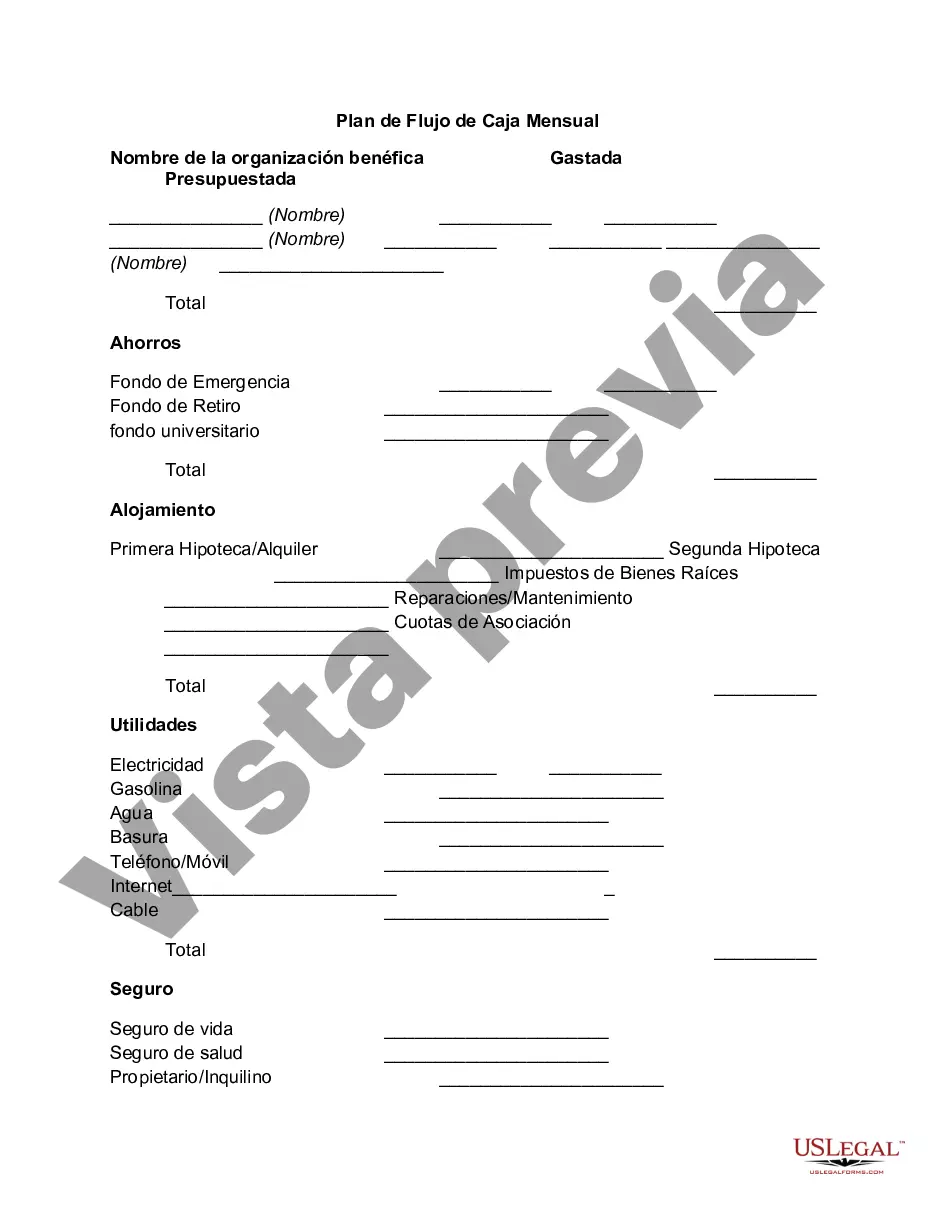

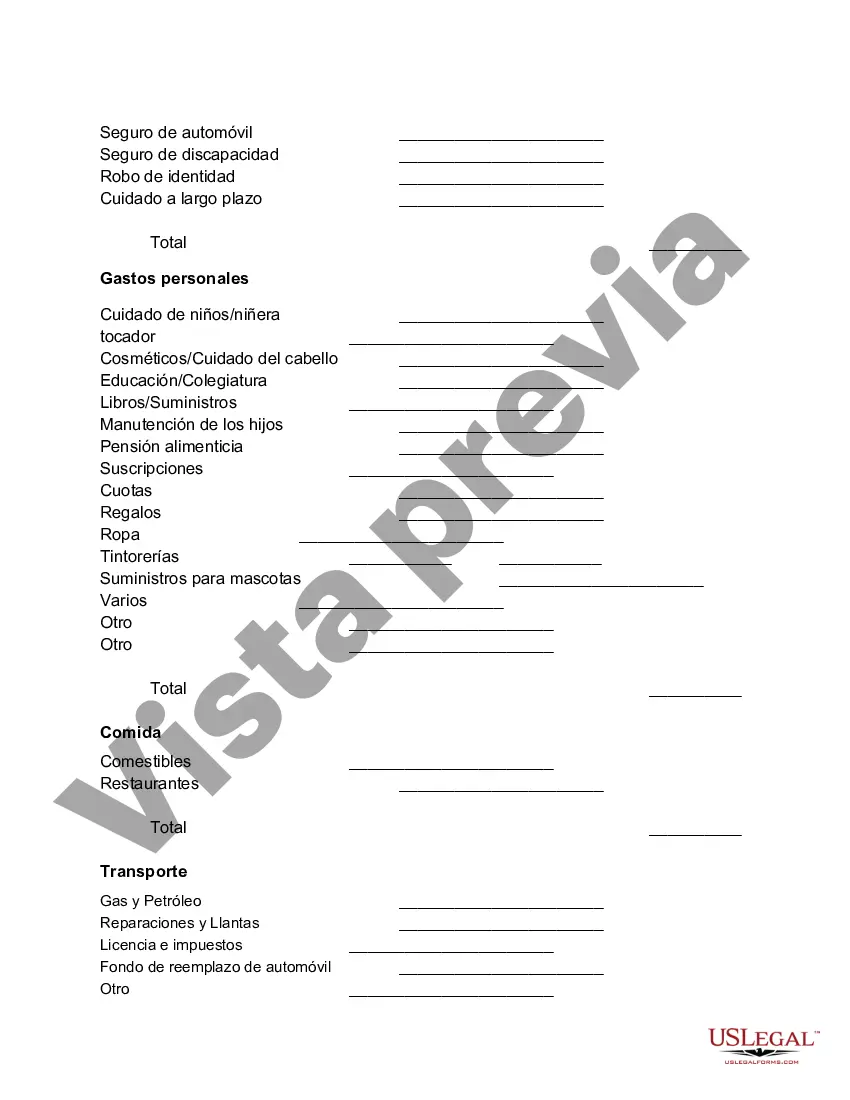

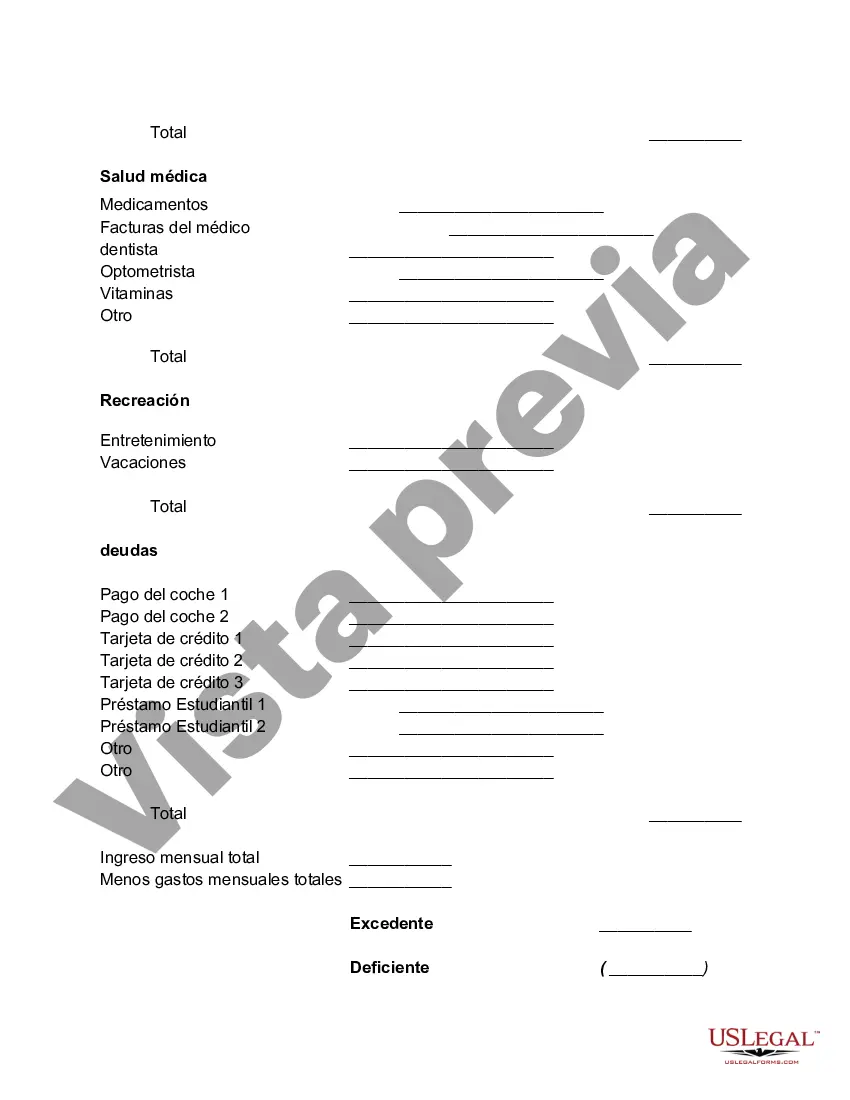

King Washington Monthly Cash Flow Plan is a financial tool designed to help individuals gain control over their money and effectively manage their monthly income and expenses. This budgeting method provides a detailed breakdown of monthly cash inflows and outflows, enabling individuals to make informed financial decisions and reach their financial goals. One of the key aspects of the King Washington Monthly Cash Flow Plan is its comprehensive nature. It takes into account all sources of income such as salary, investments, and any other monetary inflows, along with all expenses including rent/mortgage, utilities, groceries, transportation, debt payments, entertainment, and savings. By analyzing and organizing these financial elements, individuals gain a clear view of their financial situation and are empowered to plan for the future. Different types of King Washington Monthly Cash Flow Plans include variations tailored to specific financial goals or situations. For instance, the Retirement Cash Flow Plan aims at helping individuals plan their finances with a focus on retirement savings and investments. This plan takes into account additional factors like pension income, social security benefits, and various types of retirement savings accounts. Another type of King Washington Monthly Cash Flow Plan is the Debt Repayment Cash Flow Plan. This plan is specifically designed to tackle existing debts effectively. By prioritizing debt payments and allocating extra funds towards reducing debt, individuals can accelerate their journey towards becoming debt-free and increase their overall financial stability. Furthermore, the Emergency Fund Cash Flow Plan helps individuals establish and grow an emergency fund. This plan focuses on setting aside a pre-determined amount of money each month to cover unexpected expenses or financial hardships that may arise. By having an emergency fund, individuals can avoid relying on credit cards or loans during difficult times. In summary, the King Washington Monthly Cash Flow Plan is a versatile and flexible financial tool that allows individuals to efficiently manage their income, expenses, and financial goals. With its various types tailored to different needs, individuals can choose and adjust the plan that best suits their unique circumstances, helping them achieve financial stability and control.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out King Washington Plan De Flujo De Caja Mensual?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business purpose utilized in your region, including the King Monthly Cash Flow Plan.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the King Monthly Cash Flow Plan will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the King Monthly Cash Flow Plan:

- Make sure you have opened the correct page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the King Monthly Cash Flow Plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!