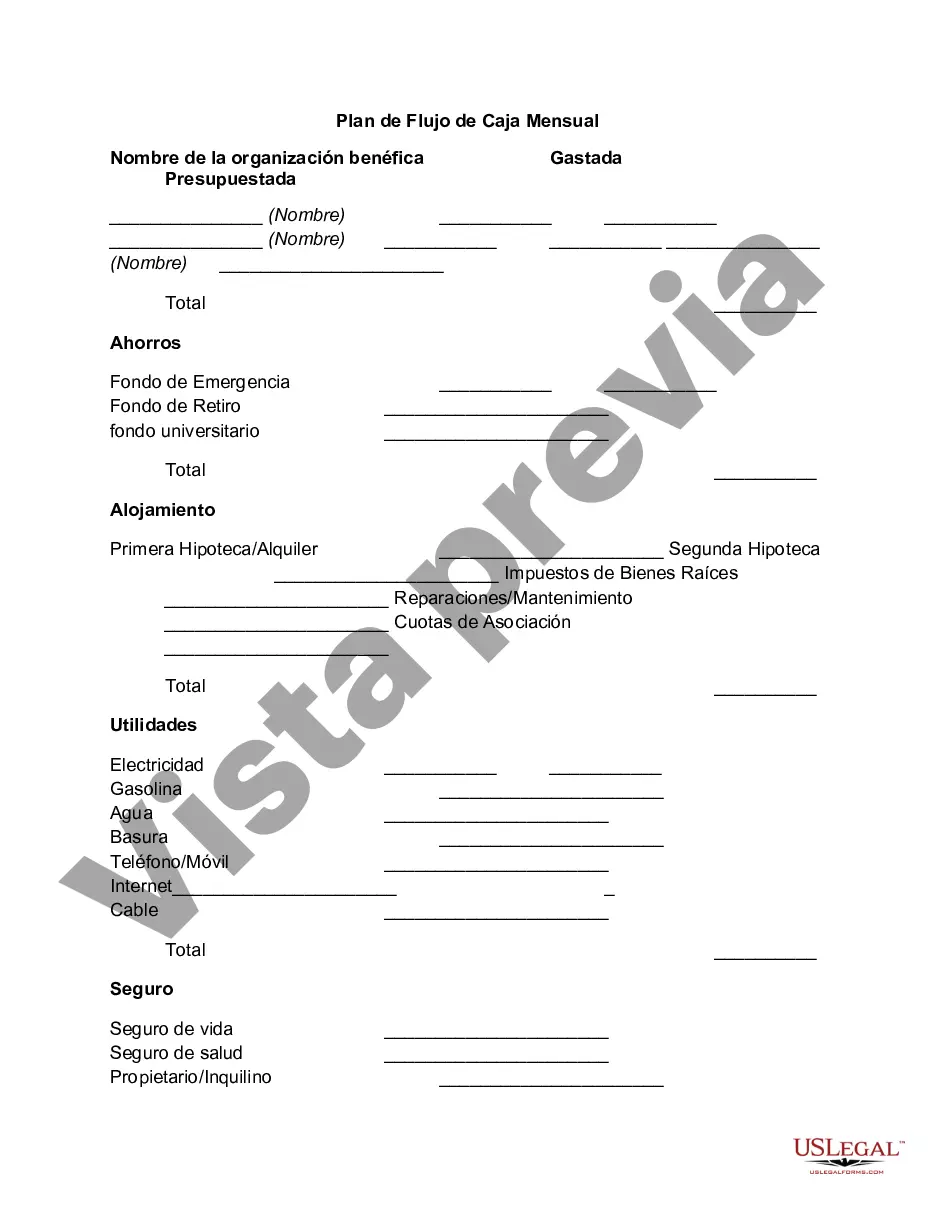

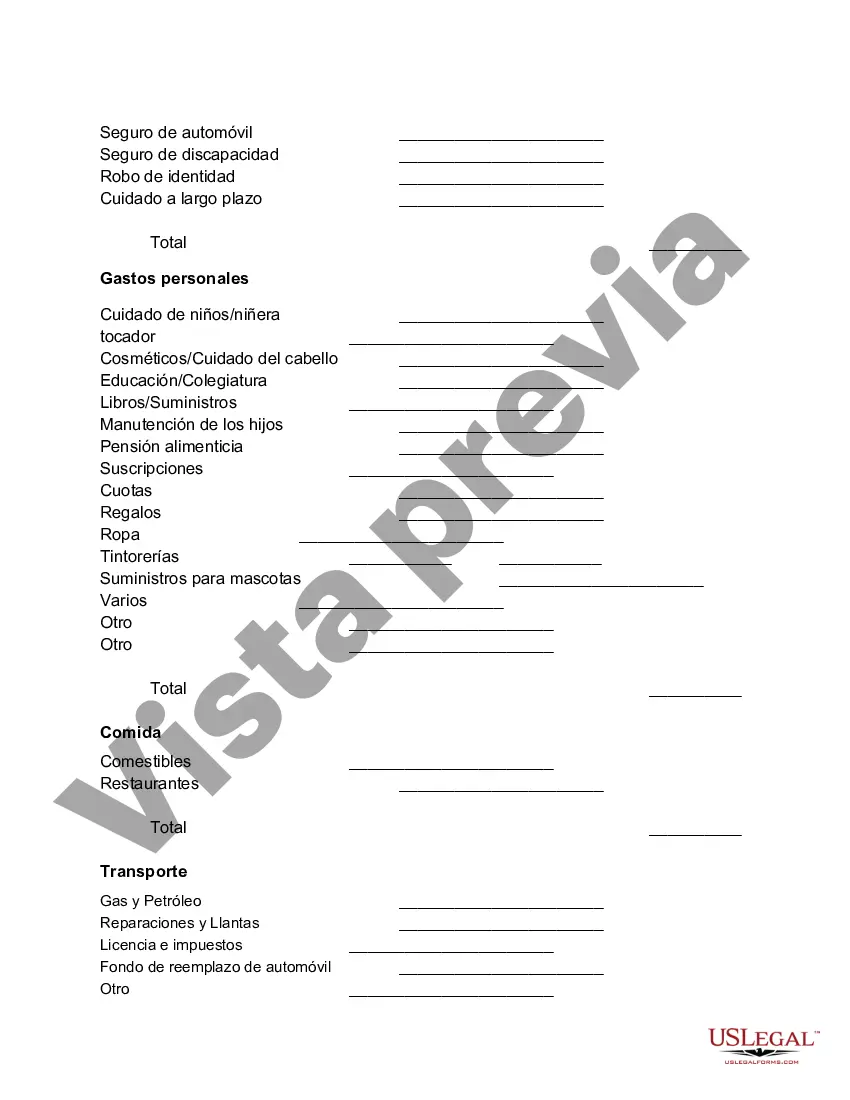

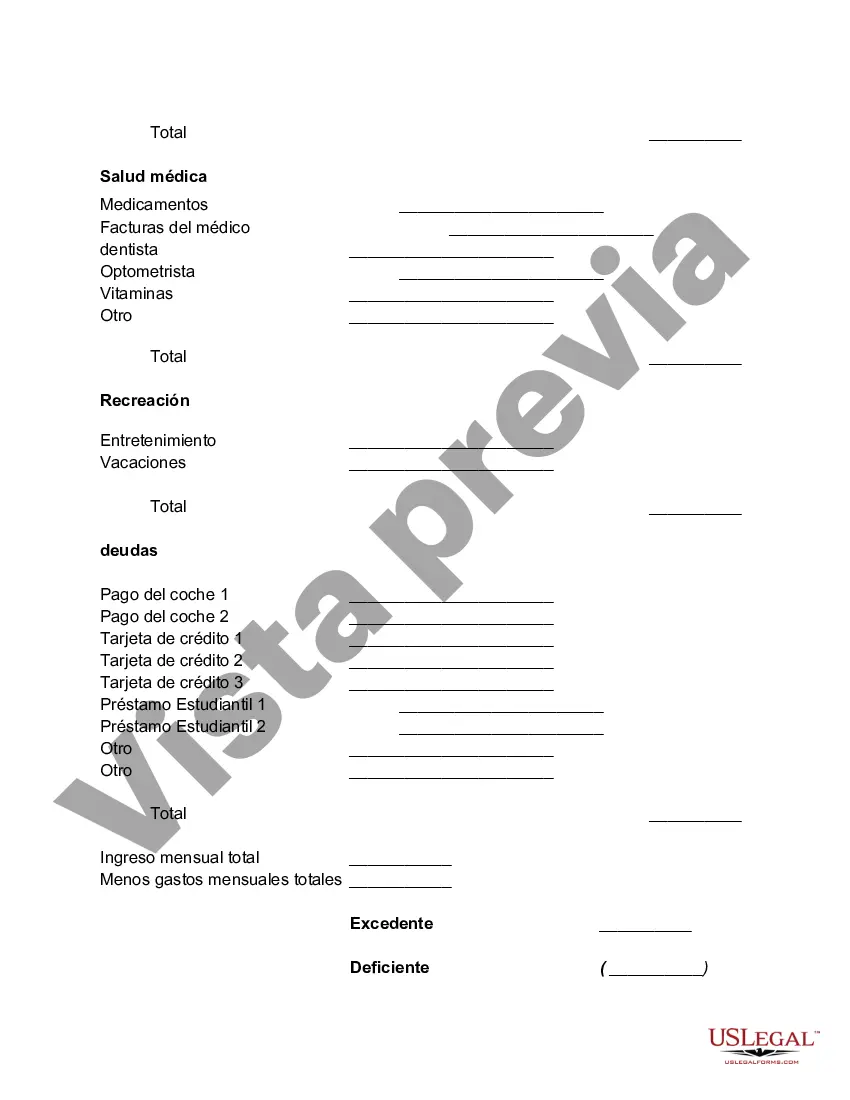

Orange California Monthly Cash Flow Plan is a financial strategy designed to help individuals or businesses in Orange, California manage their monthly cash flow effectively. This plan incorporates various budgeting techniques and strategies to ensure that income and expenses are effectively allocated. The Orange California Monthly Cash Flow Plan aims to provide a comprehensive overview of one's financial situation and helps in making informed decisions regarding income and expenses. It takes into account regular monthly income sources like salaries, dividends, or rental income, and helps in forecasting expenses such as mortgage payments, utilities, groceries, entertainment, transportation, and other necessities. By utilizing this detailed plan, individuals or businesses in Orange, California can effectively allocate their income, prioritize expenses, and eliminate unnecessary spending. This plan also aids in identifying potential savings opportunities, such as reducing discretionary expenses or renegotiating recurring bills. Different types of Orange California Monthly Cash Flow Plans may be tailored to specific needs or situations. These variations could include plans for individuals, families, or businesses. For example, a family plan might consider additional expenses like education, child care, or healthcare. Business plans, on the other hand, may include costs associated with production, inventory, marketing, or employee salaries. Other types of Orange California Monthly Cash Flow Plans could target specific goals or financial objectives. For instance, there could be plans tailored for debt reduction or savings plans designed to accumulate funds for a down payment on a home, retirement, or emergencies. These specialized plans provide a focused approach to achieving specific financial goals while maintaining a strong cash flow management strategy. In conclusion, the Orange California Monthly Cash Flow Plan is a comprehensive financial tool that assists individuals or businesses in effectively managing their monthly cash flow. It helps in tracking income and expenses, facilitates budgeting, identifies potential savings opportunities, and enables individuals or businesses to make informed financial decisions. The different types of plans cater to various needs or goals, ensuring that each individual or business in Orange, California can find the most suitable plan for their specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Orange California Plan De Flujo De Caja Mensual?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your county, including the Orange Monthly Cash Flow Plan.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Orange Monthly Cash Flow Plan will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Orange Monthly Cash Flow Plan:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Orange Monthly Cash Flow Plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!