Title: Alameda, California: Requesting a Lower Interest Rate — A Letter from a Debtor to a Credit Card Company Introduction: When looking to manage our finances effectively, it may become necessary to reach out to credit card companies and negotiate a lower interest rate for a specific time frame. This article delves into the various types of letters that debtors in Alameda, California, can write to their credit card companies, seeking a reduced interest rate temporarily. These letters provide an opportunity for debtors to express their financial hardships and present a compelling case for a lower interest rate, ultimately helping them regain control over their debts. 1. Alameda California Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate due to Financial Hardship: This type of letter outlines the debtor's specific financial constraints and describes the difficulties they face in managing their credit card payments. Debtors can emphasize their efforts to meet their financial obligations and request the credit card company's assistance by granting a lower interest rate. By highlighting their willingness to resolve their debts, debtors make a strong case for temporary relief. 2. Alameda California Letter from Debtor to Credit Card Company Requesting a Promotional Interest Rate: In this letter, debtors in Alameda, California, highlight their loyalty to the credit card company and inquire about any promotional interest rates currently available. This type of letter often explains the debtor's good payment history and reliable behavior, which may persuade the credit card company to provide a lower interest rate for a specific promotional period, helping the debtor save money on interest charges. 3. Alameda California Letter from Debt Consolidation Agency to Credit Card Company Requesting a Lower Interest Rate for Clients: Debt consolidation agencies operating in Alameda, California, can compose letters requesting a reduced interest rate on behalf of their clients. These letters often outline the debtor's financial situation, consolidation efforts, and willingness to renegotiate the terms. By acting as mediators between the debtor and the credit card company, these letters aim to facilitate a mutually beneficial agreement for both parties. Conclusion: Writing a well-crafted letter to a credit card company in Alameda, California, seeking a lower interest rate can provide debtors with an effective way to manage their debts. By utilizing one of the aforementioned letter formats, debtors demonstrate their determination to address their financial challenges while seeking assistance from their credit card providers. Writing a personalized and persuasive letter can increase the likelihood of obtaining a temporary lower interest rate, ultimately helping debtors regain control of their financial situations.

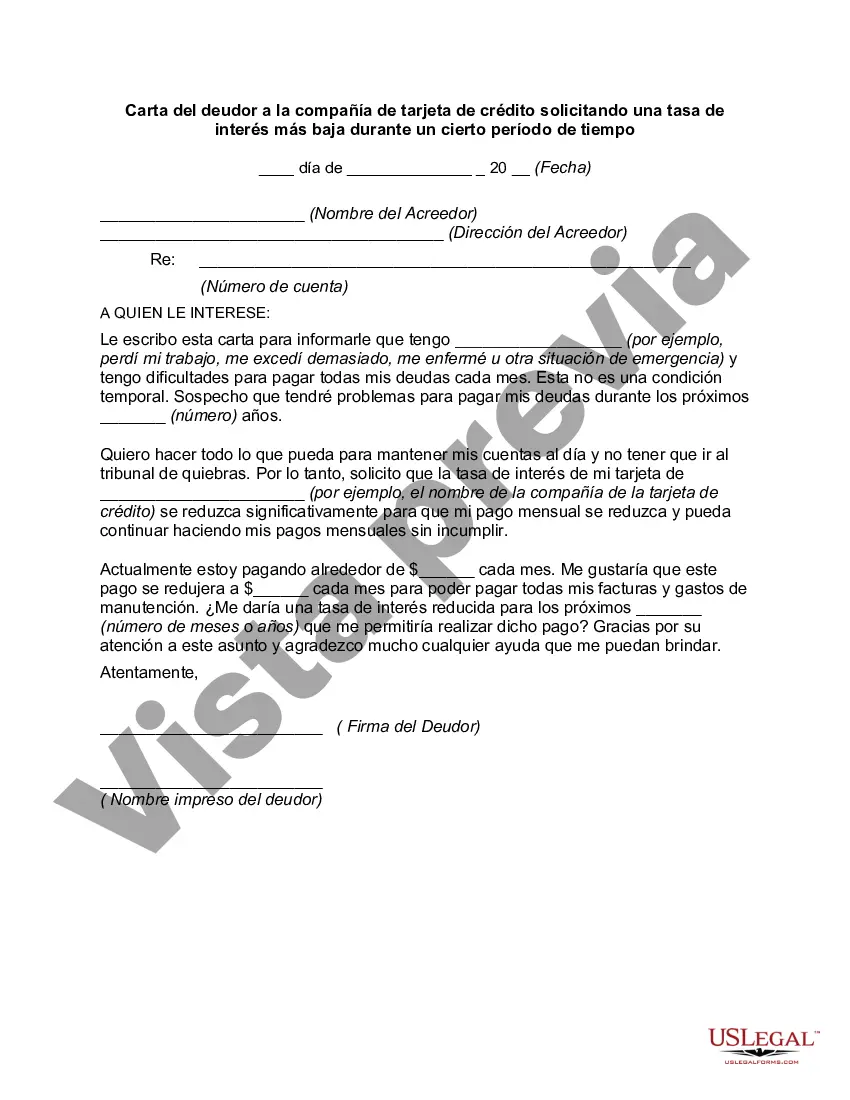

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Alameda California Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

Do you need to quickly draft a legally-binding Alameda Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time or probably any other form to manage your own or corporate matters? You can go with two options: contact a legal advisor to draft a valid paper for you or draft it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant form templates, including Alameda Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the Alameda Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Alameda Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the documents we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Si pagas antes de tu fecha de corte, es menor la cantidad que utiliza el banco para calcular cuantos intereses debes pagar. Es decir, estas ahorrandote intereses que hubieses pagado despues de la fecha de corte. Mejor aun si pagas tu deuda en su totalidad, en ese caso no hay intereses que pagar en absoluto.

Si puedes realizar tu pago anticipadamente, esto no te genera ningun problema. El pago realizado se reflejara en el saldo de tu tarjeta de credito.

¿Que pasa si no se paga a tiempo la tarjeta de credito? El no pagar tu tarjeta de credito trae consecuencias a corto plazo, como la inhabilitacion de esta y el cobro de intereses, y tambien puede traer repercusiones a largo plazo en tu vida financiera, que pueden perjudicarte a la hora de pedir un prestamo personal.

No pagar o no pagar a tiempo una tarjeta de credito genera comisiones, por las que los clientes pueden pagar desde 100 y hasta 900 pesos, esto incluyendo otros cargos, informo la Comision Nacional para la Proteccion y Defensa de los Usuarios de Servicios Financieros (Condusef).

La forma ideal de manejar una tarjeta de credito es que pagues antes de la fecha limite de pago la totalidad de lo usado, de forma que no incurras en intereses por el financiamiento del dinero.

Si no pudiste pagar tu tarjeta de credito durante el cierre y el vencimiento, despues de hasta cinco dias corridos sin recibir el pago minimo, la tarjeta de credito se inhibira y no podra ser utilizada hasta el momento de recibir el pago.

¿Que pasa si pagas antes? Lo primero que cambiaran seran los intereses que se calculan con base al Saldo Promedio Diario. Esto quiere decir que si pagas una parte proporcional pero no el total de tu cuenta, cuando llegue tu fecha de corte, el monto de los intereses disminuira significativamente.

No pagar tu tarjeta implicara que haya un reporte negativo en Buro de Credito, el cual afectara tu reputacion financiera no solo frente al banco con el que tienes la deuda, sino ante cualquier banco o institucion que consulte tu historial crediticio en caso de que en algun momento en el futuro solicites un credito de

Modelo de carta para dar de baja la tarjeta de credito En mi caracter de titular de tarjeta de credito xxx GOLD: Numero de cuenta: xxxCUIT: xxx, vengo por la presente a solicitar de modo fehaciente LA NO RENOVACION DE LA TARJETA DE CREDITO 2026 mencionada y por ende darla de baja en forma inmediata.

Cuando una persona realiza un pago adelantado, tiene la opcion de que este pago adicional aplique solo al capital de su deuda (y no intereses), de manera que al reducirse el capital, tambien bajen los intereses totales a pagar. Esta operacion se denomina 'pago anticipado' (antes llamado prepago).