Cook Illinois Consumer Equity Sheet is a financial document that provides a comprehensive overview of the equity status and holdings of consumers in Cook County, Illinois. It enables individuals residing in Cook County to keep track of their financial positions and evaluate their net worth. This equity sheet encompasses various categories such as real estate, investments, savings, retirement accounts, and other assets. The Cook Illinois Consumer Equity Sheet serves as a valuable tool for individuals to gain insights into their financial health and make informed decisions regarding their wealth management. By analyzing the details provided in this sheet, consumers can assess their progress towards achieving their financial goals and identify areas where they may need to make necessary adjustments. Within the Cook Illinois Consumer Equity Sheet, there are different types of equity sheets that focus on specific areas of personal finance. These include: 1. Real Estate Equity Sheet: This type of equity sheet provides a snapshot of an individual's properties, including their current market value, mortgage balances, and equity owned in each property. This allows users to understand the value of their real estate assets and determine if any adjustments, such as refinancing or property investments, are needed. 2. Investment Equity Sheet: The investment equity sheet presents detailed information about an individual's investment portfolio. It includes holdings in stocks, bonds, mutual funds, or other investment vehicles along with their current value, cost basis, and net equity. This helps consumers analyze their investment performance and make better-informed investment decisions. 3. Savings Equity Sheet: The savings equity sheet focuses on an individual's savings accounts, such as checking accounts, savings accounts, money market accounts, certificates of deposit (CDs), and other liquid assets. It provides a clear picture of the amount of money held in these accounts and allows consumers to assess their liquidity and emergency funds. 4. Retirement Equity Sheet: This equity sheet concentrates on an individual's retirement accounts, such as 401(k), Individual Retirement Accounts (IRAs), pensions, or other retirement savings vehicles. It outlines the current value, contributions, growth, and equity of these accounts, enabling individuals to track their progress towards retirement goals and make necessary adjustments to their retirement savings strategies. 5. Other Assets Equity Sheet: This category includes any additional assets that do not fall under the above types, such as vehicles, collectibles, valuable possessions, or business assets. The other assets' equity sheet allows individuals to account for these assets and factor them into their overall net worth calculation. Overall, the Cook Illinois Consumer Equity Sheet provides a holistic view of an individual's financial well-being, assisting them in making informed decisions related to wealth management, investment strategies, and achieving their financial goals. It is a powerful tool that helps Cook County residents assess their financial health and plan for a more secure future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Hoja de Equidad del Consumidor - Consumer Equity Sheet

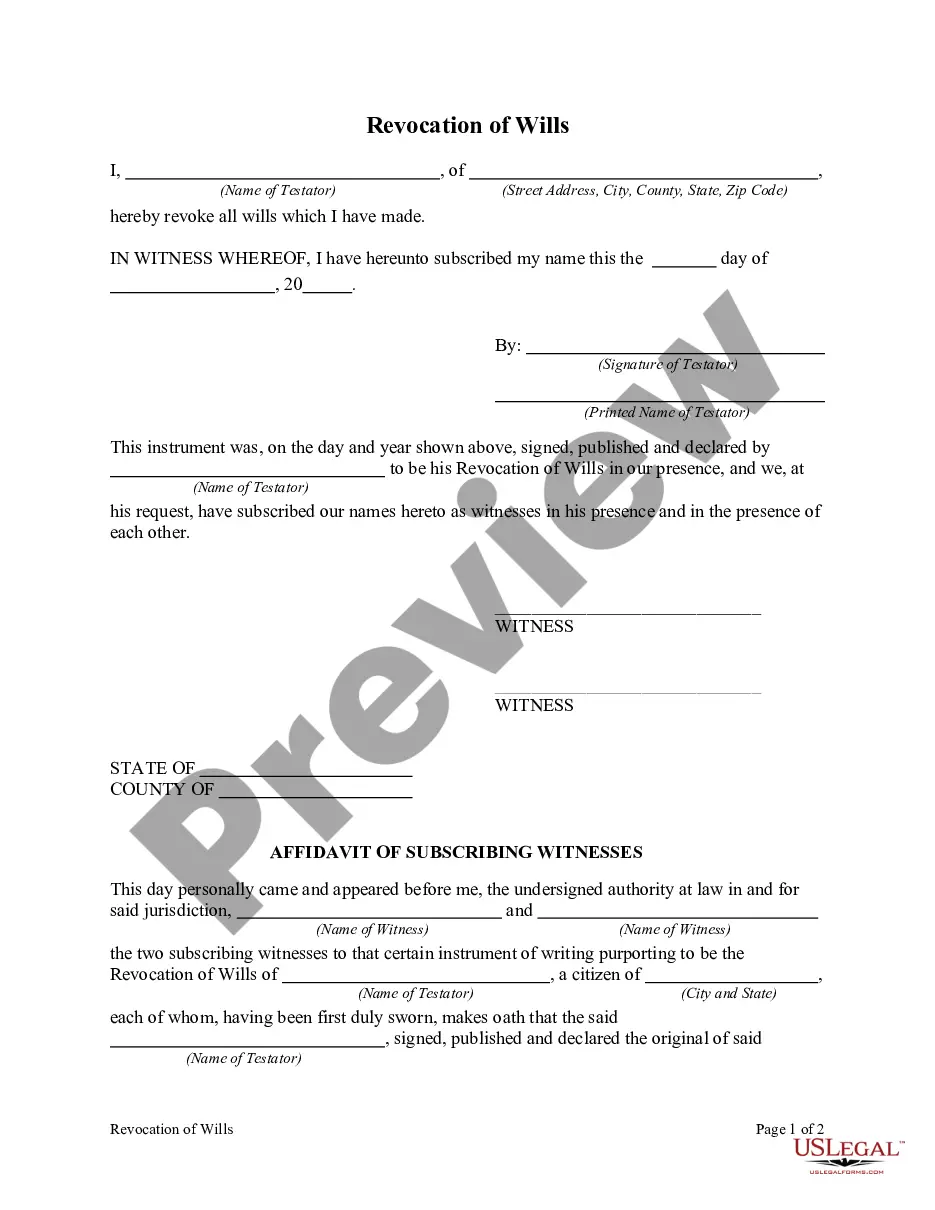

Description

How to fill out Cook Illinois Hoja De Equidad Del Consumidor?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Cook Consumer Equity Sheet suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Cook Consumer Equity Sheet, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Cook Consumer Equity Sheet:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cook Consumer Equity Sheet.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!