Title: A Comprehensive Guide to Writing a Collin, Texas Letter from a Debtor to Their Credit Card Company Requesting a Temporary Lower Interest Rate Introduction: In Collin, Texas, just like any other place, many individuals face financial challenges and seek ways to manage their debt effectively. One possible solution for credit card debtors is to draft a well-written letter to their credit card company, requesting a temporary lower interest rate. By doing so, they can significantly reduce their financial burden over a certain period of time. In this article, we will explore the different types of letters that debtors in Collin, Texas, can write to their credit card companies and provide a detailed guide on how to craft an effective one. 1. Standard Collin, Texas Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate: This type of letter is the most common and straightforward. It consists of a formal request from the debtor to the credit card company, explaining the reasons for seeking a temporary reduction in the interest rate. Debtors should explain any financial hardships they are facing, present evidence of their ability to make payments, and propose a specific time frame for the requested lower rate. 2. Collin, Texas Letter from Debtor to Credit Card Company Seeking Relief during Personal Crisis: In cases where a debtor is experiencing an unexpected personal crisis such as a major health issue, family emergency, or loss of employment, this type of letter emphasizes the urgency of the need for a temporary lower interest rate. The debtor can describe their situation in detail, highlight any temporary difficulties they are facing, and clearly express the desire to maintain a good credit history. 3. Collin, Texas Letter from Debtor to Credit Card Company Requesting a Lower Rate Based on Improved Creditworthiness: Sometimes debtors in Collin, Texas have made significant improvements in their financial circumstances, such as increased income or improved credit scores. In such cases, this type of letter can focus on demonstrating these positive changes. Debtors should provide supporting documents, such as pay stubs, tax forms, or credit reports, to support their claims. The letter should highlight how these improvements make them a more reliable borrower, justifying the request for a temporary lower interest rate. 4. Collin, Texas Letter from Debtor to Credit Card Company Offering Incentives for a Lower Interest Rate: Debtors in Collin, Texas can consider writing this type of letter if they are willing to make concessions or offer incentives in exchange for a lower interest rate. This could include committing to higher monthly payments, making a lump-sum payment, or agreeing to a longer-term repayment plan. By presenting their good faith efforts, debtors can appeal to the credit card company's willingness to accommodate their request for a temporary lower rate. Conclusion: When composing a Collin, Texas letter from a debtor to their credit card company requesting a lower interest rate for a certain period of time, debtors must be clear, concise, and professional in their communication. Additionally, it is essential to provide relevant documentation and present a well-reasoned argument that highlights the debtor's commitment to improving their financial situation. Using the above-mentioned types of letters as a guide, debtors in Collin, Texas can increase their chances of obtaining the desired temporary reduction in interest rates, ultimately enabling them to manage their debt more effectively.

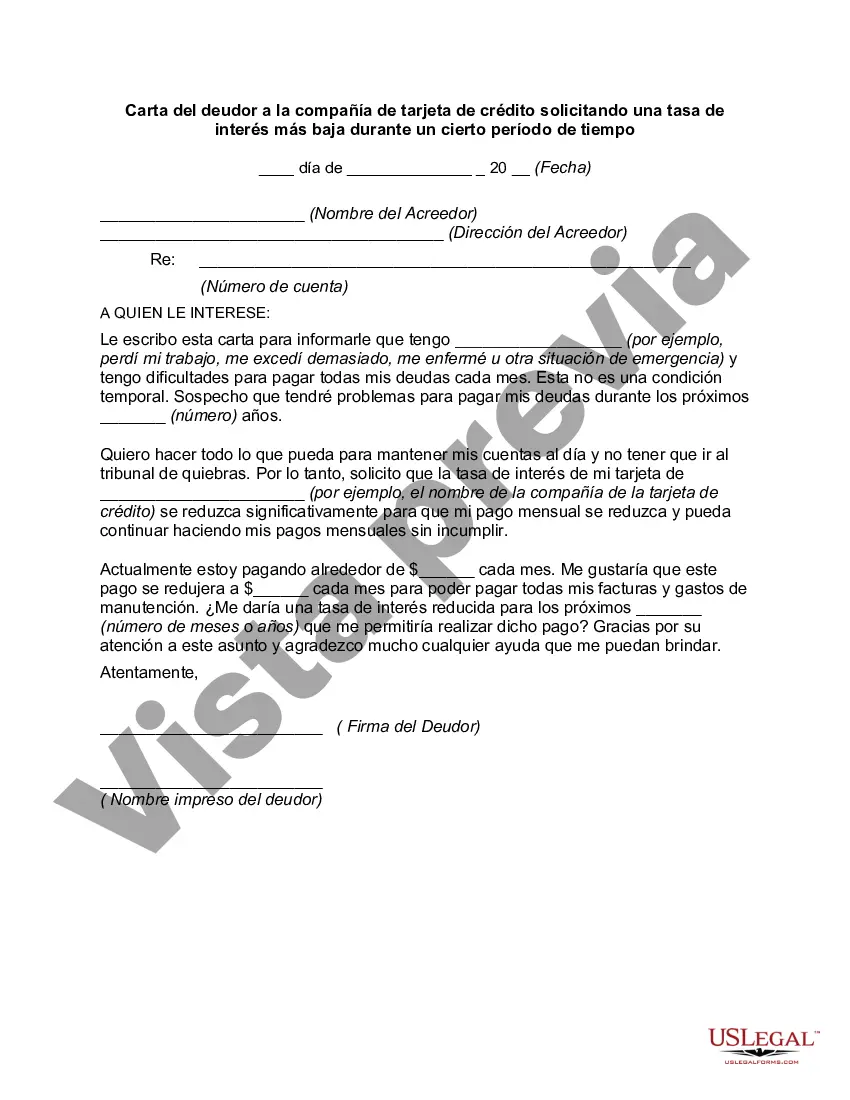

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Collin Texas Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Collin Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Collin Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Collin Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time:

- Make sure you have opened the proper page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Collin Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!