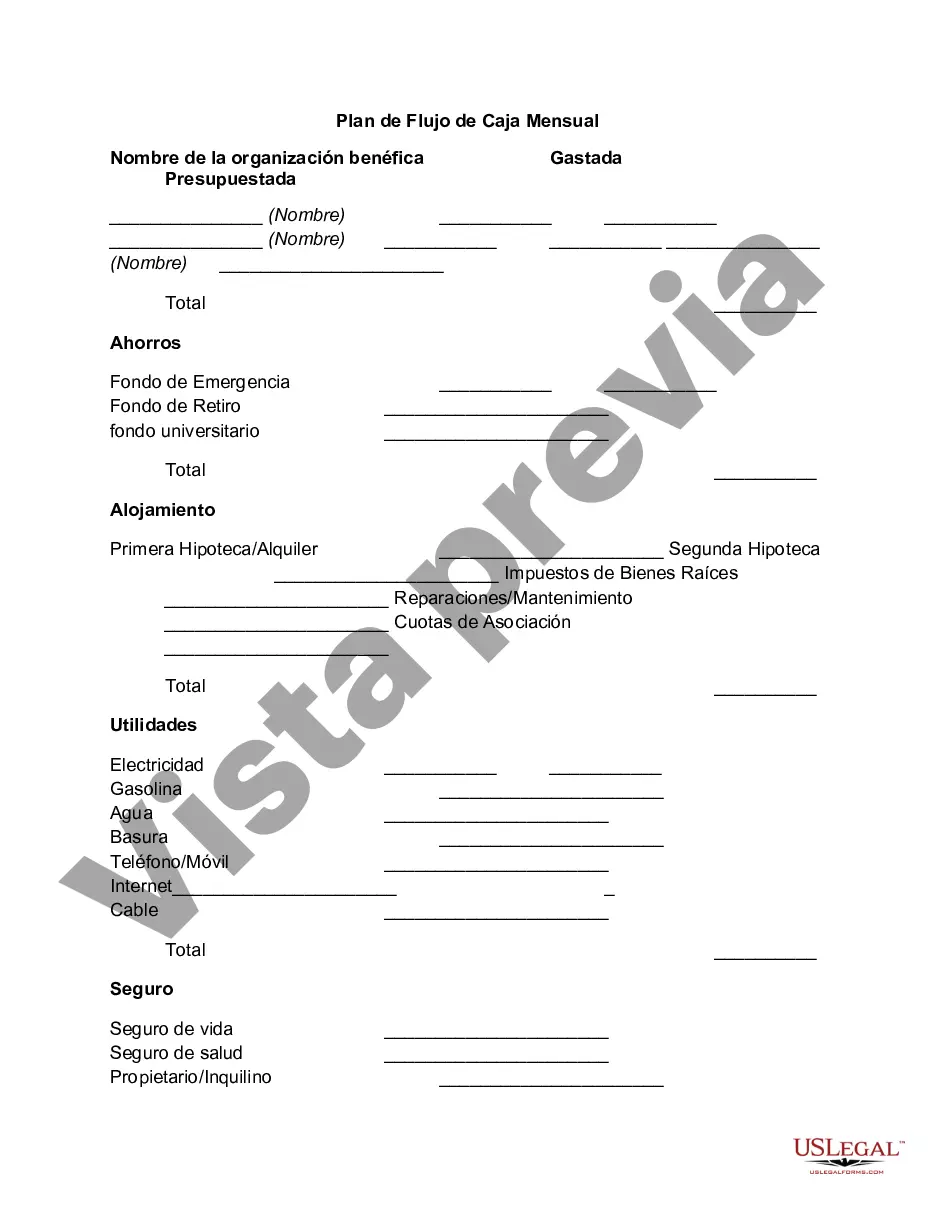

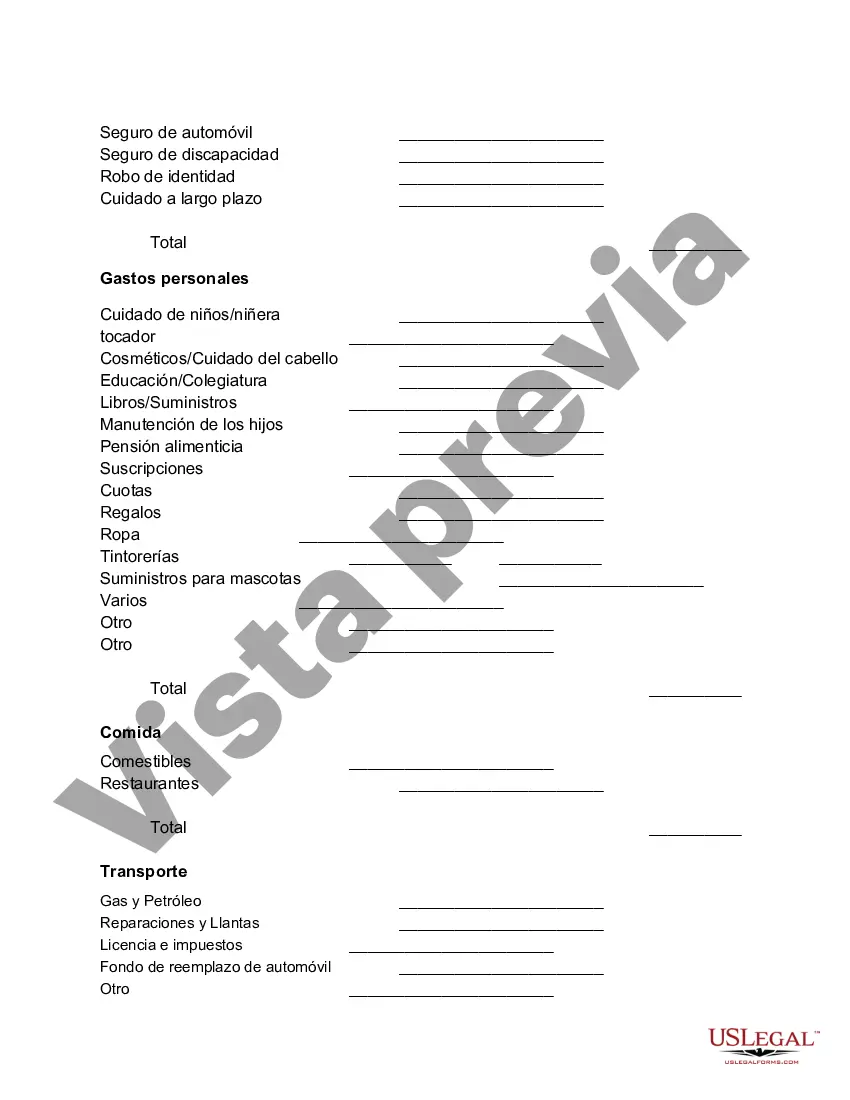

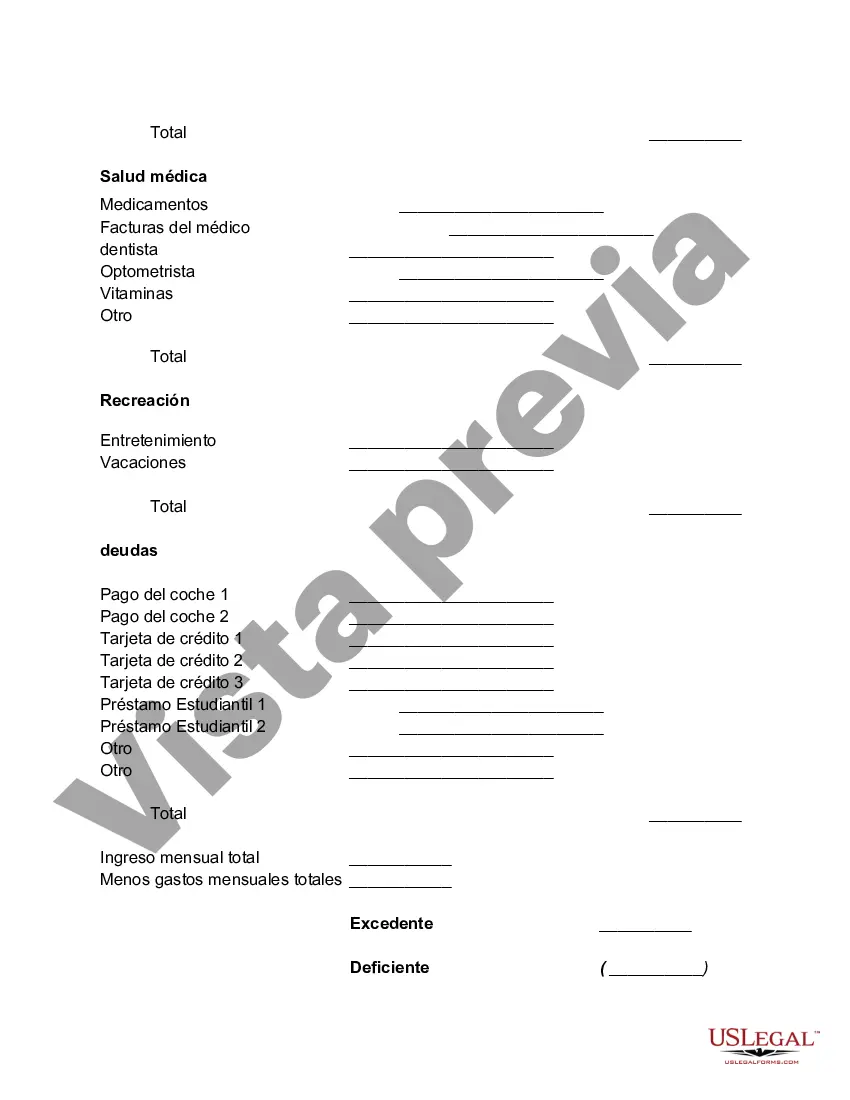

Riverside California Monthly Cash Flow Plan is a financial planning tool designed to help individuals or households in Riverside, California, effectively manage their income and expenses on a monthly basis. It provides a detailed analysis of their cash flow, allowing them to allocate their funds wisely and make informed financial decisions. The Monthly Cash Flow Plan helps Riverside residents track their monthly income from various sources, such as salaries, investments, or business profits. It also enables them to categorize and monitor their expenses, including housing costs, transportation, groceries, utilities, entertainment, healthcare, and more. By using the Riverside California Monthly Cash Flow Plan, individuals can gain a comprehensive understanding of their financial situation. This enables them to set meaningful financial goals, create a realistic budget, and identify areas where they can potentially save money or reduce expenses. The plan highlights any cash surplus or deficit, assisting individuals in making adjustments to their spending habits or finding ways to maximize their savings. There are various types of Riverside California Monthly Cash Flow Plans available, each tailored to meet different financial needs and priorities. Here are a few notable types: 1. Basic Monthly Cash Flow Plan: This plan focuses on essential cash inflows and outflows, providing a general overview of an individual's financial situation. 2. Comprehensive Monthly Cash Flow Plan: This plan offers a more detailed analysis, incorporating a wider range of income sources and expense categories. It is suitable for individuals or households with complex financial portfolios or businesses. 3. Debt Management Monthly Cash Flow Plan: This type of plan specifically caters to those who want to pay off their debts systematically. It includes additional sections dedicated to tracking and managing debt repayments, enabling individuals to develop effective strategies for debt reduction. 4. Savings and Investment Monthly Cash Flow Plan: This plan emphasizes saving and investing for future financial goals, such as buying a house, starting a business, or planning for retirement. It integrates long-term financial planning elements into the monthly cash flow analysis. Regardless of the type of Riverside California Monthly Cash Flow Plan one chooses, its aim remains the same: to provide a comprehensive overview of an individual's financial situation, enhance financial awareness, and empower them to make informed decisions about their money. Ultimately, using a well-structured monthly cash flow plan can help individuals in Riverside, California, achieve greater financial stability and reach their long-term financial objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Riverside California Plan De Flujo De Caja Mensual?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the Riverside Monthly Cash Flow Plan.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Riverside Monthly Cash Flow Plan will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to get the Riverside Monthly Cash Flow Plan:

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Riverside Monthly Cash Flow Plan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!