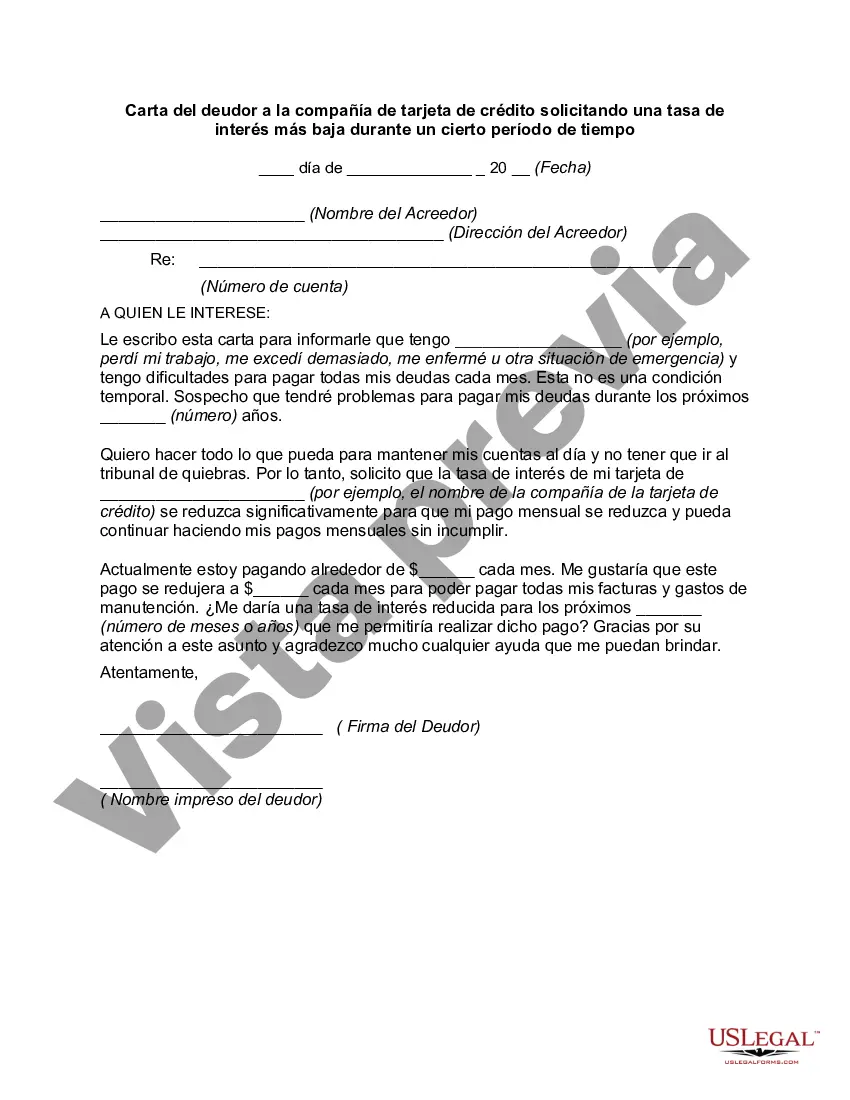

Title: Chicago, Illinois — Requesting a Lower Interest Rate: A Letter from a Debtor to a Credit Card Company Keywords: Chicago Illinois, letter, debtor, credit card company, lower interest rate, certain period of time Introduction: Welcome to the vibrant city of Chicago, Illinois! In this detailed description, we will explore a specific topic concerning debt management within the context of Chicago, focusing on a letter from a debtor to a credit card company. We will delve into the importance of requesting a lower interest rate for a certain period of time, offering insights into its benefits and steps to compose an effective letter. Types of Chicago, Illinois Letters from Debtors to Credit Card Companies Requesting a Lower Interest Rate for a Certain Period of Time: 1. Formal Request: This type of letter is typically structured in a formal manner, adhering to proper business letter-writing etiquette. It is designed to convey a professional and serious tone, aiming to establish a constructive dialog with the credit card company. 2. Persuasive Appeal: Employing persuasive language and a compelling argument, this type of letter seeks to convince the credit card company to grant the debtor a lower interest rate temporarily. It may include personal experiences, financial hardships, or other relevant factors contributing to the request's validity. 3. Negotiation Proposal: A negotiation-oriented letter aims to propose a mutually beneficial agreement between the debtor and the credit card company. It provides alternative solutions, such as suggesting an extended payment plan or a reduced interest rate for a specific duration, emphasizing how this would benefit both parties involved. Content Structure for a Letter Requesting a Lower Interest Rate: 1. Heading: Include your contact information (name, address, phone number, and email), followed by the credit card company's details (name, address, and customer service phone number). 2. Salutation: Address the recipient professionally, using appropriate titles (e.g., "Dear Customer Service Representative" or "To Whom It May Concern"). 3. Introductory Paragraph: State your purpose clearly and concisely. Express your appreciation for being a customer and highlight the length of your relationship with the company. 4. Background and Reasoning: Provide factual details about your current financial situation, such as income, expenses, and any extenuating circumstances. Explain the reasons necessitating a lower interest rate to ensure timely payment and demonstrate your commitment to resolving the debt responsibly. 5. Supporting Documentation: Attach relevant documentation supporting your claims, such as pay stubs, medical bills, or any official correspondences. Ensure copies are provided while retaining the originals. 6. Request and Proposed Terms: Articulate your preferred terms for the lower interest rate, including the desired interest rate reduction percentage and the duration of the temporary adjustment. Emphasize how this arrangement will enable you to make consistent payments. 7. Conclusion: Close the letter courteously, expressing gratitude for their consideration and willingness to work together to find a suitable resolution. 8. Formal Closing: End the letter formally, utilizing professional closings such as "Yours sincerely" or "Respectfully." 9. Signature: Sign your name above your typed name, indicating your awareness and agreement to the content of the letter. 10. Enclosure: If applicable, list the enclosed documents to ensure nothing is overlooked. Conclusion: By crafting a well-structured and persuasive letter to your credit card company, you can effectively request a lower interest rate for a specific time frame. Remember to tailor the content to your personal circumstances, while maintaining professionalism throughout the letter. As a Chicago, Illinois resident, it is crucial to proactively manage your finances and seek mutually beneficial agreements, enhancing your own financial well-being and strengthening your relationship with the credit card company.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Chicago Illinois Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Chicago Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Chicago Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Chicago Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!