Title: Understanding Chicago, Illinois: The Windy City's Vibrant Charm Introduction: Chicago, Illinois, also known as the Windy City, is a captivating metropolis located in the heart of the Midwest. Renowned for its architectural marvels, cultural diversity, world-class museums, and iconic landmarks, Chicago draws in millions of visitors each year. This letter serves as a guide to explore the different facets of this enchanting city while addressing the specific topic of a letter to a creditor confirming an agreement to temporarily postpone monthly payments. Types of Chicago, Illinois Letter to Creditor Confirming Agreements: 1. Chicago, Illinois Letter to Creditor Confirming Agreement Due to COVID-19: In light of the unprecedented COVID-19 pandemic, financial hardships have affected many individuals in the city. This particular type of letter addresses the specific circumstances related to the pandemic, such as job loss, decreased income, or medical expenses. It requests temporary postponement of monthly payments and outlines the agreed-upon terms until the situation stabilizes. 2. Chicago, Illinois Letter to Creditor Confirming Agreement During Economic Downturn: During economic downturns, such as recessions or financial crises, individuals may face challenges paying their debts promptly. This type of letter emphasizes the economic climate and its impact on personal financial stability. It seeks the creditor's understanding and requests a temporary postponement of monthly payments until the economic situation improves. 3. Chicago, Illinois Letter to Creditor Confirming Agreement Due to Personal Crisis: Personal crises, such as unexpected medical emergencies, natural disasters, or unforeseen family situations, can lead to financial strain. This letter highlights the unique circumstances affecting the debtor's ability to fulfill their financial commitments. It presents a request to temporarily postpone monthly payments, from a compassionate perspective, until the crisis is resolved. Content Body: [Begin the letter with a polite salutation to the creditor] 1. Introduce Yourself and Describe the Circumstances: Provide your full name, address, creditor's name, and account details to establish formal communication. Clearly explain the current situation causing financial hardship, ensuring that the creditor understands the challenges faced. 2. Explain the Impact on Finances: Elaborate on how the aforementioned circumstances have negatively impacted your financial stability, making it difficult to meet the monthly payment obligations. Emphasize the importance of finding temporary relief while presenting any supporting documentation that validates your claims, such as medical bills, termination letters, or unemployment documentation. 3. Express Gratitude and Willingness to Cooperate: Express your gratitude for the creditor's previous support and understanding. Highlight your intention and determination to honor your financial obligations once the temporary postponement period concludes. Assure them that this request is made in good faith and with a sincere commitment to resolving the situation swiftly. 4. Propose Temporary Postponement Agreement: Specify the duration for which you seek to temporarily postpone the monthly payments. Suggest a realistic and moderate timeframe, aligning with your personal circumstances. Additionally, propose alternative repayment options, such as extending the loan tenure or monthly payment amount adjustment, if applicable and agreeable to both parties. 5. Request Written Confirmation: Conclude the letter by requesting written confirmation from the creditor of their acceptance and understanding of the agreement. Include your contact information and express willingness to discuss the matter further or provide any additional supporting documents if required. [End the letter with a courteous closing and your full name] Conclusion: A Chicago, Illinois Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed is an essential tool for individuals facing financial challenges in the vibrant city of Chicago. By tailoring the letter to address specific circumstances such as COVID-19, economic downturns, or personal crises, individuals can navigate their financial obligations with transparency, seeking temporary relief while maintaining good faith with their creditors.

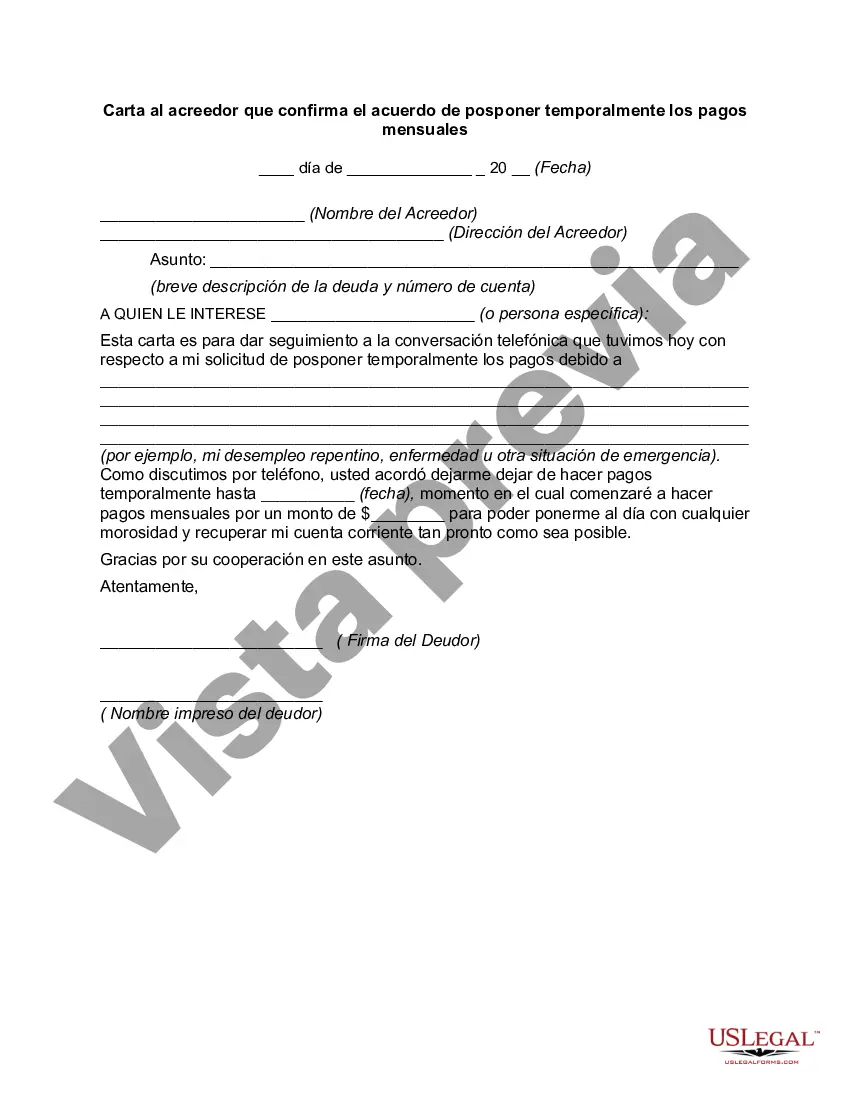

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Chicago Illinois Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

Do you need to quickly create a legally-binding Chicago Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed or probably any other form to manage your personal or business matters? You can go with two options: contact a legal advisor to draft a legal paper for you or create it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Chicago Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, double-check if the Chicago Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's intended for.

- Start the searching process again if the form isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Chicago Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!