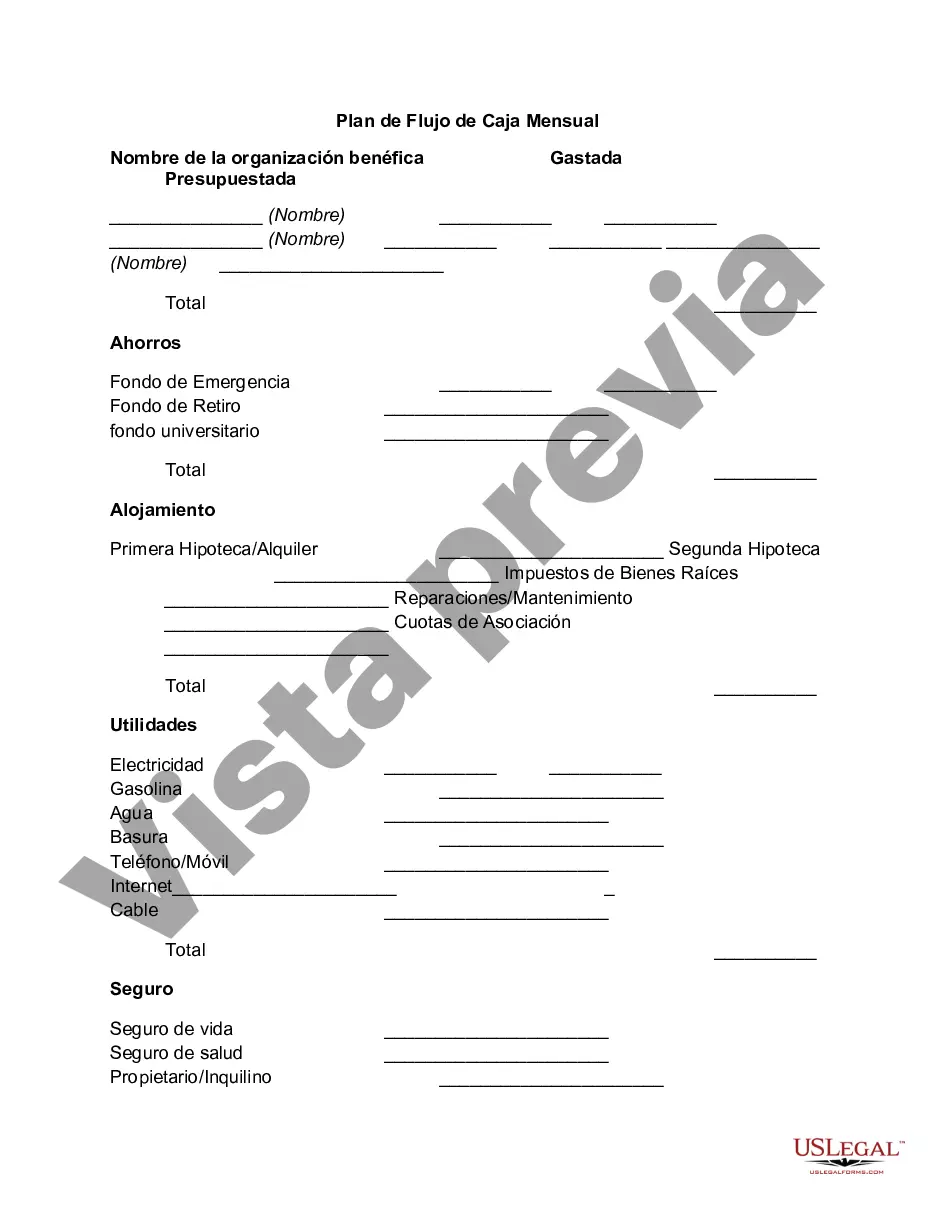

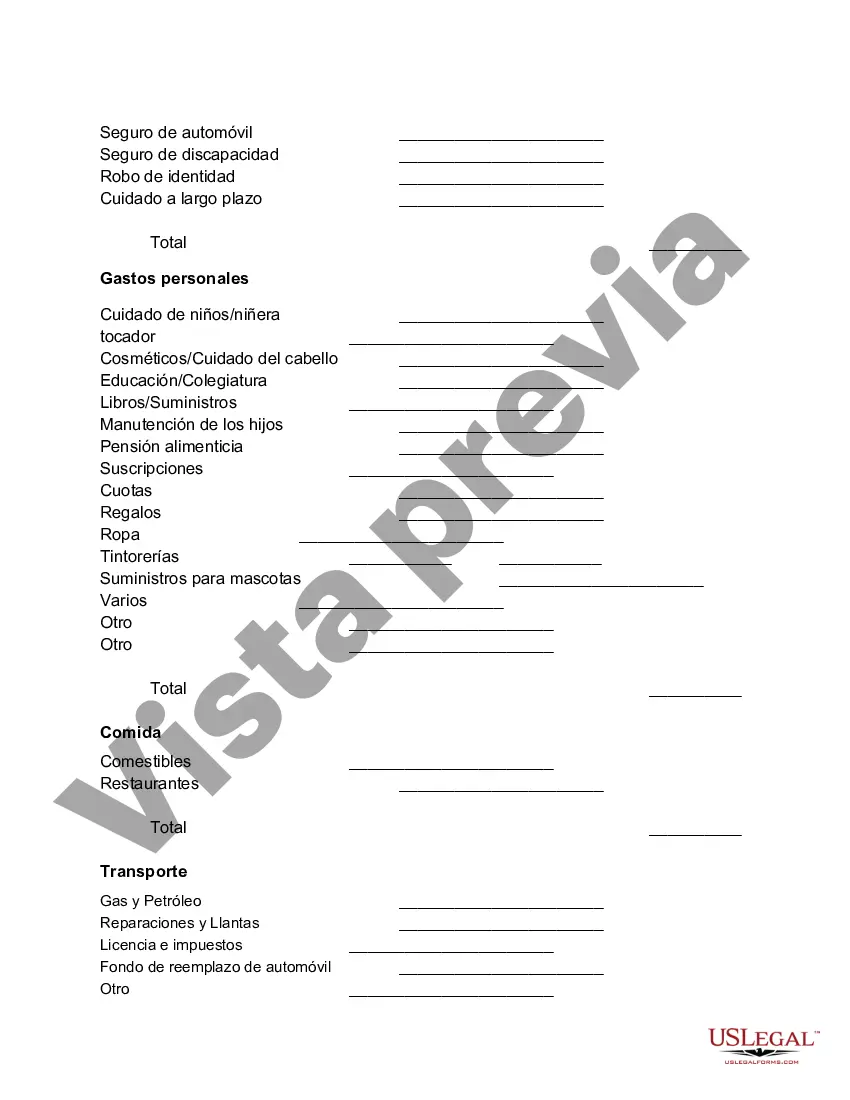

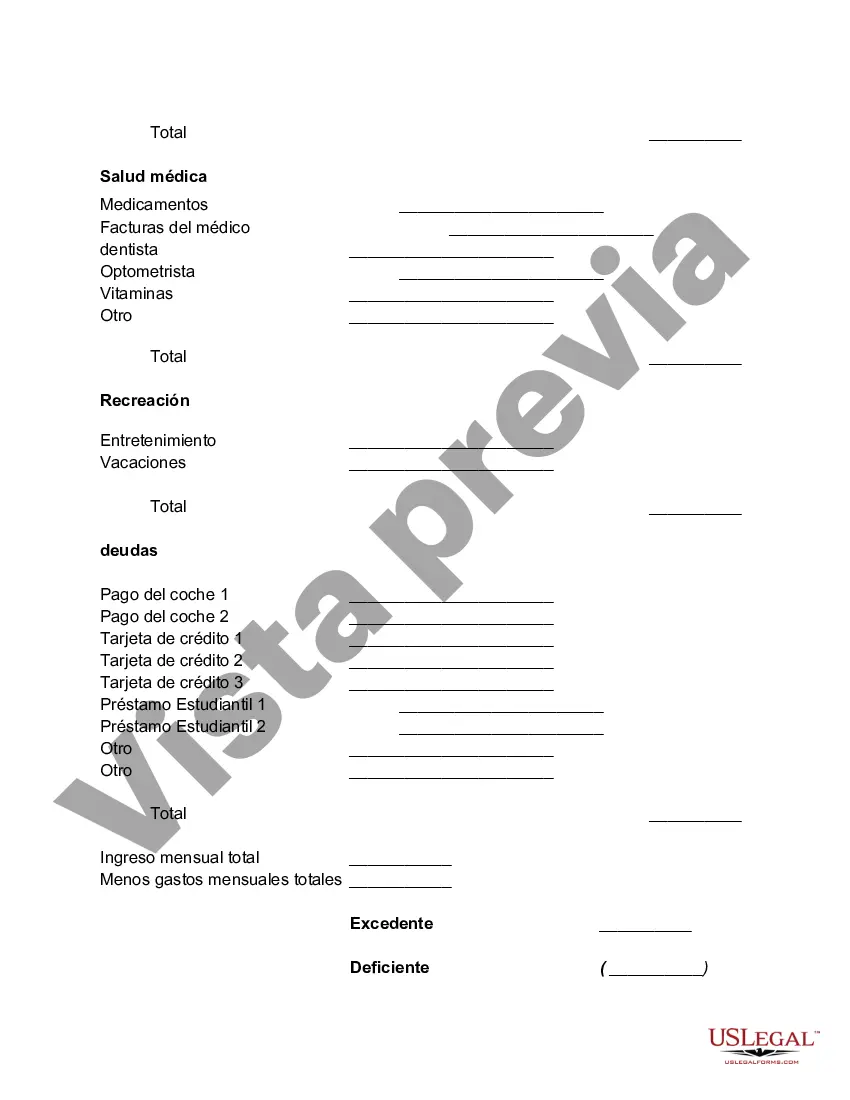

Kings New York Monthly Cash Flow Plan is a highly effective budgeting tool designed to help individuals and families manage their finances efficiently. With a focus on controlling expenses and increasing savings, this plan provides a comprehensive framework to track and analyze monthly income and expenditures. By implementing this system, users can gain a deeper understanding of their financial position and make informed decisions to achieve their monetary goals. The Kings New York Monthly Cash Flow Plan offers various types, each catering to specific financial needs and situations. These plans include: 1. Kings New York Monthly Cash Flow Plan for Individuals: This version is tailored for single individuals who want to establish a strong financial foundation. It helps users keep a close eye on their income, expenses, and saving opportunities, ensuring they can effectively plan for the future. 2. Kings New York Monthly Cash Flow Plan for Families: Designed to address the unique challenges and expenses faced by families, this plan helps households better allocate their resources, manage bills, set financial goals, and save for both immediate needs and long-term objectives. 3. Kings New York Monthly Cash Flow Plan for Entrepreneurs: Geared towards individuals who run their own businesses, this plan assists entrepreneurs in tracking their business's income and expenses alongside their personal finances. It enables business owners to make sound financial decisions while ensuring personal financial stability. 4. Kings New York Monthly Cash Flow Plan for Retirees: Specifically created for retirees, this plan aids in managing retirement income, investments, and expenses. It helps retirees optimize their savings, protect their assets, and maintain a comfortable lifestyle during their golden years. 5. Kings New York Monthly Cash Flow Plan for Students: Tailored to meet the unique financial challenges faced by students, this plan provides a tool for tracking income from various sources (e.g., part-time jobs, scholarships), managing educational expenses, and planning for future academic and career goals. Implementing the Kings New York Monthly Cash Flow Plan involves a step-by-step process. Users need to start by tracking their monthly income from various sources, such as salaries, investments, or side hustles. They can then categorize their expenses into specific categories like housing, transportation, groceries, entertainment, education, and more. By monitoring and reviewing their cash flow regularly, individuals can identify areas where they can cut back or make adjustments to optimize their budget. The Kings New York Monthly Cash Flow Plan empowers individuals and families with a comprehensive financial management tool, allowing them to gain control over their money, avoid unnecessary debts, a.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Kings New York Plan De Flujo De Caja Mensual?

Preparing documents for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Kings Monthly Cash Flow Plan without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Kings Monthly Cash Flow Plan by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Kings Monthly Cash Flow Plan:

- Examine the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!