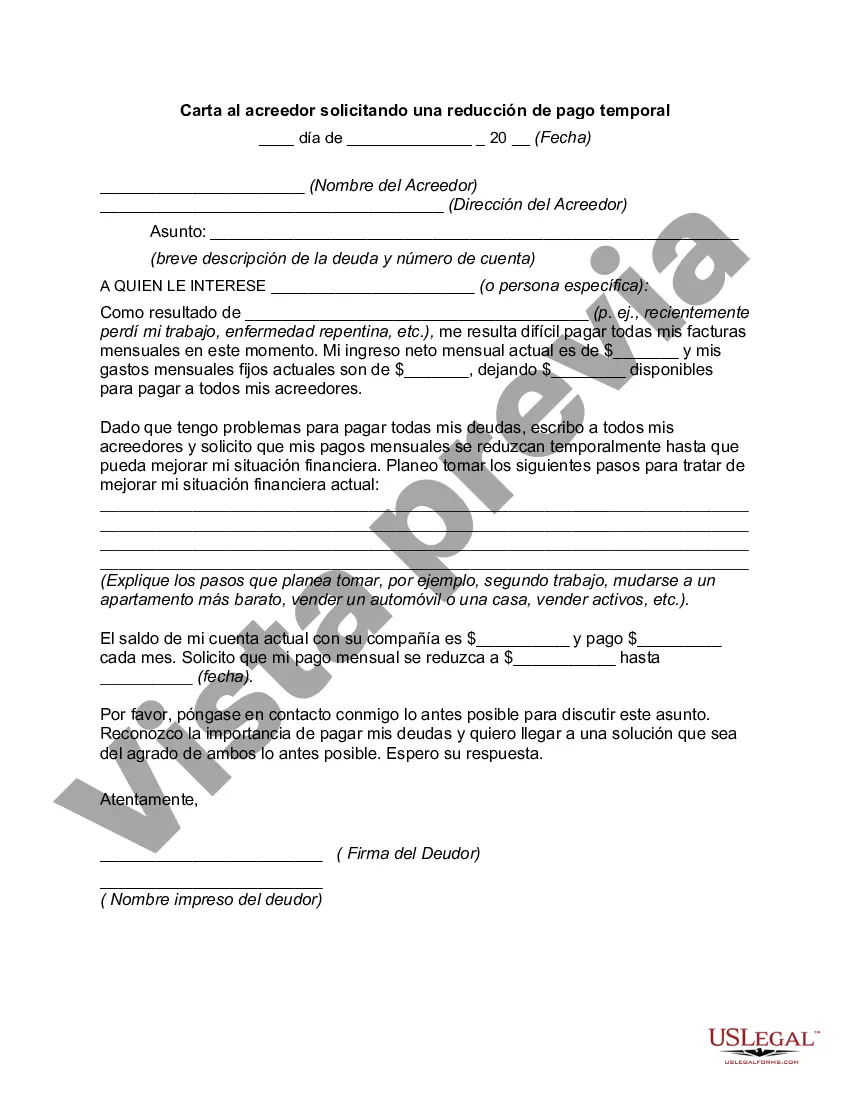

Oakland, Michigan, is a vibrant and diverse city located in Oakland County. Known for its rich history, beautiful neighborhoods, and thriving community, Oakland offers a variety of attractions and opportunities for its residents. When facing financial difficulties, it may become necessary to seek temporary payment reductions from creditors to ease the burden. One effective way to address this issue is by writing a well-crafted Oakland, Michigan, letter to a creditor requesting a temporary payment reduction. Such a letter should be concise and professional, clearly explaining the reasons for seeking temporary relief while addressing the creditor by name. It is important to demonstrate respect and open communication throughout the letter. To start, include relevant information such as your full name, contact details, and account number. Briefly explain the current financial situation that has prompted the need for a temporary payment reduction. Be honest and transparent about any hardships, such as a loss of income, unexpected medical expenses, or a sudden financial emergency. Express your commitment to meeting financial obligations in the long term and emphasize that the temporary reduction is only sought as a means to get through a challenging period. Offer a realistic proposal for the reduced payment amount, indicating how it will enable you to manage your expenses without defaulting on the debt. It may be helpful to include a detailed breakdown of your current income and expenses to support your request. If applicable, mention any past positive payment history, highlighting your efforts to fulfill your obligations. Enlist any available financial aid or assistance programs that could contribute to your financial stability, if applicable. Express openness to discussing alternative options or negotiating a revised payment plan that better aligns with your present circumstances. It is crucial to conclude the letter by expressing gratitude for the creditor's understanding and cooperation throughout this process. Reiterate your willingness to provide any additional documentation or information required to support your request. Different types of Oakland, Michigan, letters to creditors requesting temporary payment reductions may vary based on the specific financial circumstances individuals or businesses find themselves in. Examples may include: 1. Oakland, Michigan, Letter to Mortgage Lender Requesting a Temporary Payment Reduction: This letter specifically targets mortgage lenders and addresses the need for temporary relief in mortgage payments due to unforeseen financial setbacks. 2. Oakland, Michigan, Letter to Auto Loan Creditor Requesting a Temporary Payment Reduction: Designed for individuals struggling with auto loan payments, this letter seeks temporary relief to avoid repossession or collection actions. 3. Oakland, Michigan, Letter to Credit Card Company Requesting a Temporary Payment Reduction: Targeting credit card companies, this letter aims to negotiate a temporary reduction in minimum payments to alleviate financial strain temporarily. Overall, an Oakland, Michigan, letter to a creditor requesting a temporary payment reduction should be sincere, well-structured, and persuasive, aiming to establish open lines of communication and find mutually beneficial solutions during challenging times.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Carta al acreedor solicitando una reducción de pago temporal - Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Oakland Michigan Carta Al Acreedor Solicitando Una Reducción De Pago Temporal?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Oakland Letter to Creditor Requesting a Temporary Payment Reduction, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Oakland Letter to Creditor Requesting a Temporary Payment Reduction from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Oakland Letter to Creditor Requesting a Temporary Payment Reduction:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!