Suffolk New York Consumer Equity Sheet is a comprehensive document that provides a detailed overview of the financial position and consumer equity of individuals or businesses living in Suffolk, New York. This sheet is designed to track and analyze an individual's assets, liabilities, and net worth, allowing a better understanding of their financial health. The Suffolk New York Consumer Equity Sheet encompasses various categories of assets, including real estate holdings, investments, savings, retirement accounts, vehicles, and personal property. It also includes liabilities such as mortgages, loans, credit card debts, and other outstanding obligations. By carefully analyzing the Suffolk New York Consumer Equity Sheet, individuals can gain insights into their financial position and make informed decisions regarding investments, debts, and overall financial planning. This sheet acts as an essential tool for financial advisors, banks, lenders, and individuals themselves to assess creditworthiness, evaluate risks, and determine eligibility for loans, mortgages, or other financial services. Different types of Suffolk New York Consumer Equity Sheets may exist based on specific criteria or target audiences. Examples can include: 1. Individual Consumer Equity Sheet: This type of sheet focuses on an individual's financial situation, providing a comprehensive breakdown of their assets, liabilities, and net worth. It considers their personal income, expenses, and financial goals. 2. Small Business Consumer Equity Sheet: Aimed at small business owners in Suffolk, New York, this sheet outlines the financial standing of the company. It considers factors like revenue, expenses, assets (including inventory and equipment), liabilities (such as loans and accounts payable), and overall equity. 3. Real Estate Consumer Equity Sheet: This type of sheet is centered around individuals or businesses that predominantly own or have substantial investments in real estate properties in Suffolk, New York. It highlights property values, mortgages, rental income, property taxes, and other related financial aspects. 4. Investment-focused Consumer Equity Sheet: Tailored for individuals or businesses focused on investments, this sheet provides detailed information on investment portfolios, securities, mutual funds, stocks, bonds, and other investment-related assets or liabilities. In conclusion, Suffolk New York Consumer Equity Sheet is a vital financial document that allows individuals or businesses to evaluate their financial standing, make informed decisions, and plan for a more secure financial future. By analyzing different types of these sheets, individuals can gain valuable insights and develop effective strategies to achieve their financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Hoja de Equidad del Consumidor - Consumer Equity Sheet

Description

How to fill out Suffolk New York Hoja De Equidad Del Consumidor?

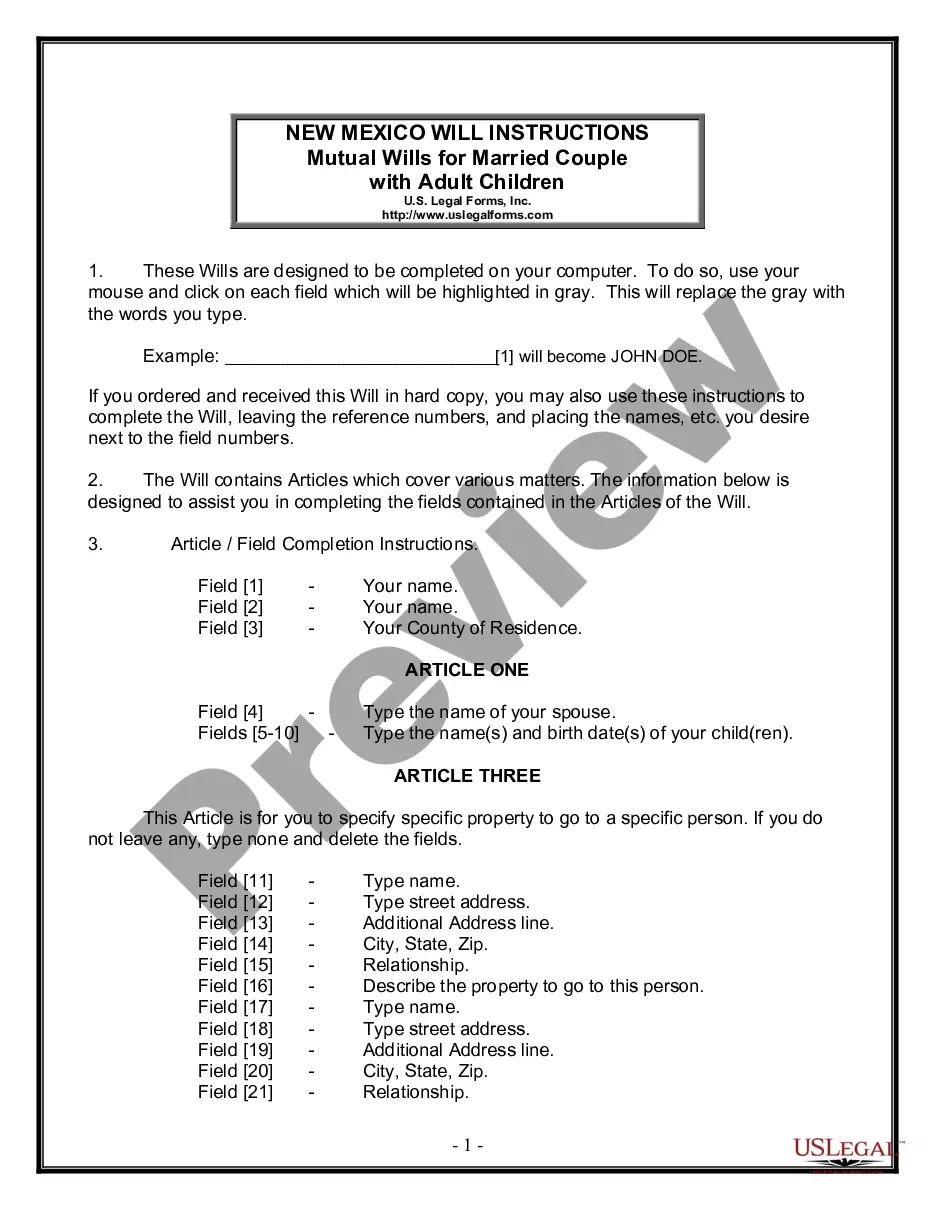

Are you looking to quickly create a legally-binding Suffolk Consumer Equity Sheet or probably any other document to handle your personal or corporate matters? You can go with two options: hire a legal advisor to write a valid document for you or draft it completely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get professionally written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific document templates, including Suffolk Consumer Equity Sheet and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, double-check if the Suffolk Consumer Equity Sheet is adapted to your state's or county's regulations.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Suffolk Consumer Equity Sheet template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!