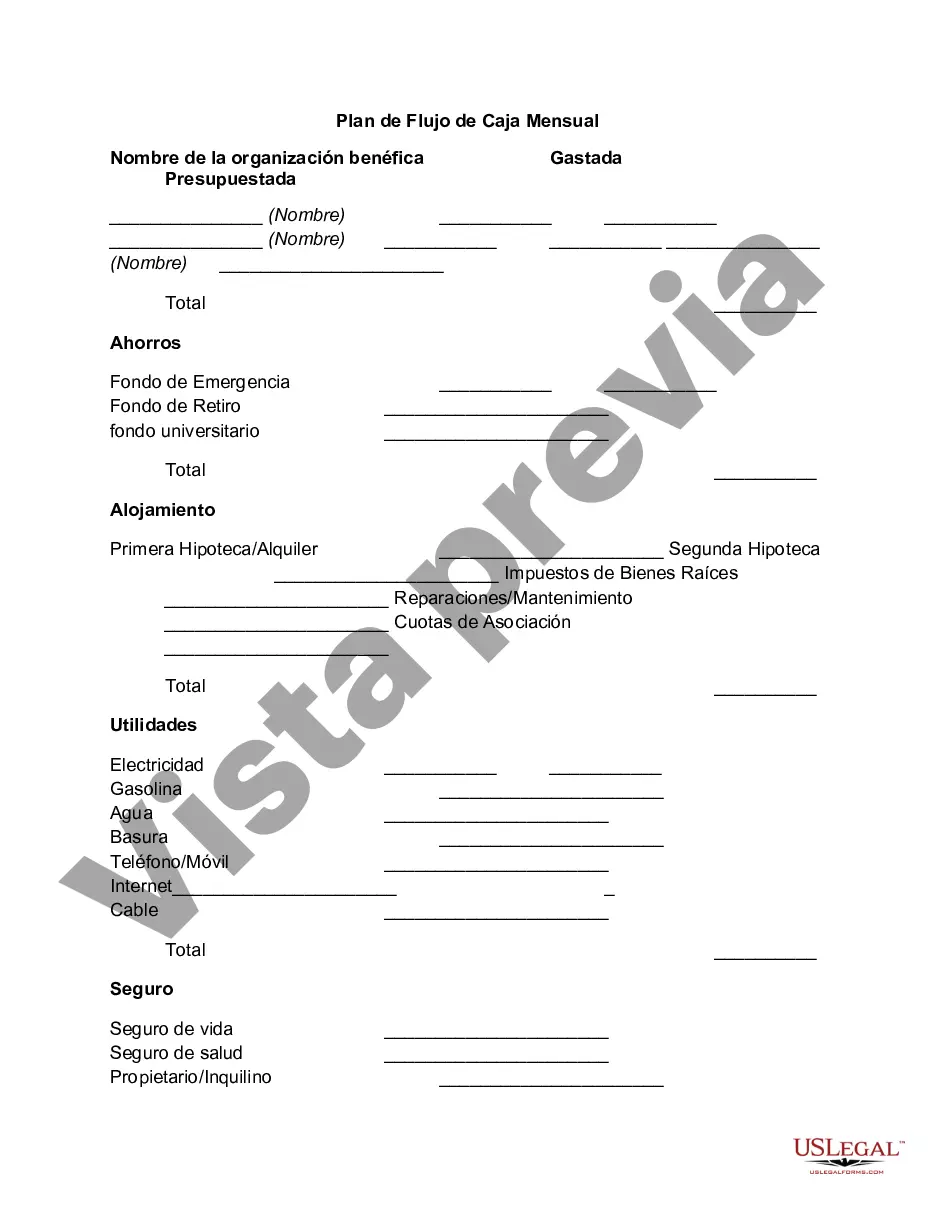

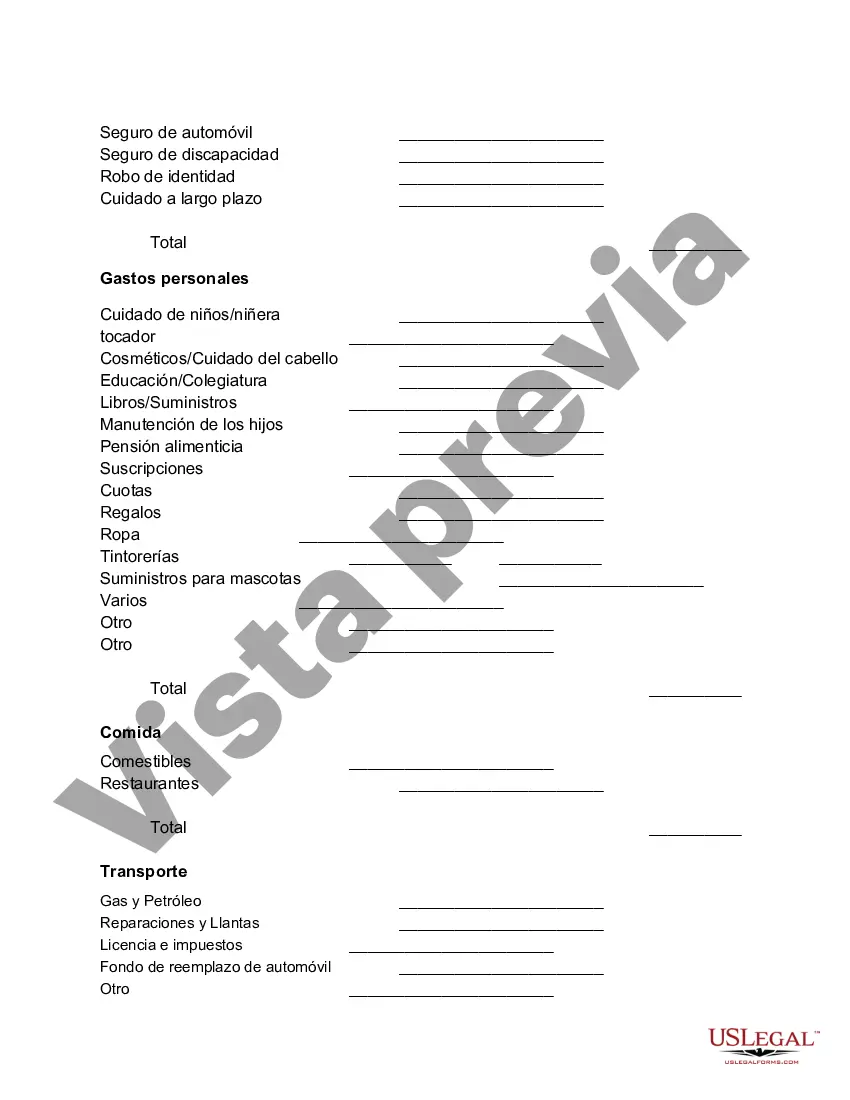

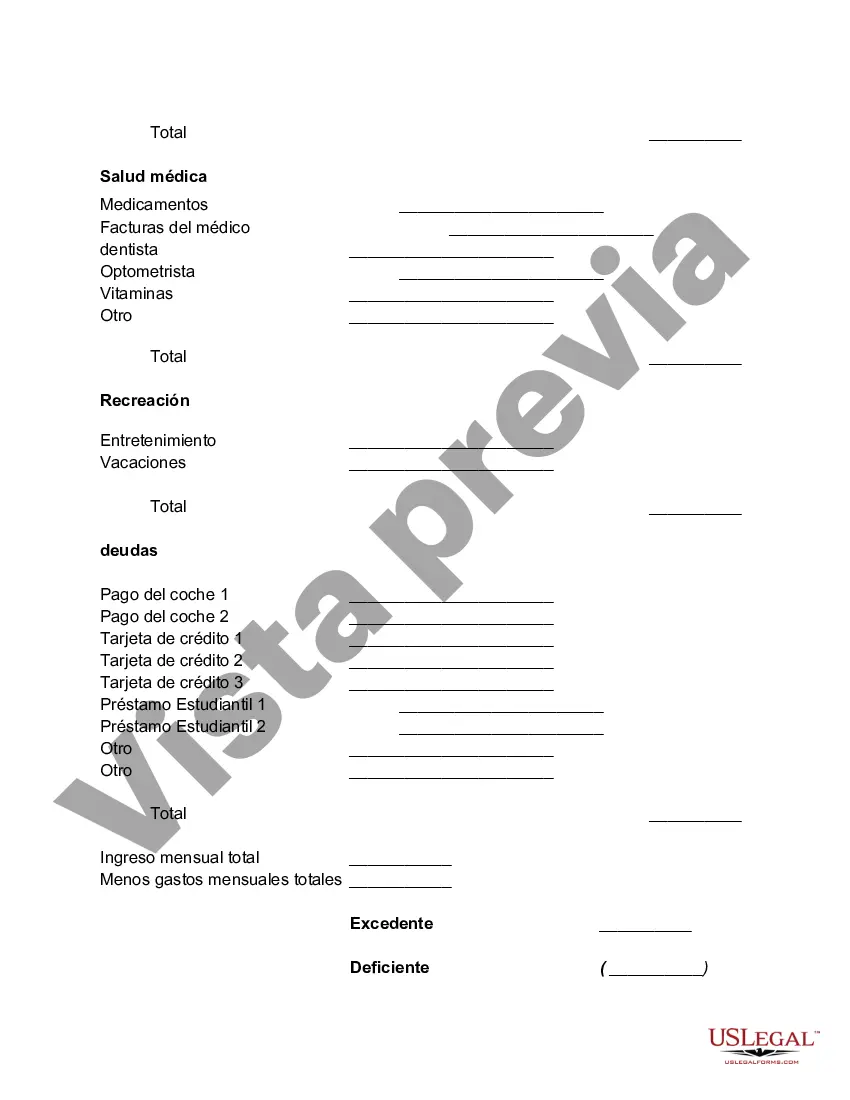

Mecklenburg North Carolina Monthly Cash Flow Plan is a financial management tool designed to help individuals and families in Mecklenburg County effectively manage their monthly income and expenses. By creating a detailed plan, residents can gain control over their finances and make informed decisions to meet their financial goals. The Mecklenburg North Carolina Monthly Cash Flow Plan takes into account all sources of income, including salary, investments, and side gigs, as well as recurring expenses like rent/mortgage, utilities, groceries, transportation, healthcare, and entertainment. With this plan, residents are encouraged to track their monthly income and expenses meticulously to ensure financial stability and avoid unnecessary debt. Implementing the Mecklenburg North Carolina Monthly Cash Flow Plan involves the following steps: 1. Income Evaluation: Determine all sources of income, including regular paychecks, freelance work, rental income, or dividends from investments. 2. Expense Tracking: List down all monthly expenses, such as rent/mortgage, utilities, transportation costs, groceries, insurance premiums, debt payments, subscriptions, and any other financial obligations. 3. Categorization: Group expenses into categories like fixed (rent/mortgage, insurance) and variable (groceries, entertainment) to get a clearer picture of spending patterns. 4. Setting Goals: Identify short-term and long-term financial goals, such as saving for emergencies, paying off debt, or planning for retirement. Allocate specific funds towards each goal. 5. Budget Allocation: Create a personalized budget by assigning an appropriate amount to each expense category. This step ensures that expenses remain within the limits of available income. 6. Regular Review: Continuously assess the effectiveness of the plan by comparing actual spending against the budget. Make adjustments if necessary to ensure better financial management. Variations of the Mecklenburg North Carolina Monthly Cash Flow Plan may include specialized plans designed for specific financial goals or circumstances, such as: 1. Debt Repayment Plan: Focused on strategies to pay off debts efficiently, including prioritizing high-interest debts and utilizing debt consolidation or negotiation methods. 2. Savings and Investment Plan: Tailored towards individuals aiming to grow their savings or invest for long-term goals by allocating specific percentages of income to different investment vehicles such as stocks, mutual funds, or retirement accounts. 3. Emergency Fund Plan: Concentrates on building a financial safety net to cover unforeseen expenses or emergencies by allocating a predetermined amount of income specifically towards an emergency savings account. Mecklenburg North Carolina Monthly Cash Flow Plan provides residents with a comprehensive approach to manage their income and expenses effectively. By implementing this plan and its variations, individuals and families can achieve financial stability, stay on top of their expenses, and work towards their desired financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Mecklenburg North Carolina Plan De Flujo De Caja Mensual?

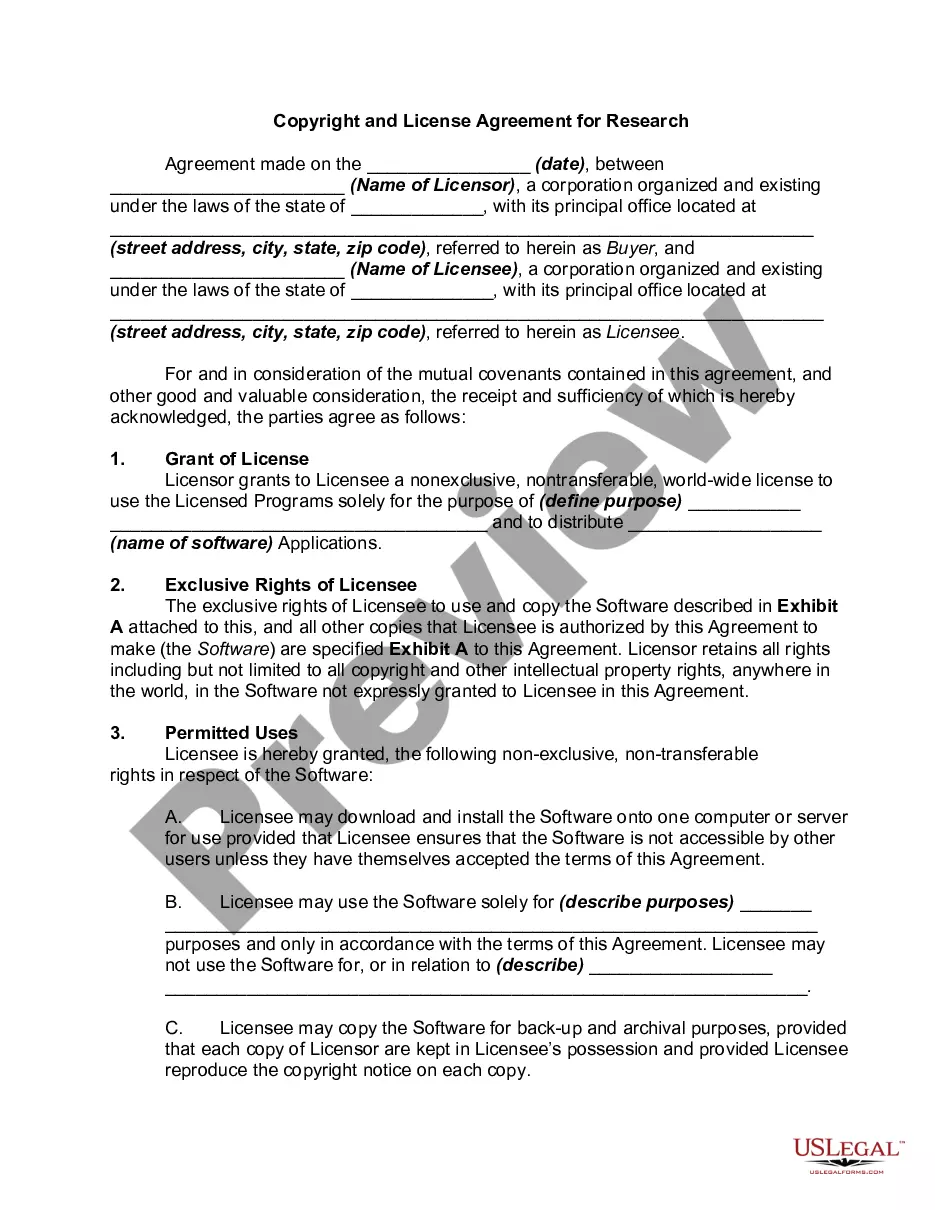

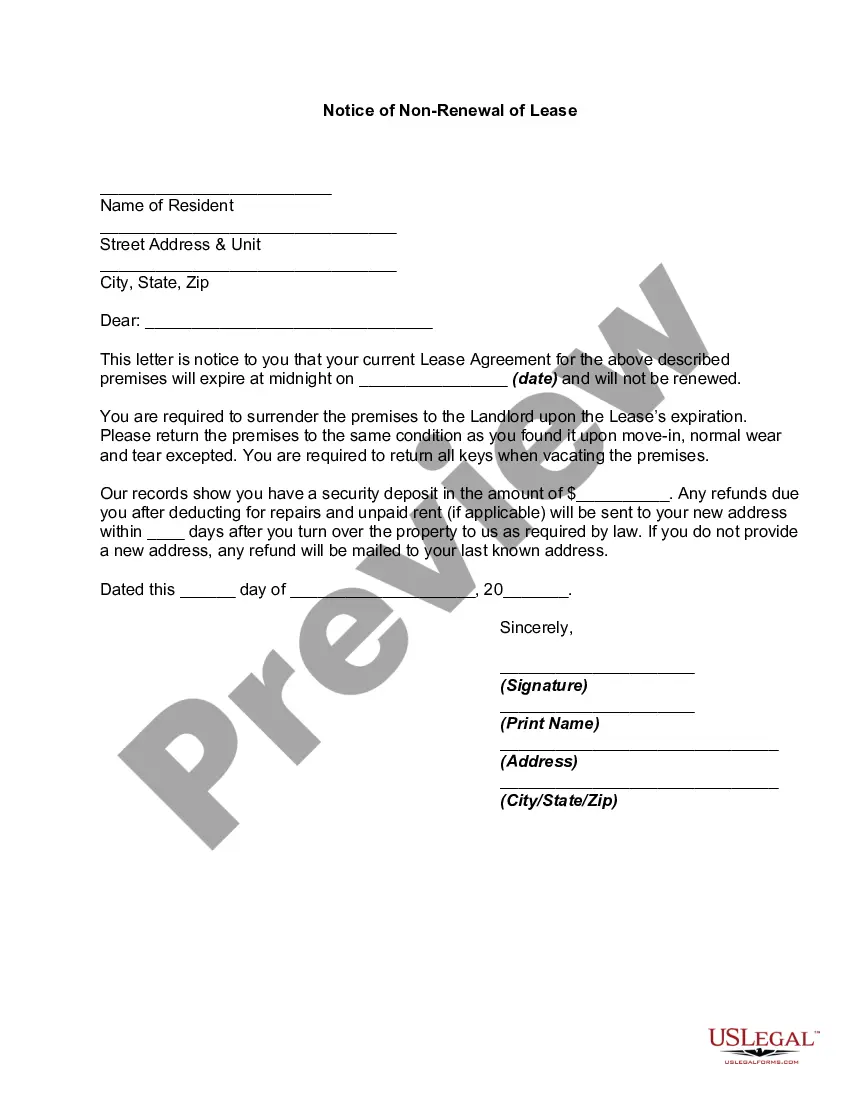

If you need to get a trustworthy legal form supplier to get the Mecklenburg Monthly Cash Flow Plan, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning resources, and dedicated support team make it easy to locate and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to search or browse Mecklenburg Monthly Cash Flow Plan, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Mecklenburg Monthly Cash Flow Plan template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or complete the Mecklenburg Monthly Cash Flow Plan - all from the convenience of your home.

Join US Legal Forms now!