Title: Nassau, New York Letter to Creditor Confirming Agreement to Temporarily Postpone Monthly Payments Keywords: Nassau, New York, letter, creditor, agreement, confirm, temporarily, postpone, monthly payments Introduction: In Nassau, New York, individuals who are experiencing temporary financial difficulties may need to correspond with their creditors to request a temporary postponement of monthly payments. This letter is an essential communication tool to confirm the agreement reached with the creditor and ensure both parties are clear about the terms and conditions. Different types of correspondence can be categorized by the specific situation, such as hardship letters, forbearance requests, or deferment agreements. The following article dives into the details of a Nassau, New York Letter to Creditor Confirming Agreement to Temporarily Postpone Monthly Payments. Content: 1. Importance of a Nassau, New York Letter to Creditor Confirming Agreement: — Explaining the significance of a written confirmation to document the agreement between the debtor and the creditor. — Emphasizing the role of this letter as legal evidence to avoid potential misunderstandings or disputes in the future. — Elaborating on how it helps maintain transparency and trust between the parties involved. 2. Components of the Letter: — A salutation and proper identification of the creditor and debtor. — A clear and concise statement requesting a temporary postponement of monthly payments. — Mentioning the reason for the financial hardship and providing supporting documentation, if required. — Proposing the duration of the temporary postponement, ensuring it is realistic and manageable for both parties. — Suggesting alternative payment arrangements, such as an extended loan term or increased monthly payments after the agreed-upon postponement period. — Acknowledging any accrued interest during the postponement period and discussing the repayment plan. — Expressing gratitude for the creditor's understanding and cooperation. — Closing the letter professionally with the debtor's signature and contact information. 3. Types of Nassau, New York Letters to Creditor Confirming Agreement: a) Hardship Letter: — Details the debtor's financial hardships, such as job loss, medical emergencies, or unforeseen expenses. — Demonstrates the debtor's willingness and commitment to fulfilling their financial obligations once the temporary postponement ends. b) Forbearance Request: — Requests the creditor's consideration in temporarily suspending or reducing monthly payments due to financial constraints. — Discusses the debtor's ability to adhere to a revised payment plan after the forbearance period. c) Deferment Agreement: — A voluntary agreement between the debtor and the creditor to postpone monthly payments for a specific period due to extraordinary circumstances. — Outlines the terms of the deferment, including any applicable interest charges and revised repayment plans. Conclusion: When experiencing financial difficulties, the appropriate and effective way to request a temporary postponement of monthly payments from a creditor in Nassau, New York is through a well-crafted letter. By confirming the mutual agreement in writing, debtors can protect their interests and maintain a positive relationship with creditors. Understanding the different types of Nassau, New York Letters to Creditor Confirming Agreements provides guidance and helps debtors choose the most appropriate approach for their specific circumstances. Remember to customize the content of the letter to reflect your unique situation, adding any necessary supporting documentation and contacting legal or financial advisors, if required.

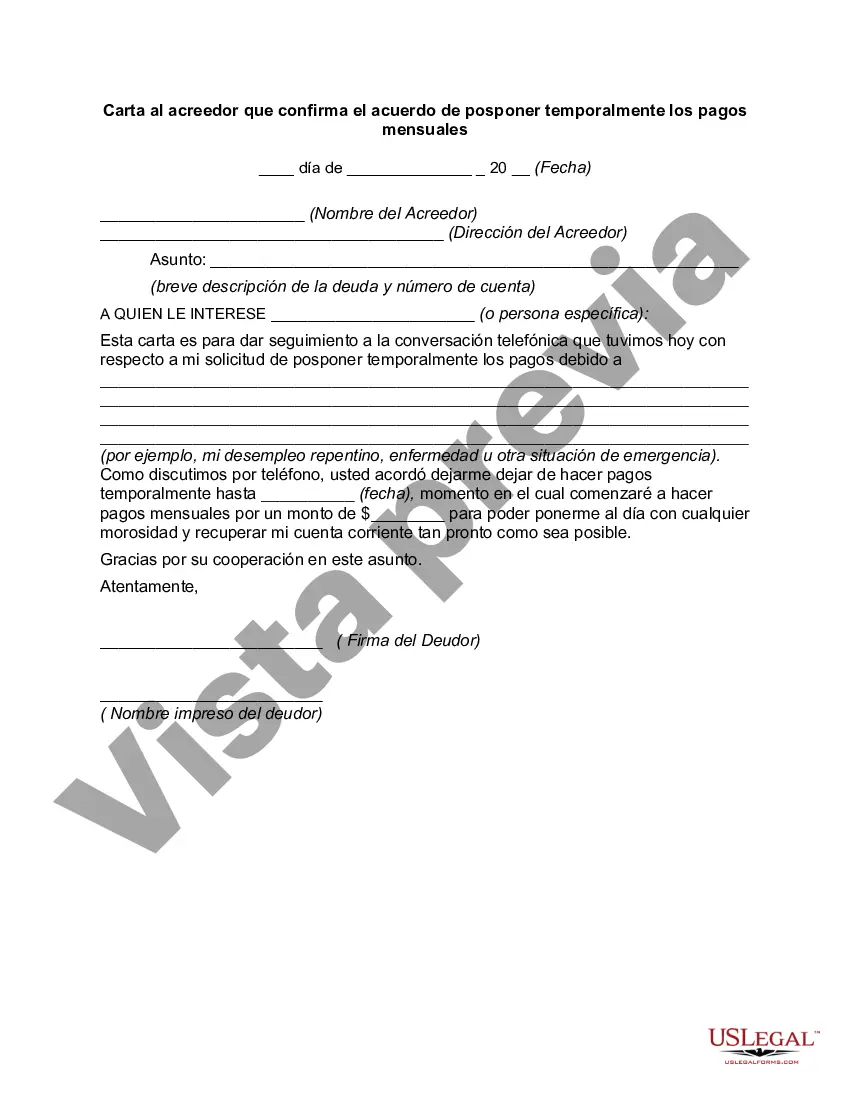

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Nassau New York Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Nassau Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Nassau Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Nassau Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed:

- Make sure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Nassau Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!