Wake North Carolina Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed: A Comprehensive Guide Introduction: A Wake North Carolina Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed is a written correspondence sent by a debtor residing in Wake, North Carolina, to their creditor, acknowledging an agreed-upon arrangement to suspend or delay monthly payments temporarily. This type of letter is vital for individuals facing financial hardships or unexpected circumstances that hinder their ability to meet their monetary obligations promptly. By using this letter, debtors can request a temporary suspension of monthly payments while ensuring transparency and maintaining a respectful relationship with their creditors. Below, you will find a detailed description of the essential components, guidelines, and potential variations of a Wake North Carolina Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Key Components of the Letter: 1. Sender's Information: The letter should begin by providing the debtor's full name, current address, phone number, and email address. This information ensures that the creditor can easily identify and contact the debtor when necessary. 2. Creditor's Information: Next, the debtor should include the creditor's name, mailing address, and any specific contact person assigned to their account. This information helps streamline communication and ensures that the letter reaches the intended recipient. 3. Date: Including the date at the beginning of the letter is important for record keeping purposes and establishes a timeline for the agreement. 4. Formal Salutation: Begin the letter with an appropriate salutation, such as "Dear [Creditor's Name]," or "To Whom It May Concern." 5. Explanation of Financial Situation: Clearly articulate the reasons for the temporary postponement of monthly payments. Describe any unexpected events, financial hardships, or personal circumstances that have led to the inability to honor the original payment arrangement. 6. Request for Temporary Postponement: State the desired duration for suspending the monthly payments and explain why this period is necessary. It is important to propose a realistic and reasonable timeframe that meets the debtor's needs and allows for a potential resolution. 7. Offer of Good Faith: Assure the creditor that despite the delay in payments, the debtor is committed to fulfilling their financial obligations in due course. Highlight any steps taken to mitigate the situation or alternative payment arrangements that can be agreed upon during the temporary suspension period. 8. Acknowledgment of Late Fees or Interest: If applicable, acknowledge the potential accrual of late fees, penalties, or interests during the temporary postponement. Address the intention to address these additional costs promptly once the regular payments resume. 9. Request for Written Confirmation: Politely ask the creditor to provide written confirmation of the agreed-upon payment postponement. This ensures both parties have a documented understanding and helps prevent any misunderstandings in the future. 10. Gratitude and Closing: Convey sincere gratitude to the creditor for their understanding, flexibility, and cooperation during this challenging situation. End the letter with a formal closing, such as "Yours sincerely" or "Respectfully," followed by the debtor's full name and signature. Potential Variations: — Wake North Carolina Letter to Mortgage Lender Confirming Agreement that Monthly Payments be Temporarily Postponed — Wake North Carolina Letter to Credit Card Company Confirming Agreement that Monthly Payments be Temporarily Postponed — Wake North Carolina Letter to Auto Loan Provider Confirming Agreement that Monthly Payments be Temporarily Postponed — Wake North Carolina Letter to Medical Service Provider Confirming Agreement that Monthly Payments be Temporarily Postponed In each case, the basic structure and content of the letter remain similar, but the specific creditor and debt details may vary. It is essential to tailor the letter accordingly to address each unique creditor and their specific agreement terms. Keywords: Wake North Carolina, Letter to Creditor, Confirming Agreement, Monthly Payments, Temporarily Postponed, financial hardships, unexpected circumstances, debtor, creditor, suspension of payments, written correspondence, financial obligations, formal salutation, offer of good faith, acknowledgment of additional costs, written confirmation.

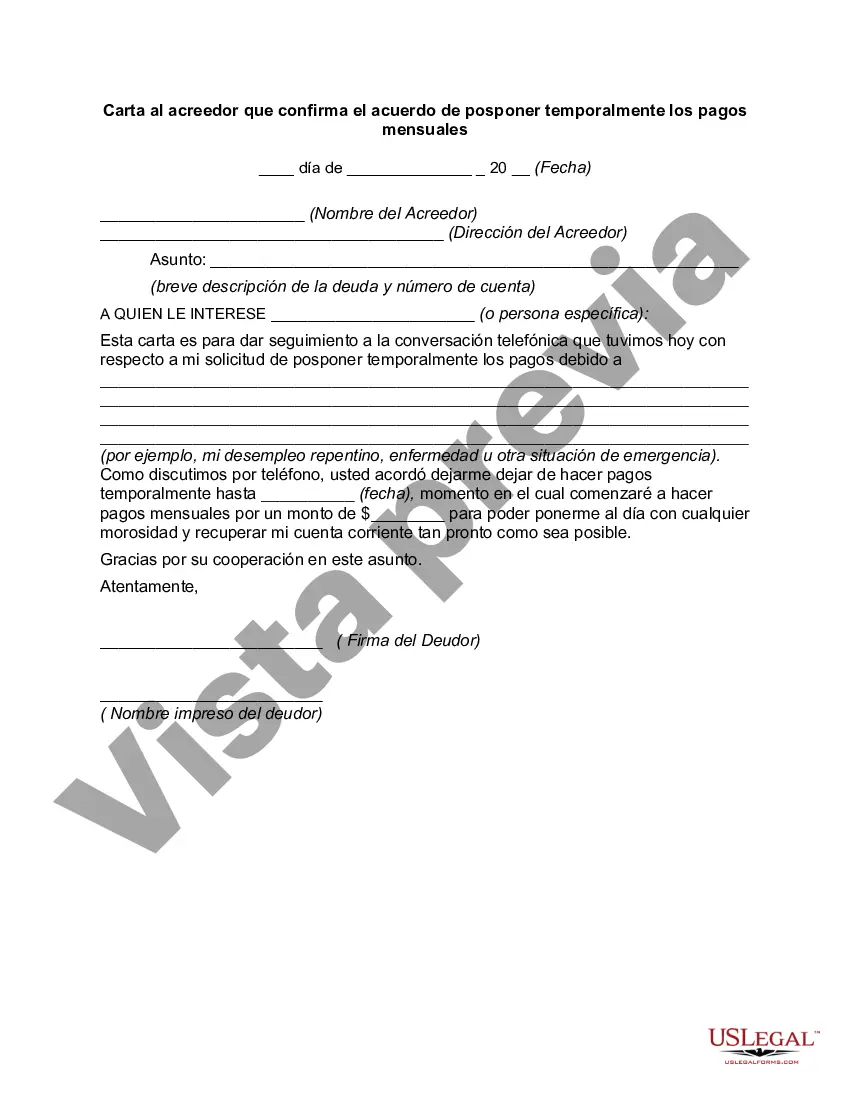

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Wake North Carolina Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

Whether you intend to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Wake Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to obtain the Wake Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wake Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!