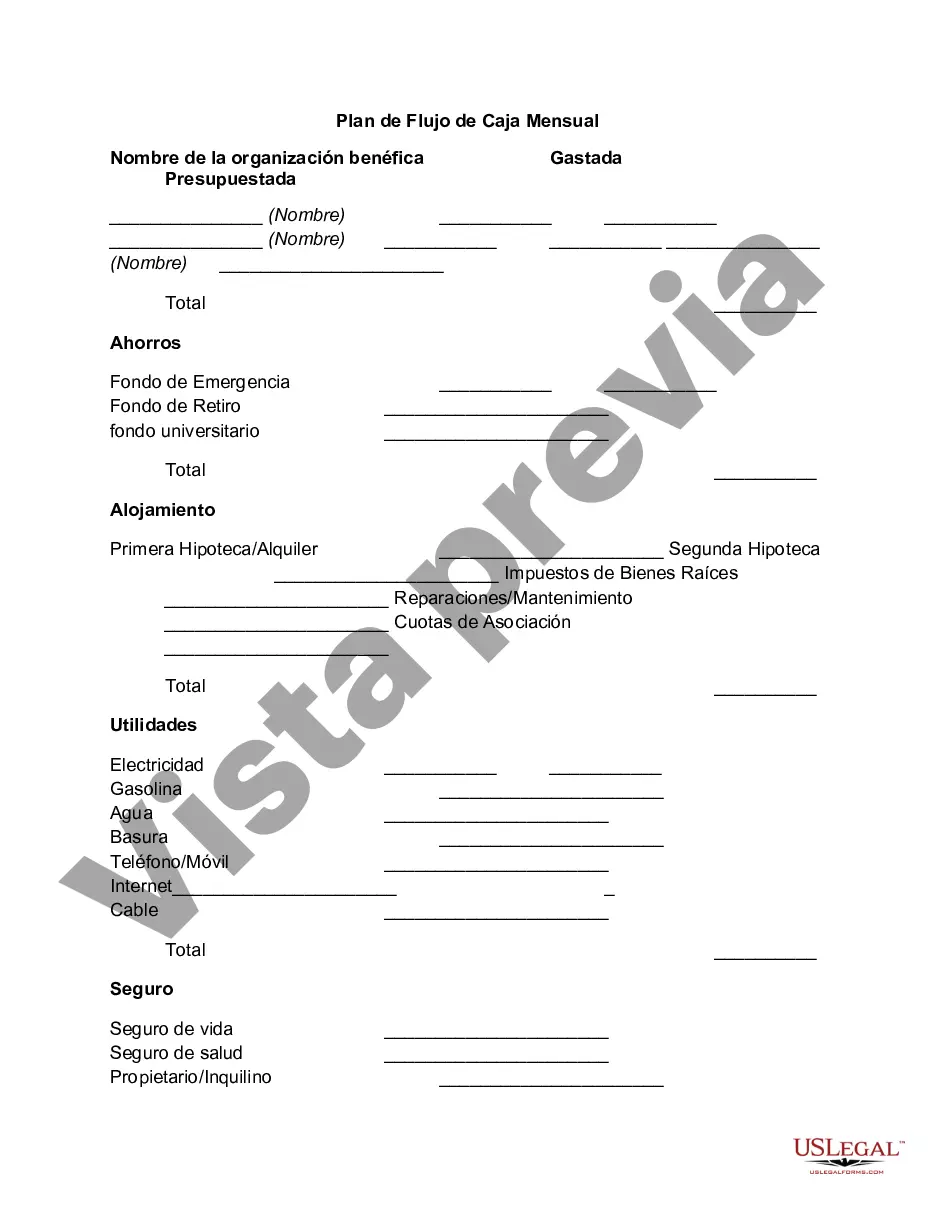

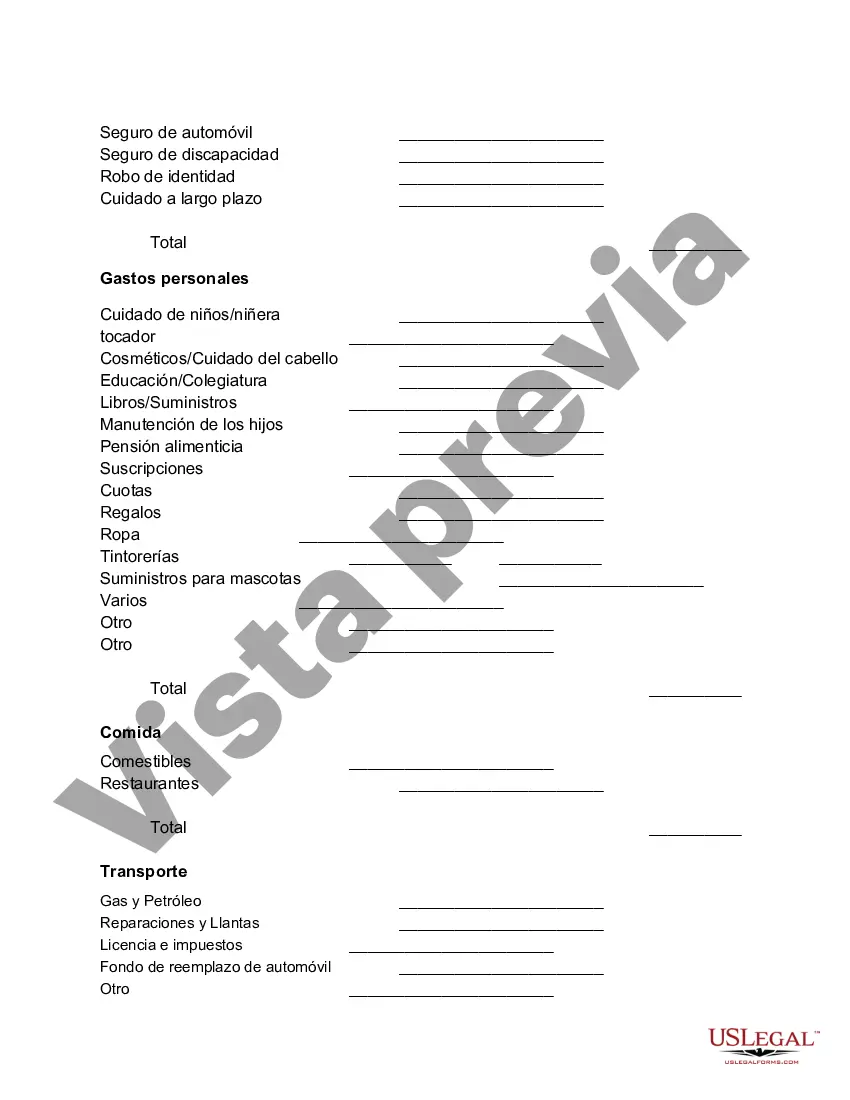

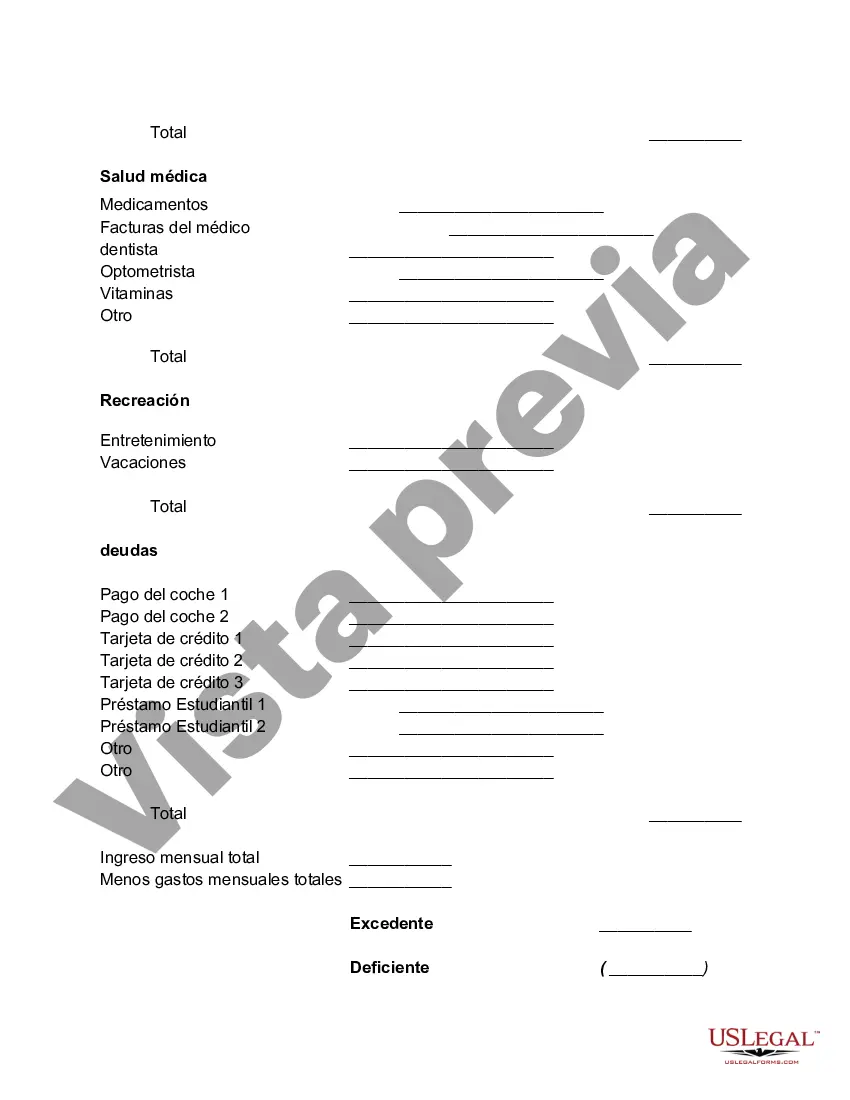

Contra Costa California Monthly Cash Flow Plan is a financial tool designed to help individuals and families in Contra Costa County, California, effectively manage their income and expenses on a monthly basis. This budgeting plan is crucial for ensuring financial stability and achieving short-term and long-term financial goals. The Contra Costa California Monthly Cash Flow Plan provides a comprehensive breakdown of all sources of income and expenses incurred by individuals or families residing in Contra Costa County. By tracking and analyzing income and expenses, one can gain a clear understanding of their financial situation and make informed decisions accordingly. The plan takes into account various income sources including salaries, wages, investments, and any additional sources of income. It also considers different types of expenses such as housing, utilities, transportation, groceries, education, healthcare, and entertainment, among others. By carefully monitoring income and expenses, individuals can identify areas where they may be overspending or areas where they can potentially save money. This awareness allows for adjustments to be made to the budget, facilitating the achievement of financial goals, such as saving for a down payment on a house, paying off debts, or planning for retirement. Different types of Contra Costa California Monthly Cash Flow Plans include: 1. Individual Cash Flow Plan: This plan is designed for individuals who are responsible for managing their own finances. It helps individuals track their income and expenses accurately, allowing them to make necessary adjustments to live within their means and achieve financial stability. 2. Family Cash Flow Plan: This plan is specifically tailored for families living in Contra Costa County. It considers the combined income and expenses of all family members and provides a detailed overview of the family's financial status. This plan assists families in effectively allocating their resources to meet both individual and family financial goals. 3. Business Cash Flow Plan: This plan caters to individuals who own or manage businesses in Contra Costa County. It focuses on tracking business income and expenses, ensuring proper cash flow management, and providing insights to make informed financial decisions for business growth and sustainability. The Contra Costa California Monthly Cash Flow Plan is an essential tool for anyone aiming to gain control over their financial situation. By diligently following and updating the plan, individuals and families can experience financial security, reduce stress, and work towards building wealth and achieving their dreams.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Contra Costa California Plan De Flujo De Caja Mensual?

Whether you plan to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Contra Costa Monthly Cash Flow Plan is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Contra Costa Monthly Cash Flow Plan. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Contra Costa Monthly Cash Flow Plan in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!