessary for Cook Illinois to request a temporary payment reduction from their creditors. This letter serves as a formal request to the creditor, outlining the reasons for the temporary payment reduction and providing supporting documentation if required. 1. Introduction: The letter begins with a polite and professional salutation, addressing the creditor by name or the appropriate department within the creditor's organization. The introduction should briefly explain the purpose of the letter, which is to request a temporary payment reduction. 2. Identification and Contact Information: Cook Illinois provides the necessary identification and contact information, including the company's name, address, and phone number. This information helps the creditor easily reference the account in question. 3. Account Information: Cook Illinois specifies the relevant account details, such as account numbers, outstanding balances, and payment due dates. This information enables the creditor to quickly locate and assess the account. 4. Explanation of Financial Difficulties: Cook Illinois provides a comprehensive explanation of the financial difficulties that necessitate a temporary payment reduction. This explanation may include reasons such as a decrease in revenue, unexpected expenses, or economic downturns affecting the transportation industry. 5. Supporting Documents: If available, Cook Illinois may attach supporting documents to further validate their financial situation. This can include financial statements, bank statements, income reports, or any other relevant documentation that demonstrates the challenges faced by the company. 6. Request for Temporary Payment Reduction: Cook Illinois makes a clear and concise request for a temporary payment reduction. They should specify the desired reduction, whether it is a percentage or a specific payment amount, and the proposed duration of the temporary reduction. 7. Assurances of Future Payments: To assure the creditor, Cook Illinois emphasizes that the temporary payment reduction is a temporary measure and that they intend to resume regular payments as soon as financially possible. They may outline a proposed plan for future payments, such as increased payments or extended terms, to demonstrate their commitment to honoring the debt. It is important to note that there may be variations of Cook Illinois letters to creditors requesting a temporary payment reduction based on individual circumstances. These variations may involve additional information, such as a repayment plan proposal, financial hardship details, or specific legal provisions. The description above outlines the general content relevant to this type of letter, which can be tailored and customized to suit specific requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ovorion Junta De Andalucia - Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Cook Illinois Carta Al Acreedor Solicitando Una Reducción De Pago Temporal?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Cook Letter to Creditor Requesting a Temporary Payment Reduction, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed materials and tutorials on the website to make any activities associated with document completion straightforward.

Here's how you can locate and download Cook Letter to Creditor Requesting a Temporary Payment Reduction.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the validity of some records.

- Examine the similar forms or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Cook Letter to Creditor Requesting a Temporary Payment Reduction.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Cook Letter to Creditor Requesting a Temporary Payment Reduction, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you have to cope with an exceptionally complicated situation, we recommend getting an attorney to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific paperwork effortlessly!