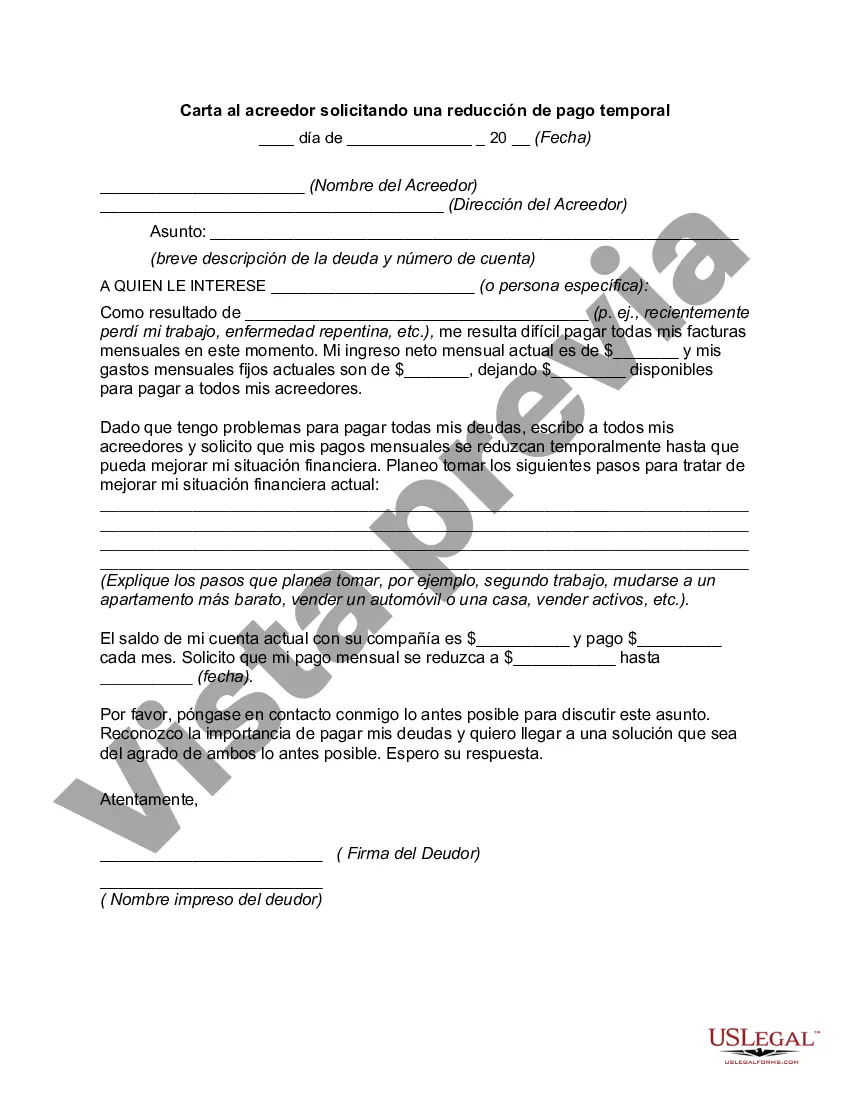

Travis Texas Letter to Creditor Requesting a Temporary Payment Reduction, also known as a hardship letter, is a formal document written by individuals residing in Travis County, Texas, who are facing financial difficulties and are unable to meet their regular payment obligations. This letter serves as a request to the creditor to temporarily reduce the amount of payment due. When drafting a Travis Texas Letter to Creditor Requesting a Temporary Payment Reduction, it is crucial to include specific keywords and elements to ensure its effectiveness. Some of these important keywords and elements include: 1. Introduction: Begin the letter with a formal salutation, such as "Dear [Creditor's Name]." Identify yourself as the debtor and provide your account or loan number to help the creditor identify your specific situation. 2. Explanation of Financial Hardship: Clearly state the reasons for your financial hardship, such as a sudden job loss, reduction in income, medical emergency, or other significant life events that have affected your ability to make regular payments. It is important to provide detailed and honest information to support your case. 3. Current Financial Situation: Provide an overview of your current financial situation, including your income, expenses, and any other financial obligations you must fulfill. This will help the creditor understand the extent of your financial difficulties. 4. Request for Temporary Payment Reduction: Clearly state your request to the creditor, asking for a temporary reduction in your monthly payment obligations. Specify the desired reduction amount or suggest an alternative payment plan that is more manageable for you. 5. Explanation of Repayment Strategy: Outline your proposed plan for repaying the outstanding debt after the temporary payment reduction period ends. It is essential to assure the creditor that you are committed to fulfilling your obligations once your financial situation improves. 6. Supporting Documents: Attach relevant supporting documents to validate your financial hardship, such as pay stubs, medical reports, termination notices, or any other financial statements that demonstrate your limited capacity to meet the payment obligations. 7. Contact Information: Provide your up-to-date contact information, including your phone number, email address, and mailing address. This will help the creditor to communicate with you regarding their decision or any further requirements. Other types of Travis Texas Letter to Creditor Requesting a Temporary Payment Reduction may include: 1. Mortgage Payment Reduction Request: Specifically addresses mortgage lenders or services, seeking temporary relief for mortgage payments. 2. Credit Card Payment Reduction Request: Aimed at credit card companies, requesting a temporary reduction in credit card monthly payments. 3. Auto Loan Payment Reduction Request: Targeting auto lenders, asking for a temporary reduction in monthly auto loan payments. Remember, it is crucial to personalize the letter according to your unique financial situation and creditor. Clearly state your need for temporary payment reduction, provide supporting evidence, and express your commitment to meet your obligations once circumstances improve.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Carta al acreedor solicitando una reducción de pago temporal - Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Travis Texas Carta Al Acreedor Solicitando Una Reducción De Pago Temporal?

If you need to get a reliable legal document supplier to get the Travis Letter to Creditor Requesting a Temporary Payment Reduction, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to get and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Travis Letter to Creditor Requesting a Temporary Payment Reduction, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Travis Letter to Creditor Requesting a Temporary Payment Reduction template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate agreement, or execute the Travis Letter to Creditor Requesting a Temporary Payment Reduction - all from the convenience of your sofa.

Join US Legal Forms now!